The estimated results

0

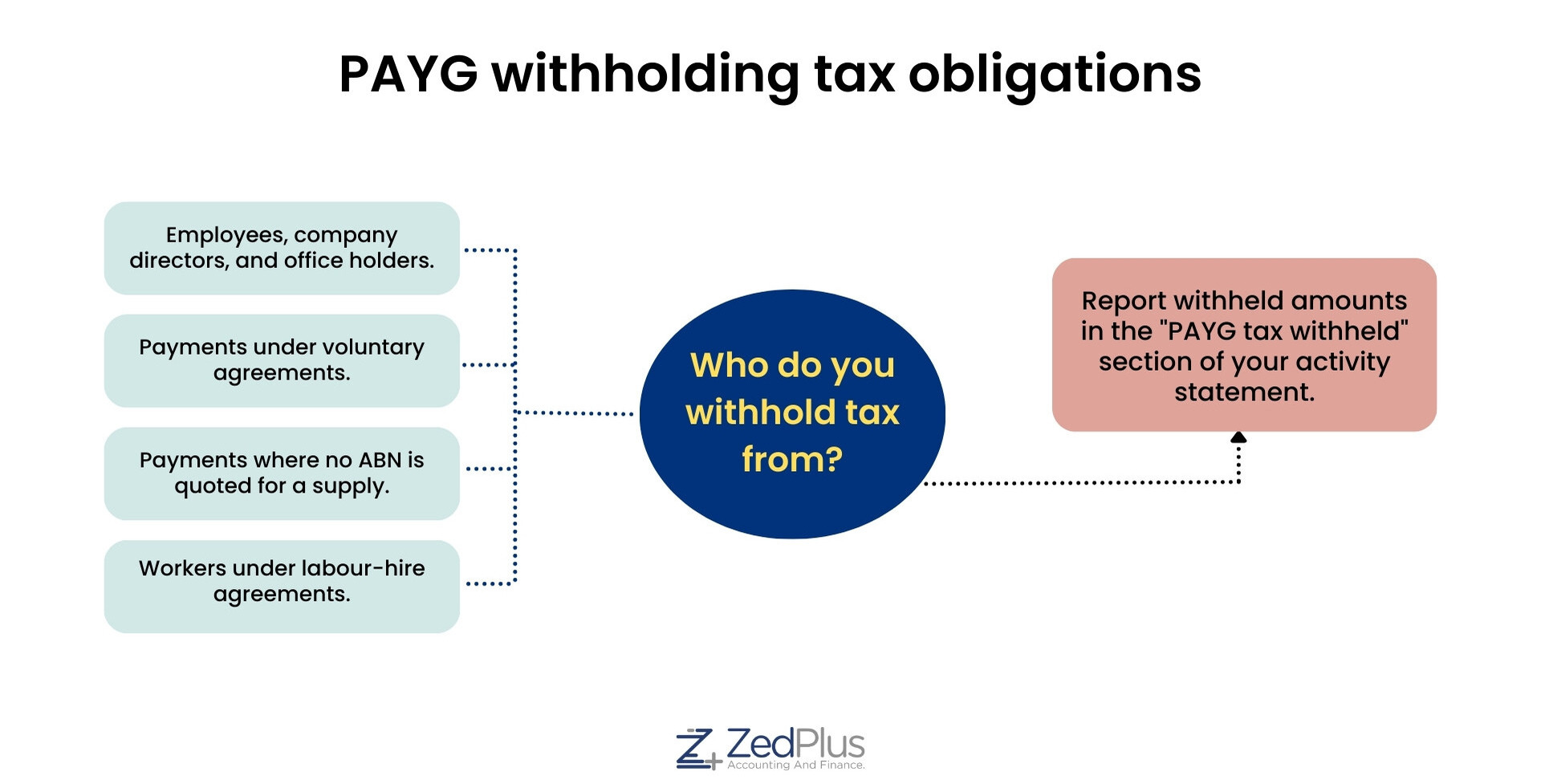

Pay as you go (PAYG) withholding is a fundamental component of income management. It is a system that requires you to pay incremental amounts towards your expected annual income tax liability. Gaining insight into your PAYG tax obligations is vital for effective financial planning and ensuring compliance with tax regulations.

Step into the realm of convenience with our PAYG calculator. This user-friendly tool is designed to give you a comprehensive estimate of your PAYG withholding, based on your income specifics.

Input your income details and our calculator will promptly generate an approximate figure for your tax obligations. This empowers you to make well-informed choices about your income management, savings, and investment strategies.

Lodge your tax return quickly

No PAYG or Income Statement required

Pay nothing up front!

Pre-filled income details & deductions

Get help from a professional accountant

Financial year

Income:

Annual taxable income

Does the above income includes super?

The estimated results

0

Base income

Tax on income

0

Medicare levy

0

Total tax

0

Net income

Per annum

0

Per month

0

Per fortnight

0

Per week

0

The information provided by our income tax calculator is for estimation purposes only and should not be considered as professional tax advice.

Your actual taxation will need to take into account all of your personal circumstances, and this site is in no way a comprehensive calculator. Further please note:

Please consult with a qualified tax professional for personalized guidance tailored to your individual circumstances.

Explore the key differences. The table below breaks it down simply for you. Understand who it affects, how often, and why.

| PAYG withholding | PAYG instalments | |

|---|---|---|

| Who it affects | Primarily employees, with tax deducted from their pay by employers. | Mainly business owners, self-employed individuals, and investors earning business or investment income. |

| Frequency | Tax is deducted each pay period, spreading tax payments throughout the year. | Payments are made quarterly or annually, depending on the taxpayer's circumstances. |

| Purpose | Primarily for payroll tax compliance, ensuring tax is regularly paid on salary or wages. | Aims to manage expected tax obligations arising from business or investment income. |

Our experts will assist you in finding, selecting, and paying off your home loan online. At your convenience, speak with one of our home loan advisors.

We are proud to offer superior customer services. We get glowing reviews from our clients. Let's check some of the testimonials!

PAYG, or pay as you go, is a system where you make payments towards your expected annual tax liability throughout the year, rather than paying a lump sum at the end. It is designed to make it easier to manage your tax obligations.

The frequency of your PAYG payments typically depends on your employer or your individual circumstances. Most commonly, PAYG amounts are withheld from each paycheck you receive.

Absolutely, our PAYG calculator is designed to estimate your PAYG withholdings based on your income details. While it provides an approximation, it can be a useful tool to give you an idea of your tax obligations.

Certainly, if you believe your circumstances have changed or the calculated amount doesn't accurately reflect your expected tax for the year, you should discuss this with your employer or tax professional to adjust your withholdings.

Yes, if you have overpaid through the PAYG system, the excess will typically be refunded to you when you lodge your annual tax return.

If you underpay through the PAYG system, you may end up with a tax bill at the end of the financial year. Therefore, it is crucial to accurately calculate and keep up with your PAYG obligations.

Yes, our PAYG calculator can accommodate multiple income sources. It is designed to provide an estimate of your PAYG withholding based on your total income.

Absolutely! ZedPlus specializes in helping individuals navigate their tax obligations, including PAYG. We offer professional services to ensure your taxes are managed effectively and compliantly.