The estimated results

0

Negative gearing is a popular investment strategy in Australia that allows individuals to offset the costs of owning an investment property against their taxable rental income. By leveraging negative gearing, you can potentially reduce your tax liability while building a property portfolio.

Our negative gearing calculator helps you establish whether your investment property is positively or negatively geared, and provides you with an estimate of your potential tax benefit.

Simply input the relevant financial details of your investment property, and the calculator will crunch the numbers to provide you with an estimate of your negative gearing potential. It gives you valuable insights into the tax advantages you may enjoy and assists in making informed financial decisions.

Lodge your tax return quickly

No PAYG or Income Statement required

Pay nothing up front!

Pre-filled income details & deductions

Get help from a professional accountant

Ownership percentage (%)

Annual rental income

Annual salary and other income

Interest and other

finance cost

Property manager fees

Advertising

Council rates

Water rates

Land tax

Strata fees

Insurance

Repairs and maintenance

Property depreciation

Cleaning and pest control

The estimated results

0

Your rental property is experiencing positive gearing due to the rental income being higher than the expenses incurred. By adding the profits to your taxable income, you will be paying 0 more in personal income tax per year

Your rental property is experiencing negative gearing due to the rental income being lower than the expenses incurred. By deducting the losses from your taxable income, you can benefit from a yearly personal income tax savings of 0

Summary

Rental income

0

Total expenses

0

Profit/(loss) on property

0

Taxable income

0

Tax benefit/(additional tax)

0

The information provided by our Negative gearing calculator is for estimation purposes only and should not be considered as professional tax advice.

Your actual taxation will need to take into account all of your personal circumstances, and this site is in no way a comprehensive calculator. Further please note:

These practical tips will help you navigate negative gearing successfully.

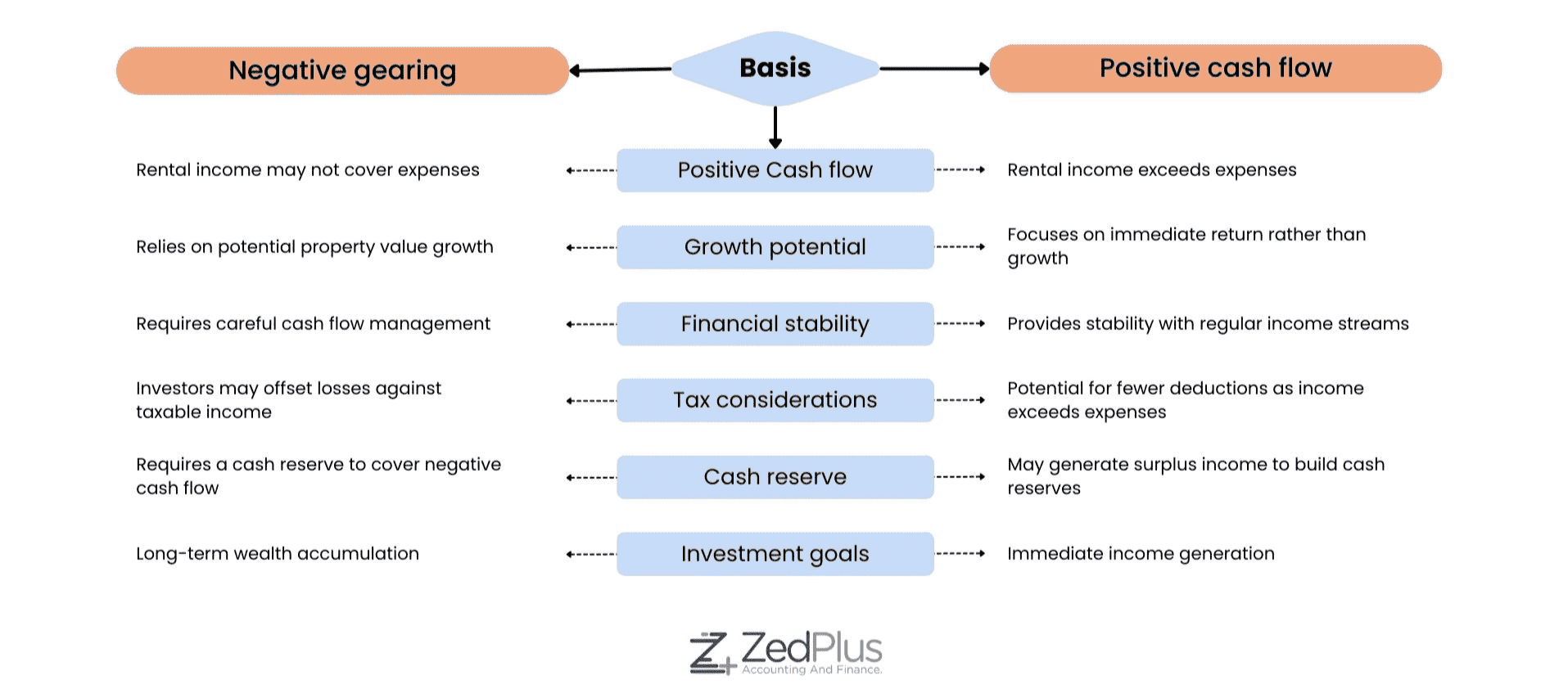

Negative gearing and positive cash flow are pivotal concepts in property investment, each influencing financial returns differently. Tabulated below are the key contrasts between these two approaches.

Tax deductions

Negative gearing allows investors to deduct property-related expenses from their taxable income, reducing their tax bill.

Potential for capital growth

While costs may exceed rental income initially, property values can appreciate, leading to profit upon sale.

Asset accumulation

Investors can acquire valuable properties with minimal upfront investment, growing their asset portfolio.

Tax refund opportunities

If negative gearing results in a tax refund, investors benefit from additional cash flow and can adjust tax with holdings.

Long-term wealth creation

Despite short-term costs, the combined benefits can lead to long-term financial growth and security.

Our team at ZedPlus comprises experienced tax professionals proficient in handling complex tax calculations with precision.

Our experts will assist you in finding, selecting, and paying off your home loan online. At your convenience, speak with one of our home loan advisors.

We are proud to offer superior customer services. We get glowing reviews from our clients. Let's check some of the testimonials!

The impact of negative gearing on your taxation can be summarized as follows:

As an investment property owner in Australia, you can claim several types of deductions. These include:

It's important to keep detailed records of these expenses to substantiate your claims.

In Australia, you can only claim deductions for the periods the property is rented out or is genuinely available for rent. If the property is not tenanted, and it's not actively being advertised for rent, then you typically can't claim deductions. However, if your property is available for rent and you're actively seeking tenants (for example, it's advertised online or through an agent), then you may be able to claim deductions for this period. As the specifics can vary, it's always best to consult with a tax advisor or the Australian Taxation Office for advice on your situation.

There are several risks associated with negative gearing. For example, if property values do not increase as expected, you may end up in a financial situation where the capital gains do not cover the accumulated losses. Moreover, if the property remains vacant without rental income for an extended period, servicing the loan becomes a challenge. The investment also depends heavily on the stability and future changes of tax legislation. A downturn in the property market, higher than expected maintenance costs, or changes in interest rates can also impact the financial viability of negatively geared properties.

No, negative gearing is not exclusive to property. It can also be applied to other income-generating assets like shares or businesses. If the costs (like interest on borrowed money) associated with these investments are higher than the income they generate, these investments can also be negatively geared. However, property is the most common asset associated with negative gearing due to the large loan amounts and related costs, and the potential for long-term capital appreciation.

When you sell a negatively geared property, any profit you make from the sale is considered a capital gain and is subject to capital gains tax (CGT). However, the Australian tax system provides a concession where if you've held an asset for more than 12 months before selling it, you're only taxed on 50% of the capital gain. This is known as the CGT discount.

Yes, as an owner of a negatively geared property, you can claim the costs of repairs and maintenance. This includes costs associated with repairing damage, defects, or deterioration of the property. However, be aware that "repairs and maintenance" does not include significant improvements or renovations - these costs are usually considered capital works and are subject to different tax rules. For instance, they might need to be depreciated over time, rather than deducted in the year they're incurred. Consulting with a tax professional can help clarify these distinctions.