The estimated results

0,000

Capital gains tax (CGT) is the tax you pay on profits from selling assets such as property, shares, or collectibles that were acquired after September 20, 1985. Given the complexity of tax laws, it is crucial to have a reliable tool for accurate CGT estimations.

Our sophisticated capital gains tax calculator is designed to demystify this process, enabling you to confidently anticipate your potential tax liabilities. This tool empowers you to make informed investment decisions and devise solid financial plans.

Regardless of the source of your capital gains - be it property transactions, stock market investments, or the ever-evolving world of cryptocurrencies - our calculator serves as a trustworthy guide to estimate your potential tax obligations.

Lodge your tax return quickly

No PAYG or Income Statement required

Pay nothing up front!

Pre-filled income details & deductions

Get help from a professional accountant

Have you owned the asset for more than 12 months?

The estimated results

0,000

Based on your income

, purchase

price and sold price , the estimated capital gains tax payable

is

The 12-month ownership rule

Yes

Summary

Sold price

0

Cost of selling

0

Purchase price

0

Cost of purchase

0

Capital gain/(loss)

0

Taxable capital gain/(loss)

0

Other taxable income

0

Capital gain tax payable

0

The information provided by our income tax calculator is for estimation purposes only and should not be considered as professional tax advice.

Your actual taxation will need to take into account all of your personal circumstances, and this site is in no way a comprehensive calculator. Further please note:

Please consult with a qualified tax professional for personalized guidance tailored to your individual circumstances.

Estimating your capital gains tax (CGT) in advance is crucial for:

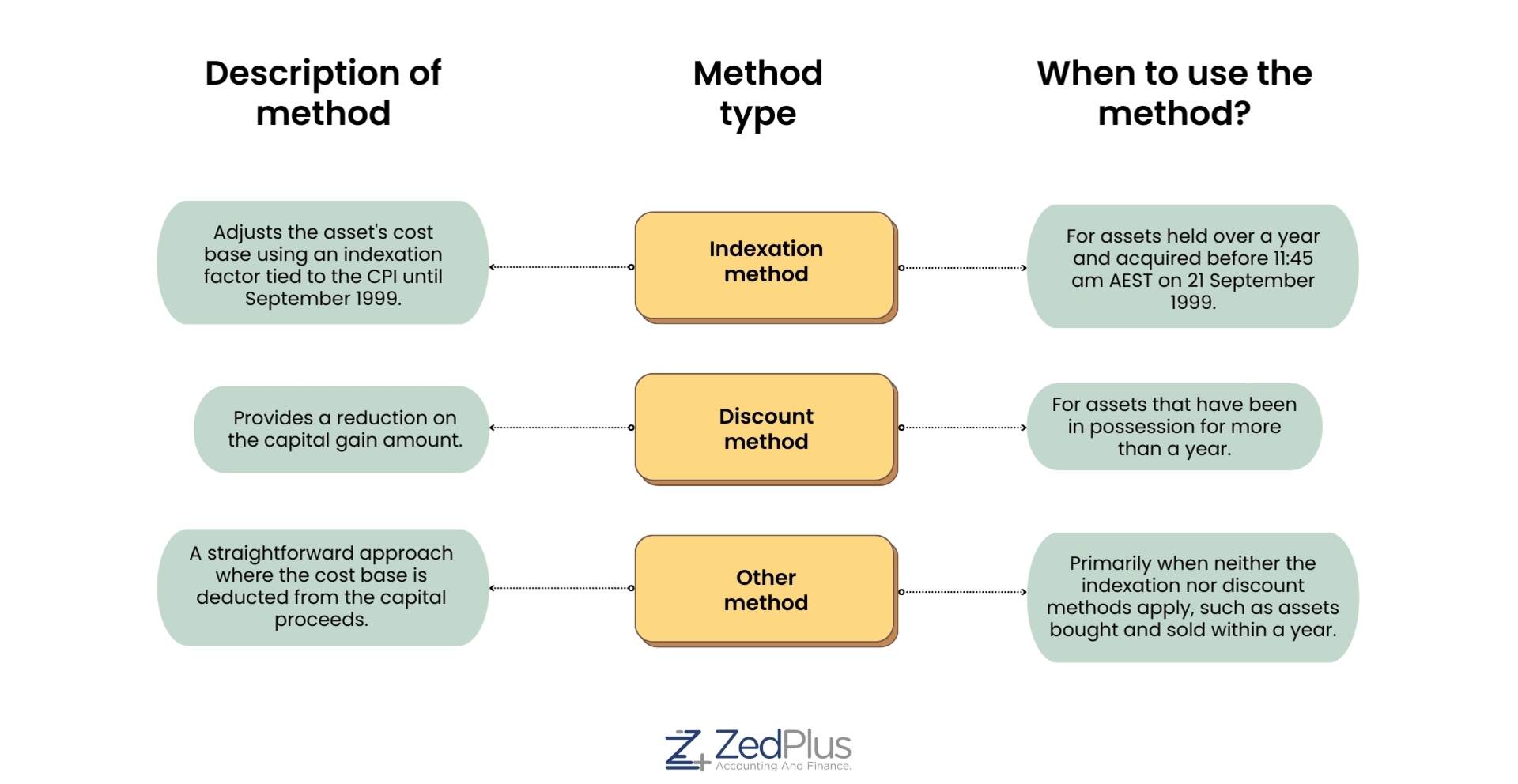

There are three methods to calculate capital gain tax. The table below provides an overview of each method and its appropriate usage:

Here are the crucial exemptions to remember while calculating your CGT:

Assets acquired

Assets acquired before Sep 20, 1985 are completely exempt from CGT considerations.

Main residence

Your primary residence is generally exempt from CGT, but specific conditions might apply.

Granny flat arrangements

Eligible granny flat arrangements are not subject to CGT upon creation or termination.

Cars and motorcycles

Personal cars and motorcycles are exempt from CGT, regardless of when they're sold.

Personal use assets

Assets for personal use costing under $10,000 are exempt from capital gains tax.

Specific awards and payouts

Certain awards and compensation payouts are exempt from Capital Gains Tax implications.

Our experts will assist you in finding, selecting, and paying off your home loan online. At your convenience, speak with one of our home loan advisors.

We are proud to offer superior customer services. We get glowing reviews from our clients. Let's check some of the testimonials!

Capital gains tax (CGT) is a tax system in Australia that targets the profits made from the sale or disposal of assets, including properties, shares, and even crypto assets. Unlike its name suggests, CGT isn't a separate entity but is integrated into your income tax. When individuals or entities dispose of assets, it's essential to understand that a CGT event might be triggered. This event is significant because it mandates the reporting of any capital gains or losses in the annual income tax return, which can subsequently affect the overall tax liability.

A CGT event is initiated when there's a change in the ownership of an asset, typically when you sell or dispose of it. This event is pivotal in the taxation landscape because it necessitates the declaration of any capital gains or losses in the income tax return for that fiscal year.

Recognizing and reporting these events are crucial as they directly influence the amount of tax an individual or entity might be liable to pay. It's always recommended to be aware of potential CGT events to ensure accurate tax reporting.

Capital losses have a significant role in the taxation framework. If you experience a capital loss, it can be used to offset any capital gains in the same fiscal year. If the losses exceed the gains, the difference can be carried forward to offset capital gains in future years. This mechanism can substantially reduce the tax liability. Therefore, it's imperative to include all capital losses in tax returns to leverage this benefit, ensuring optimal tax management.

Yes, discounts on CGT are offered in Australia to promote investments and financial growth. If you've held an asset for a minimum duration, you might be eligible for the CGT discount. Complying super funds, for instance, can avail of certain discounts. However, some entities, like companies, might not qualify for this benefit. Additionally, for those investing in certain residential properties, substantial discounts can be accessed, making it a lucrative option for potential investors.

The capital gains tax calculator is an indispensable tool for investors, primarily because of the intricate nature of tax laws. This calculator simplifies the process of estimating CGT, ensuring that investors have a clear understanding of their potential tax liabilities.

With accurate estimations at their fingertips, investors can make well-informed decisions, strategise their investments better, and anticipate any tax implications. In essence, this tool acts as a compass, guiding investors through the maze of tax laws, ensuring they remain compliant and informed.

Financial planning is a meticulous process that requires precision and foresight. The capital gains tax calculator aids in this by offering a transparent view of potential tax liabilities. With this clarity, investors can budget efficiently, allocate resources wisely, and ensure they aren't caught off-guard with unexpected tax bills.

The calculator's ability to simplify CGT complexities means that investors can seamlessly estimate their liabilities, making it an invaluable tool in the financial planning arsenal. By leveraging this tool, investors can confidently navigate their financial journey, ensuring stability and growth.