How to increase your chance of home loan approval?

Securing a home loan is a crucial step in buying a property, and it requires more than just a casual approach. With fluctuating interest rates and strict lending criteria, you must be well-prepared to increase your chances of loan approval.

This blog offers practical advice and strategies for potential homeowners, focusing on the critical aspects of the loan approval process.

From achieving pre-approval to optimising your financial profile, we provide insights and tips to help you present yourself as a strong candidate to lenders. Ideal for first-time buyers and those experienced in property investment, this blog is designed to assist you in moving closer to securing your dream home.

Key takeaways

- Begin with mortgage pre-approval to set a realistic budget and show sellers you're a serious buyer.

- Consistently pay bills on time and manage debts to boost your credit rating.

- Keep all required documents like payslips and bank statements in order.

- ZedPlus offers a hassle-free tax Be transparent about your financial history and any credit challenges to build trust with lenders.

10 tips to get your home loan approved faster and easier

Here are the 10 most important tips to consider to get your home loan approved faster and easier.

Get pre-approved for a mortgage

Starting your home-buying journey with a mortgage pre-approval is a strategic move. It sets a realistic budget for your house hunt and signals to sellers that you are a serious and prepared buyer. Obtaining pre-approval involves a preliminary assessment by a lender of your financial situation. This step requires you to provide detailed financial information, including your income, assets, debts, and credit score.

While pre-approval does not guarantee final loan approval, it gives you a significant advantage in the competitive real estate market. It’s an early commitment from a lender, indicating how much they are willing to lend you, which can be a powerful tool in negotiations with sellers. Starting this process early is recommended, allowing you to move quickly when you find the right property.

Build and maintain a good credit score

Your credit score is a crucial factor in the home loan approval process. It represents your financial history and responsibility, affecting the chances of approval and the loan terms, including interest rates.

To improve your score, focus on consistently paying bills on time, reducing outstanding debts, and avoiding new credit inquiries, as each can negatively impact your score. Regularly check your credit report for inaccuracies and dispute any errors. Remember, a higher credit score can lead to more favorable loan terms, so improving and maintaining a solid credit profile is worthwhile.

Demonstrate stable employment and income

Stable employment and a steady income are vital indicators of your ability to repay a home loan. Lenders look for applicants who have been in their current job for at least two years or have a consistent work history. This stability suggests a reliable source of income to make ongoing loan repayments.

If you’re considering a job change, it might be best to wait until after your loan is secured, as lenders favor continuity and stability in employment. For those who are self-employed or have irregular income, be prepared to provide additional documentation to prove your financial stability

Save for a down payment

A significant down payment reduces the amount you need to borrow and demonstrates your financial discipline and saving capabilities to lenders. Generally, a down payment of 20% of the property’s value is advisable.

This can also help you avoid the additional cost of lender's mortgage insurance (LMI), typically required for loans with a higher loan-to-value ratio. Start saving as early as possible, and consider strategies like budgeting and reducing non-essential expenses. A larger down payment can also improve your chances of loan approval and may result in more favorable loan terms.

Manage your finances wisely

Financial prudence is critical when applying for a home loan. Lenders will examine your spending habits, savings, and overall financial management. In the months leading up to your application, it’s vital to demonstrate that you live within your means.

Avoid large, unnecessary expenditures that could raise red flags with lenders. This includes holding off on purchasing big-ticket items like cars or expensive vacations. Such financial discipline shows lenders that you can manage your finances effectively and handle a mortgage's additional responsibility.

Organise financial documents

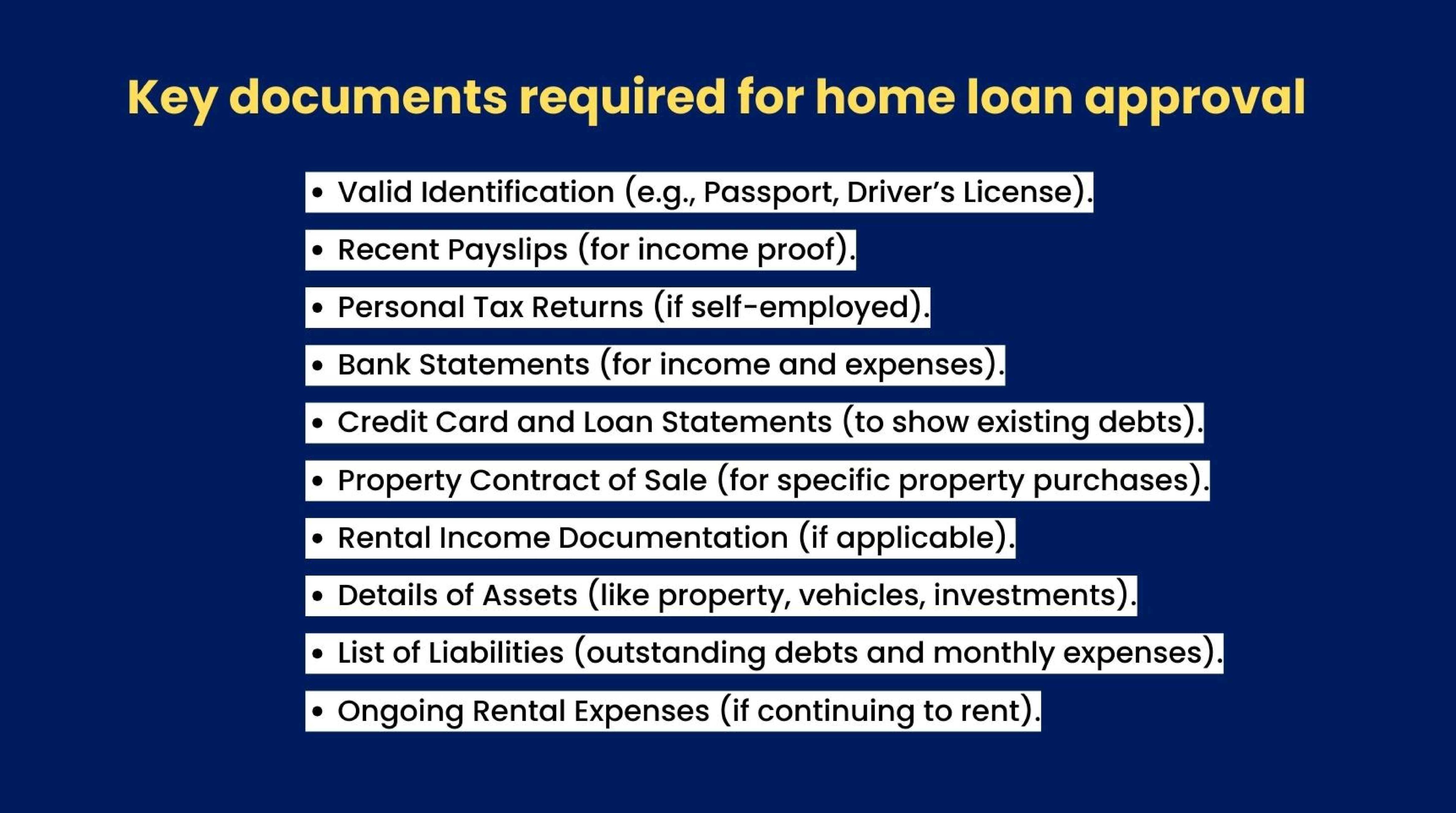

Organising your financial documents is essential for a smooth loan application process. Lenders will require various documents, such as proof of identity, income verification (like payslips or tax returns), and evidence of your assets and liabilities.

Keeping these documents in order, both in physical and digital formats, will help expedite the application process. It also demonstrates to lenders your attention to detail and organisational skills, which are positive traits in a borrower. Be sure to have recent bank statements, credit reports, and other relevant financial documentation available.

Maintain a strong savings history

A consistent savings history is attractive to lenders as it shows your ability to manage money and save over time. This is particularly important if you're required to demonstrate 'genuine savings' – a term lenders use to describe funds you've saved over a period, typically three to six months.

A solid savings history can also contribute to your down payment, reducing the amount you need to borrow and decreasing the lender’s risk. Aim to consistently set aside a portion of your income into a savings account and avoid dipping into these funds.

Tackling debt head-on

Before approaching lenders for a home loan, getting your existing debt under control is essential. This includes debts from services like Afterpay and Zip, which, although not always reflected on credit reports, are scrutinised in bank statements. Lenders often view these BNPL debts as akin to credit card obligations. Missing a payment on these platforms might be considered a default, so it's essential to keep these accounts in good standing.

If you're dealing with multiple high-interest debts, consider consolidating them into a single loan. This can simplify your payment process and reduce the interest you pay over time. Alternatively, focus on paying off debts individually, starting with those with the highest interest rates. Clearing these debts improves your loan eligibility and eases your financial burden, making it easier to manage monthly repayments.

Revised approach to applying with lenders

It's a common misconception that applying to multiple lenders for a home loan increases your chances of approval. However, this strategy can lead to unintended consequences. Each loan application results in a credit check, which, if done frequently, might negatively impact your credit score. A better approach is to carefully research and compare home loan options, limiting your applications to those that align with your financial situation and goals.

This is where ZedPlus can be particularly helpful. Our experts assist in evaluating your finances, guiding you through the process of comparing loans, and helping you choose the most suitable lender. With ZedPlus, you can ensure a more strategic and effective home loan application, avoiding the drawbacks of multiple credit inquiries.

Prioritising honesty in loan applications

Transparency is vital when applying for a home loan. Full disclosure of any outstanding debts or issues in your credit history is crucial. Lenders will uncover this information during their assessment process, and any undisclosed details can lead to a decline in your loan application due to non-disclosure.

Being upfront about your financial past, including any credit challenges, allows lenders to understand your complete financial picture. This honesty builds trust and allows one to explain any past financial missteps. Remember, lenders are more receptive to open and honest applicants about their financial situation, which helps them assess risk more accurately.

Wrap up!

Securing a home loan is a critical step towards realising your dream of owning a home, and it demands a well-thought-out strategy. By adhering to these ten vital tips, you significantly enhance your chances of a swift and trouble-free home loan approval. It's essential to remember that the path to homeownership involves more than just selecting the perfect property; it also includes choosing the right guidance and support throughout the loan process.

ZedPlus offers just that - comprehensive assistance and expert advice tailored to your unique financial situation. With our array of services, including access to a wide range of lenders and specialised support for various loan types, we are committed to facilitating a seamless and effective home loan journey for you.

Let ZedPlus be your ally in this significant venture. Reach out to us and take the first step towards making your homeownership dream a reality.