Rise of buy now pay later (BNPL) services: Implications for borrowers and lenders

In recent years, the financial landscape has undergone a significant shift, with Buy Now Pay Later (BNPL) services emerging as a popular alternative payment method to traditional credit options. These services have revolutionised the way Australians shop, enabling them to purchase items immediately and pay for them over time in manageable interest-free instalments.

This swift adoption of BNPL payments has not only changed consumer behaviour but also has wide-ranging implications for both borrowers and lenders. It is essential for consumers and financial institutions to understand these implications in order to navigate this new economic landscape effectively.

At ZedPlus, a firm of trusted tax agents and online mortgage brokers, we pride ourselves on keeping pace with these changes. Our mission is to provide holistic financial solutions to our clients, empowering them to achieve their lifestyle and financial objectives even in a rapidly evolving marketplace. In this blog, we will explore the rise of BNPL services and discuss their implications for borrowers and lenders

Key takeaways

- BNPL offers fast approvals, small payment instalments and no interest rates but has lower credit limits than credit cards.

- Manage BNPL usage when planning to apply for a mortgage by sticking to one account, linking it to your debit card, tracking payments and avoiding new plans before applying.

- New regulations will require BNPL providers to do credit checks on prospective customers and adhere to responsible lending obligations.

- Stay informed about the changes in BNPL regulations and understand how they might affect your financial plans. Reach out for assistance if needed.

Understanding the mechanics of BNPL services

Buy Now Pay Later or BNPL is a financial service that enables consumers to purchase products or services instantly and pay for them over a period of time, usually in bi-weekly or monthly instalments. Unlike traditional credit cards or loans, BNPL services often don't charge interest, unless a payment is missed or delayed, making them an attractive alternative for many shoppers.

This process is fairly straightforward. At the point of sale, either online or in-store, consumers choose the BNPL option, undergo a quick approval process, and then commit to a payment schedule. The cost of the purchase is spread over the agreed monthly payments, allowing consumers to manage their expenditures without paying the total amount upfront.

The BNPL service is not entirely new, but it's seen a remarkable growth spurt over the past few years. What started as a niche offering has become a mainstream payment method. Key BNPL players such as Afterpay and ZipPay have pioneered this trend, attracting millions of users with their flexible payment options and user-friendly platforms.

The success of BNPL can be attributed to a combination of factors including a shift towards online shopping, a growing aversion to credit card debt among younger consumers, and the convenience and simplicity offered by them. As these services continue to proliferate, their impact on financial habits and the broader lending landscape cannot be underestimated.

How do BNPL transactions affect borrowers and their financial health?

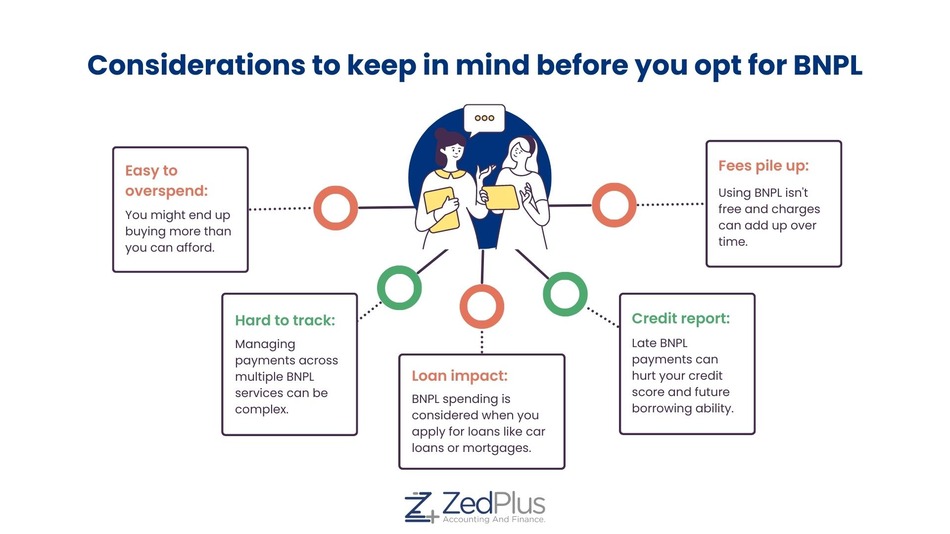

The rise of BNPL payments has had a profound impact on borrowers, offering a slew of benefits but also posing certain risks. Understanding these implications can help consumers make more informed decisions when it comes to using these services.

On the positive side, BNPL services provide immediate access to goods or services without the need for upfront payment. This allows consumers to manage their cash flow better and make purchases that might otherwise strain their budget. Furthermore, the absence of interest charges, provided payments are made on time, makes BNPL apps Australia an attractive alternative to credit cards or personal loans for many.

However, BNPL isn't without its drawbacks. One of the main concerns is that it can lead to overspending, as the ease and convenience of these services may encourage impulse purchases. Borrowers can easily fall into a debt trap if they are not careful, with missed payments resulting in late fees and, in some cases, a damaged credit score.

While BNPL services do not typically affect your credit history directly, as most providers do not conduct credit checks, consistently missing payments or having an account sent to collections could negatively impact your credit file. This could potentially affect your ability to secure other types of credit, like home loans, in the future.

Therefore, it is essential for borrowers to use BNPL services responsibly. This includes understanding the terms and conditions, keeping track of payment schedules, and ensuring they have sufficient funds to meet their obligations. By doing so, borrowers can reap the benefits of BNPL services while minimising potential risks to their financial health.

How does BNPL impact Australia's credit landscape?

The surge of BNPL services has significantly altered the lending landscape, introducing new opportunities as well as challenges for traditional and non-traditional lenders alike.

For one, it has ushered in a new era of competition in the credit market. Traditional lenders, like banks and credit card issuers, are now contending with BNPL providers who offer a more flexible and accessible credit alternative. In response, many of these institutions are seeking to adapt their products and strategies, or even collaborate with BNPL providers to meet evolving customer expectations.

Moreover, these services have opened new avenues for lenders to engage with young consumers, particularly millennials and Gen Z, who are often more averse to traditional forms of credit. This allows lenders to diversify their customer base and tap into a market segment that values convenience and digital solutions.

However, participating in the BNPL market also comes with its share of risks for lenders. The main concern is the potential for higher default rates. Given the relatively easy access to credit and the absence of traditional credit checks, there is a risk that some consumers may overextend themselves, leading to missed payments.

Furthermore, the regulatory landscape surrounding BNPL is still evolving. While currently less regulated than traditional lending, there are growing calls for stricter oversight of BNPL services. Lenders need to stay abreast of these developments and be prepared for potential changes in the regulatory environment.

Can BNPL services influence your mortgage application?

When planning to apply for a mortgage, one important factor lenders usually look at is your creditworthiness, which includes assessing your existing debts and repayment behaviours. This is where the usage of BNPL services can come into play.

While most BNPL providers do not perform hard credit checks that could impact your credit score, the amount you owe to BNPL services can be considered a liability, similar to any other form of debt. Mortgage lenders may take this into account when assessing your ability to repay the mortgage. Large outstanding BNPL balances or a history of missed payments can raise red flags, potentially affecting your mortgage application's approval and the terms you are offered.

Furthermore, if you default on repayments and the debt is sent to collections, this could show up on your credit report and significantly impact your credit score, which in turn could negatively affect your mortgage application.

With these considerations in mind, here are some expert tips for managing BNPL when applying for a mortgage:

Stick to a limit

Aim to have only one BNPL account at a time. Having multiple accounts could lead to overspending and may make it harder to keep track of all your payments.

Link your BNPL account to your debit card

Consider using your debit card instead of your credit card for BNPL purchases. This ensures you are using your own money and can help you avoid additional credit card interest.

Keep track of your BNPL commitments

Make a list of all your active BNPL plans and their payment schedules to ensure you don't miss any payments.

Manage your BNPL debt

Keep your BNPL balance at a manageable level. If your liabilities are high compared to your income, lenders might see this as a risk.

Avoid new BNPL plans before applying for a mortgage

If possible, avoid taking on new BNPL commitments when you are planning to apply for a mortgage. It is better to keep your financial profile as clean and debt-free as possible during this period.

How do BNPL services compare with credit cards?

| Point of difference | BNPL | Credit card |

|---|---|---|

| Enquiry | Usually a soft credit check doesn't impact credit score | Hard enquiry, affects credit score |

| Regulation | Not governed by the National Consumer Credit Protection Act 2009 | Governed by the National Consumer Credit Protection Act 2009 |

| Application process | Fast and easy, can start purchasing immediately after approval | Takes time, have to wait for card arrival after approval |

| Credit limit | Typically set around $2,000, can go up to $30,000 | Generally between $1,000 and $100,000 |

| Repayment | Spreads the cost of the purchase in smaller, interest-free instalments | Full payment due at once unless balance is carried, accruing interest |

| Building credit | Doesn't help to build credit score | Can improve credit score with on-time repayments |

| Bank assessment impact | Viewed as living expenses or ongoing liabilities, can reduce borrowing power | Full credit card limit assessed, can reduce borrowing power |

Regulations and the future outlook of BNPL

The burgeoning BNPL sector has long enjoyed rapid growth, largely unfettered by the regulatory norms that govern traditional financial institutions. However, recent moves by Financial Services Minister Stephen Jones indicate a shift towards more stringent oversight, closing a regulatory loophole that has previously enabled the rapid expansion of this industry.

Under the proposed changes, BNPL providers like Afterpay and Zip will have to comply with two key regulations.

Firstly, the new rules mandate BNPL companies to conduct credit checks on prospective customers through credit reporting agencies. While some providers already adhere to this practice, the formal requirement aims to curtail the risk of vulnerable customers facing financial difficulties due to multiple BNPL accounts. However, it is important to note that a credit check isn't synonymous with an affordability assessment of the loan.

Secondly, BNPL providers will need to comply with responsible lending obligations. These require a loan to be "not unsuitable" for the borrower, necessitating some form of financial assessment. However, in a concession to BNPL providers, these obligations will be scalable. This implies that smaller loans of a few hundred dollars may not require as extensive a financial background check as a $10,000 personal loan, for instance.

The specifics of how these regulations will be implemented in practice remain unclear. Over the coming months, details on the extent of required income and expense assessments for prospective customers will be determined.

This development illustrates that the regulatory landscape for BNPL services is becoming more defined. While it could potentially introduce friction into the lending process and slow the industry's growth, it also ensures greater consumer protection laws.

Final word

The rise of BNPL services, is reshaping the financial sector. While BNPL offers flexibility and convenience, it is essential to manage your commitments wisely and consider the potential impact on future financial decisions, such as mortgage applications.

With new regulations on the horizon, the BNPL landscape is becoming more secure but also more complex. As consumers, staying informed about these changes is key to leveraging BNPL responsibly and beneficially.

At ZedPlus, we are dedicated to assisting you in understanding and navigating these changes. For any queries about how BNPL might affect your financial plans, don't hesitate to reach out. Our goal is to provide you with comprehensive financial solutions that align with your unique needs and objectives.