The importance of financial literacy for managing debt and building wealth

Financial literacy is the ability to understand and use various financial skills, including personal financial management, budgeting, and investing. It is about making informed decisions about your finances, knowing how to keep a close eye on your debt, and how to effectively build wealth for the future. No matter what stage of life you are in, financial literacy provides the tools and understanding needed to create a sustainable financial plan and navigate potential pitfalls along the way.

Now, why is this particularly relevant for us Australians? Our country has a complex financial landscape, with unique aspects like superannuation funds and a dynamic real estate market. Add to that the constant changes in tax laws, and you realise how crucial it is to stay financially informed.

As a leading tax agent and online mortgage broker, ZedPlus is committed to improving financial literacy, helping people manage their debt more efficiently, and guiding them towards secure wealth creation. Stay with us as we explore the significance of financial literacy in managing your debt and building wealth.

Key takeaways

- Financial literacy plays a pivotal role in wealth creation, enabling people to make informed decisions about saving, investing and retirement savings.

- The Australian Government has several initiatives designed to improve financial literacy among citizens.

- Online mortgage brokers can help clients understand loan terms and conditions and provide valuable insights into the property market.

- Tax agents like ZedPlus can provide support for navigating the complexities of tax laws and making the most of available deductions and tax benefits.

Understanding financial literacy

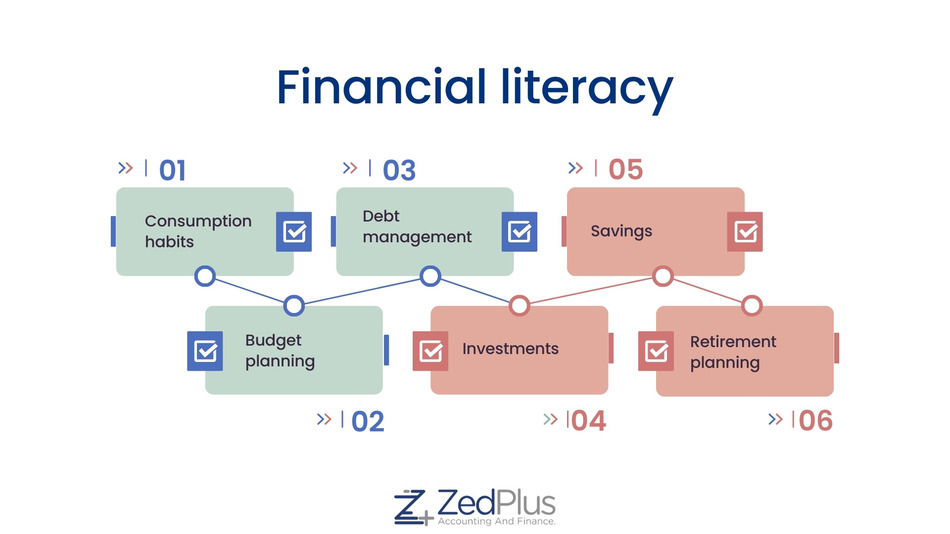

To navigate the financial maze, you first need to understand some main concepts that form the backbone of financial literacy. Let's break them down:

Budgeting

This is your financial plan, mapping out your income and expenses over a set period, generally a month. It is the crucial first step towards managing money, rather than letting it control you.

Investing

This involves committing your money to different financial options, like the stock market, bonds, or real estate, to grow it over time. Understanding the principles of investing can help you maximise your wealth and establish financial stability.

Debt management

It is about understanding the cost of your debt, developing strategies to pay it off and knowing how to utilise good debt to your advantage.

Savings and retirement planning

This is the process of setting money aside for future expenditures. Retirement planning, in particular, is an integral part of this, especially with unique elements like superannuation.

There is a strong correlation between financial literacy and financial well-being. According to research by the Australian Securities and Investments Commission (ASIC), those with better financial knowledge and behaviour are more likely to exhibit positive financial indicators, such as holding less bad debt, saving regularly, and not exceeding credit limits.

Essentially, financial literacy empowers you to take control of your money, which can lead to improved financial security and independence. In the rapidly changing financial landscape, ZedPlus is committed to raising this literacy level, helping people get access to the tools and knowledge they need to secure their financial future.

How can financial literacy help you manage and reduce debt?

Understanding the intricacies of debt is a vital aspect of financial literacy. To begin with, it is important to distinguish between good debt and bad debt. Good debt refers to borrowings, such as student loans or home mortgages that can help generate income or increase your net worth over time. On the contrary, bad debt often involves purchasing depreciating assets or things that do not contribute to wealth accumulation, like high-interest credit card debt from discretionary spending.

Interest rates significantly impact the cost of your loans and credit card debt. Simply put, the higher the interest rate, the more you end up paying back. A firm grasp of how interest rates work can guide your borrowing decisions, helping you to select lower-cost options and pay off higher-interest debt faster.

Here are a few tips for effectively managing and reducing debt:

Budgeting

Allocate a certain amount of your income towards paying off your debts.

Prioritising

Pay off debts with higher interest rates first to reduce the total interest you will pay.

Consolidation

If applicable, consolidate multiple debts into one with a lower interest rate to simplify repayments.

Let's look at an example of successful debt management due to financial literacy.

Take the case of Jane, a resident of Sydney. She had a mix of good and bad debt, with a sizeable home mortgage and significant credit card debt. Jane attended financial literacy workshops and worked with a financial advisor to better understand her debt situation. By creating a budget, prioritising her high-interest debt, and learning about the impact of interest rates, Jane successfully reduced her debt within a year and restructured her mortgage payments to pay it off faster.

A higher degree of financial literacy can significantly improve your ability to manage debt and reduce it, ultimately leading to a better credit score and financial security.

How does financial literacy empower wealth creation?

Building wealth is not an overnight event; it is a process. A solid understanding of financial concepts can help you build this wealth strategically and sustainably.

The first concept you need to understand is the power of compounding interest. It is where your interest earns interest, and your savings can grow exponentially over time. Regular savings, when combined with the power of compound interest, can accumulate into significant wealth.

Next, it is crucial to have a grasp of investment basics. These include understanding different investment options like stocks, bonds, real estate, and superannuation funds. Each of these assets comes with its own risk-reward profile, and it is important to choose according to your financial goals, risk tolerance, and time horizon.

When it comes to retirement planning, one cannot overlook the role of superannuation funds. They form the cornerstone of retirement income for many, and understanding their workings can help you optimise your retirement accounts.

Wealth creation isn't only about making investments, but also about diversifying them to manage risk. Diversification involves spreading your investments across different asset types to reduce exposure to any single asset or risk.

Let's illustrate this with a case study.

Consider David, a Melbourne-based professional. David had always been a regular saver, but his real financial transformation began when he started investing in a diversified portfolio. By educating himself about the financial markets and seeking advice from professionals, David began investing in a mix of stocks, bonds, and real estate while consistently contributing to his super fund. Today, David's diversified portfolio not only generates a steady stream of income but also provides him with a safety net against market volatility.

Thus, financial literacy plays a pivotal role in wealth creation, enabling people to make informed decisions about saving, investing, and retirement savings. The more financially literate you are, the better equipped you are to make informed investment decisions.

How can financial literacy help with tax planning?

Here's how financial literacy can help with tax planning:

Awareness of tax laws

Financial literacy helps individuals understand tax laws, regulations, and obligations. It enables them to stay informed about changes in tax codes, deductions, and credits, maximising their tax benefits.

Efficient record keeping

It also promotes good record-keeping practices, ensuring individuals maintain accurate financial documentation. This allows for easy retrieval of necessary information during tax filing, reducing the risk of errors or missed deductions.

Identifying tax deductions and credits

Financial literacy empowers individuals to identify eligible tax deductions and credits. They can proactively seek out opportunities to maximise deductions for expenses such as education, healthcare, homeownership, retirement contributions, and charitable donations.

Effective tax planning

Furthermore, it helps individuals develop effective tax planning strategies. They can anticipate and manage their tax obligations throughout the year, making estimated tax payments, and adjusting their financial decisions to optimise tax outcomes.

Efficient professional advice

Financial knowledge enables individuals to better engage with tax professionals. They can ask relevant questions, understand tax advice given, and actively participate in discussions to ensure their tax planning aligns with their financial goals.

What are the government initiatives for enhancing financial literacy?

The Australian Government recognises the importance of financial literacy and has initiated several programs and strategies to improve it among its citizens.

One of these initiatives is the Australian Securities and Investments Commission (ASIC)'s MoneySmart program. This is a comprehensive online resource offering free and impartial financial literacy skills. The program aims to improve people's understanding of financial matters and their ability to manage their personal finance. It provides resources and tools for budget planning, saving, investing, superannuation, and more.

In addition to MoneySmart, ASIC also leads the National Financial Literacy Strategy - a unified approach to enhance financial well-being. The strategy promotes a more systematic and coordinated approach to improving financial literacy, encouraging participation from the government, businesses, not-for-profit organisations, and the education sector.

How do mortgage brokers enhance financial literacy and facilitate property investment?

In the intricate realm of finance, mortgage brokers often play a pivotal role in enhancing financial literacy, particularly in the area of home loans and property investment.

Firstly, mortgage brokers can help clients better understand loan terms and conditions. They demystify jargon, making it easier to comprehend the various aspects of a loan agreement. This includes understanding interest rates, repayment options, loan tenure, and potential penalties. With this knowledge, you can confidently choose a loan that suits your financial situation and goals.

Secondly, mortgage brokers serve as guides in the property market. They provide valuable insights into market trends and help you understand the potential risks and returns associated with property investment. They can offer advice on choosing properties that align with your long-term investment strategy and financial objectives.

At ZedPlus, we are more than just an online mortgage broker; we are your partners in financial literacy. We believe that an informed client makes the best decisions, and therefore, we are committed to providing you with the knowledge you need to make informed financial choices. We offer personalised advice on managing debt, building wealth, understanding taxes, and navigating the mortgage process. Our mission is to help you make sense of your finances, empowering you to take control of your financial future.

On the taxation front, understanding the tax system is an integral part of financial literacy. The tax laws are complex, and staying informed about the changes can be challenging. That's where tax agents like ZedPlus come into play. We help you navigate the intricacies of tax laws, ensuring you meet your obligations while also making the most of the available deductions and tax benefits.

Wrapping up

Financial literacy is your compass in the world of finance. It guides you towards better debt management, empowers you to build wealth, and above all, enhances your financial well-being. The power to shape your financial future truly lies in your hands, and it begins with a commitment to learning and understanding.

At ZedPlus, we are your partners in this journey towards financial literacy. We invite you to reach out to us for any assistance you need in managing your debt, planning your investments, or building your wealth. Together, let's work towards a financially secure future. Remember, your journey towards financial independence starts with the first step. Take that step today!