What is the impact of mortgage interest rate changes on loan repayments and how to prepare for them?

Introduction

Ever wondered how changes in mortgage interest rates can affect your home loan repayments? Well, fluctuations in interest rates can have a profound impact on your monthly mortgage repayments, influencing your budget, financial goals, and overall financial stability.

Picture this: you have taken the leap into homeownership, secured a mortgage loan, and all seems well. But suddenly, interest rates start to fluctuate, leaving you puzzled about how they might impact your monthly repayments.

By comprehending the dynamics behind interest rate changes, you gain the power to proactively adapt, strategise, and make informed decisions to safeguard your financial well-being.

At ZedPlus, we have the expertise to guide you through the intricacies of mortgage interest rate fluctuations and help you prepare effectively. As tax agents and online mortgage brokers in Australia, we specialise in developing customised strategies tailored to fit your unique needs. So, let’s get started.

Key takeaways

- Mortgage rate fluctuations can have an impact on your finances, but understanding the changing market environment is crucial.

- Seek guidance from mortgage brokers, tax agents, and financial advisors to make informed decisions.

- Various government assistance programs are available to provide relief and incentives for homeowners facing financial difficulty.

- ZedPlus can provide tailored advice and assistance to navigate the complexities of mortgage repayment and interest rate rise.

What are mortgage interest rates, and how do they impact your loan repayments?

Mortgage interest rates refer to the percentage charged by lenders on the amount borrowed for a mortgage loan. They determine the cost of borrowing and directly influence your monthly home loan repayments. When interest rates rise, your repayments increase, and vice versa.

Understanding how these rates impact your loan repayments is crucial for managing your budget and long-term financial goals. Even a slight change in interest rates can have a significant impact on the total amount you repay over the life of the loan.

What factors contribute to the fluctuations in mortgage interest rates?

A complex interplay of factors influences mortgage rates. Comprehending these factors can assist in anticipating rate changes and making informed decisions about when to borrow.

-

Economic conditions:

In periods of economic prosperity, demand for credit may increase, driving interest rates up. Conversely, during downturns, demand may decrease, potentially lowering rates.

-

Inflation:

High inflation can lead to higher mortgage rates as lenders aim to offset the future decrease in purchasing power. In contrast, low inflation rates may lead to lower interest rates.

-

Monetary policy:

The Reserve Bank of Australia (RBA) uses monetary policy to manage the economy and inflation. Adjustments to the cash rate by the RBA can directly influence mortgage rates.

-

Government debt:

Interest rates on Australian government bonds can serve as a mortgage rate benchmark. Changes in investor demand for government bonds can cause corresponding changes in mortgage rates.

-

Market forces:

Fluctuations in home buying, which impact the demand for mortgages, can influence mortgage rates. Increased demand can drive rates up, while decreased demand can lower rates.

-

Financial market conditions:

The conditions in financial markets, particularly the share and bond markets, can influence mortgage rates. Increased demand for safer assets like bonds can lower mortgage rates.

-

International economic factors:

Global economic instability may lead investors to safer assets, impacting Australian mortgage rates. If the demand for these safer assets increases, mortgage rates often decrease.

-

Regulatory changes:

Regulatory changes affecting banks and lenders can impact the cost of providing mortgages, and these costs may be passed onto consumers via changes in mortgage rates.

How does the Reserve Bank of Australia influence mortgage interest rates through its cash rate decisions?

The Reserve Bank of Australia (RBA) plays a crucial role in influencing interest rates in the country. As the central bank, the RBA has the power to set the official cash rate, which directly affects the interest rates offered by banks and financial institutions.

The RBA adjusts the cash rate based on various economic factors and its monetary policy objectives. These factors include inflation levels, economic growth, employment rates, and global economic conditions. By increasing or decreasing the official cash rate, the RBA aims to manage inflation, stimulate or cool down the economy, and promote overall financial stability.

Changes in the cash rate have a ripple effect on mortgage interest rates. When the RBA lowers the cash rate, banks can borrow money at lower costs, allowing them to offer lower interest rates on home loans. This can result in reduced monthly repayments for borrowers. Conversely, when the RBA raises the cash rate, banks pass on the increased costs to borrowers, leading to rising interest rates and potentially higher repayments.

It's important for borrowers to keep an eye on the RBA's cash rate decisions and understand how they can impact their mortgage interest rates. While the RBA's cash rate is influential, it's worth noting that banks may also consider other factors, such as funding costs, market competition, and risk management, when determining their specific interest rates.

What are the differences between fixed and variable interest rates?

When it comes to home loans, understanding the distinction between fixed and variable interest rates is essential. Fixed interest rates refer to a set rate that remains unchanged for a specific period, providing stability and predictability in your monthly repayments. On the other hand, variable rate can fluctuate based on market conditions, leading to potential changes in your repayments over time.

With a fixed-rate home loan, you lock in a specific rate for the duration of the fixed period, which can range from a few years to the entire loan term. This allows you to plan your budget effectively, knowing that your repayments will remain constant throughout the remaining loan term. It provides peace of mind and shields you from any potential increases in interest rates.

In contrast, the variable-rate loan is tied to market conditions and can be adjusted periodically. These rates may start with an initial fixed period, after which they can fluctuate based on factors such as economic conditions, central bank policies, and lender discretion. As a result, your monthly repayments may increase or decrease as the interest rates change.

Choosing between fixed and variable interest rates depends on various factors, including your financial circumstances and goals. If you prefer stability and want to plan your budget accurately, a fixed interest rate may be suitable. However, if you are comfortable with potential rate fluctuations and believe rates may decrease in the future, a variable rate could offer advantages.

Remember, it's important to evaluate the pros and cons of each option based on your financial circumstances. Seeking guidance from a trusted broker or financial advisor can help you make an informed decision that aligns with your specific needs and preferences.

How changes in mortgage interest rates can affect monthly repayments?

Changes in mortgage interest rates have a direct impact on your monthly home loan repayments. When interest rate rises, your monthly repayments also increase, and when rates decrease, your repayments decrease as well. This is because the interest rates affect the portion of your repayment that goes towards paying off the interest on the home loan.

Case study: Impact of interest rate increase on disposable income and loan repayments

-

Background

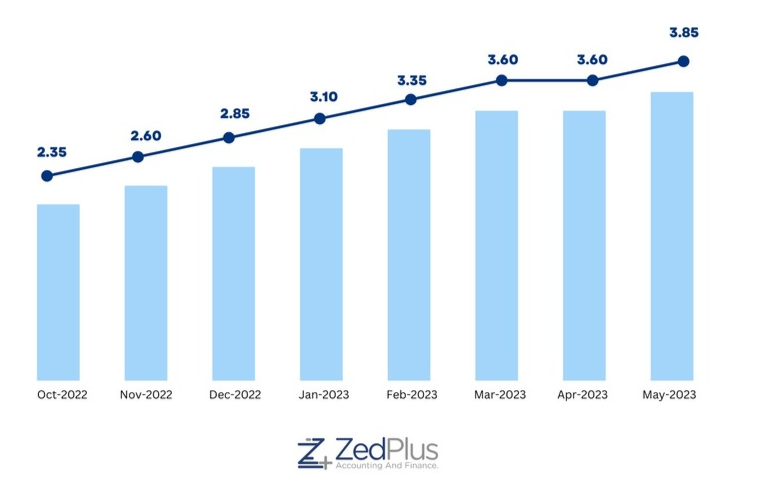

Consider an individual called Jane living in Australia who secured a home loan worth $500,000 with a 30-year term at an initial interest rate of 2.35%.

At this rate, Jane's monthly mortgage repayment would be approximately $1,929. This cost, alongside other household expenses, is covered by Jane's income. After all expenses, Jane's remaining funds serve as her disposable income.

-

The interest rate increase

Over the course of the last 6-8 months, the interest rate on Jane's home loan increased from 2.35% to 3.85%. This adjustment led to Jane's monthly repayment rising to approximately $2,347. In effect, Jane's repayment costs increased by $418 each month.

-

Impact on Jane's disposable income and household budget

This increase in Jane's mortgage repayment directly impacts her disposable income. As Jane has to budget an extra $418 each month to meet her increased mortgage repayments, she has less flexibility in her budget. This could mean reducing spending on non-essential items such as dining out, entertainment, and vacations, and potentially cutting back on other household expenses. If Jane's income isn't increasing at the same rate as her mortgage repayment, it could put additional strain on her budget and lifestyle.

-

Long-term financial implications

The long-term implications of this interest rate increase are equally significant. At the original interest rate of 2.35%, Jane would have paid a total of about $694,860 over the 30-year term. However, with the increased interest rate of 3.85%, Jane's total repayment over the loan term will rise to approximately $845,100.

If interest rates were to decrease back to 2.35%, her monthly repayment would drop back to approximately $1,929, and the total repayment over the term of the loan would again reduce to around $694,860.

-

Conclusion

This case study illustrates the significant impact even a modest change in interest rates can have on an individual's disposable income, monthly budget, and long-term financial planning. It is therefore crucial for borrowers to keep an eye on interest rate changes and factor them into their financial planning. It also underscores the importance of understanding the terms and conditions of a loan agreement and the potential implications of fluctuating interest rates.

How can you develop strategies to cope with mortgage interest rate changes and their impact on loan repayments?

Stay informed

To be ready for mortgage interest rate changes, it is necessary for you to stay informed. Stay updated on economic news and interest rate forecasts. Make it a habit to follow reliable sources such as financial publications or reputable websites that track interest rate movements, providing valuable insights for your financial decisions. At ZedPlus, we make it a point to keep all our clients updated about any changes with regular emails.

Evaluate your current financial situation

Assess your current financial condition and evaluate your loan affordability. Take the time to review your budget and understand your repayment capabilities. This will help you gauge how potential changes in interest rates may affect your financial stability.

Consider refinancing options

Explore the potential benefits of refinancing your mortgage during favourable interest rate environments. Understand the costs and terms associated with refinancing, and carefully evaluate if it aligns with your financial goals and circumstances. At ZedPlus, our customers are our priority. We can help you with refinancing your loan, offering you expert advice regarding terms, cost and savings.

Establish an emergency fund

Recognise the importance of having an emergency fund to handle unexpected financial conditions. Set aside a portion of your income regularly to build and maintain an emergency fund, providing a safety net during times of uncertainty.

Consult with professionals

Seek guidance from mortgage brokers, tax agents, and financial advisors. They can provide personalised strategies and advice tailored to your specific needs, helping you navigate interest rate changes and make informed decisions. At ZedPlus we have the requisite expertise to guide you through the intricacies of mortgage interest rate fluctuations and help you prepare effectively.

By following these steps, you can better prepare yourself for mortgage interest rate changes and proactively manage your finances in a changing market environment.

What government assistance programs are available to support homeowners during challenging times?

During challenging times, various government assistance programs are available to support homeowners. These programs aim to provide relief and incentives to individuals navigating the complexities of mortgage repayments. Here are some key programs to be aware of:

Mortgage relief schemes

Lender-backed mortgage relief schemes offer temporary financial assistance to homeowners experiencing difficulty in meeting their home loan repayments. These schemes may provide options such as loan repayment deferrals, reduced interest rates, or extended loan terms. Eligibility criteria and application processes vary, so it's essential to research and understand the specific requirements of each program.

First-home buyer incentives

The First Home Owner Grant (FHOG) is a valuable incentive aimed at helping first-time homebuyers achieve their homeownership goals. Eligible applicants can receive a grant of up to $10,000 when purchasing or building a new residential property. However, certain criteria must be met, such as being an Australian citizen or permanent resident and occupying the property as a principal place of residence.

To access government assistance programs, homeowners should visit relevant government websites, consult with brokers, or engage with local housing authorities. It's important to gather accurate information and fulfil any necessary documentation requirements to ensure a smooth application process. If all this looks daunting, you can simply contact us at ZedPlus, your dependable online mortgage broker in Australia.

Remember, government assistance programs are designed to provide temporary relief and support. It's advisable to explore long-term repayment strategies and seek professional advice when needed to maintain financial stability and make informed decisions regarding your mortgage.

Final note

Understanding the impact of mortgage interest rate changes is crucial for borrowers. It's important to take proactive steps to prepare for rate changes and seek professional assistance if needed.

At ZedPlus, we are here to help. Our team of experts can provide personalised guidance and strategies tailored to your needs. Whether it's evaluating your financial situation, exploring refinancing options, or establishing an emergency fund, we have the knowledge and experience to support you.

Don't navigate rate changes alone – let ZedPlus be your trusted partner in achieving financial stability.