The estimated results

0,000

Capital gains tax (CGT) is the tax you pay on profits from selling assets like property, shares, or cryptocurrency. In Australia, CGT is part of your income tax and applies to most assets acquired after 20 September 1985.

Our free capital gains tax calculator helps you estimate your CGT based on ATO rules. Whether you are selling an investment property, shares, or digital assets, the tool calculates your capital gains quickly and accurately.

If you are wondering how much capital gains tax you might owe, our CGT calculator Australia gives reliable estimates using current tax thresholds and discount rules.

Avoid surprise tax bills, stay compliant, and plan ahead.

Lodge your tax return quickly

No PAYG or Income Statement required

Pay nothing up front!

Pre-filled income details & deductions

Get help from a professional accountant

Have you owned the asset for more than 12 months?

The estimated results

0,000

Based on your income

, purchase

price and sold price , the estimated capital gains tax payable

is

The 12-month ownership rule

Yes

Summary

Sold price

0

Cost of selling

0

Purchase price

0

Cost of purchase

0

Capital gain/(loss)

0

Taxable capital gain/(loss)

0

Other taxable income

0

Capital gain tax payable

0

The information provided by our income tax calculator is for estimation purposes only and should not be considered as professional tax advice.

Your actual taxation will need to take into account all of your personal circumstances, and this site is in no way a comprehensive calculator. Further please note:

Please consult with a qualified tax professional for personalized guidance tailored to your individual circumstances.

Calculating your CGT early offers several financial and tax planning benefits. Here’s why it matters:

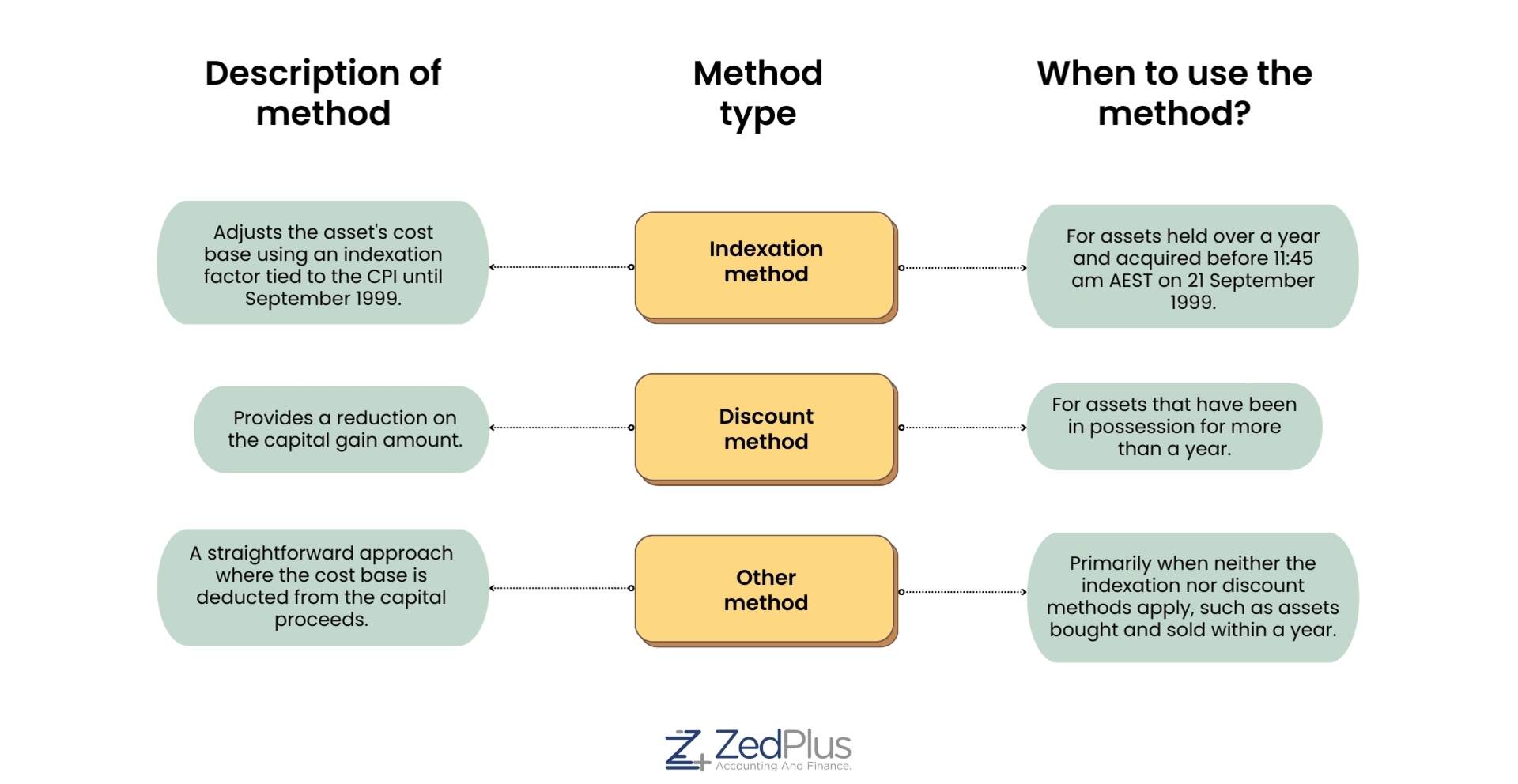

The Australian Taxation Office allows three main methods for calculating capital gains tax. Each method applies depending on the type of asset, ownership period, and acquisition date:

Here are the crucial exemptions to remember while calculating your CGT:

Assets acquired

Assets acquired before Sep 20, 1985 are completely exempt from CGT considerations.

Main residence

Your primary residence is generally exempt from CGT, but specific conditions might apply.

Granny flat arrangements

Eligible granny flat arrangements are not subject to CGT upon creation or termination.

Cars and motorcycles

Personal cars and motorcycles are exempt from CGT, regardless of when they're sold.

Personal use assets

Assets for personal use costing under $10,000 are exempt from capital gains tax.

Specific awards and payouts

Certain awards and compensation payouts are exempt from Capital Gains Tax implications.

Our experts will assist you in finding, selecting, and paying off your home loan online. At your convenience, speak with one of our home loan advisors.

We are proud to offer superior customer services. We get glowing reviews from our clients. Let's check some of the testimonials!

The actual tax on $100,000 profit varies with your income bracket and ownership period. For long-term holdings, a 50% discount may reduce the taxable gain to $50,000, which is then taxed at your marginal rate.

A $200,000 capital gain is added to your taxable income. If you held the asset for more than 12 months, a 50% discount may apply, reducing the taxable portion to $100,000. Use a calculator to estimate your tax precisely.

For investment properties, CGT is calculated by subtracting the cost base from the sale price. If held longer than 12 months, you may receive a 50% discount. Your final tax is based on the reduced gain added to your income.

You may avoid CGT on property if it was your main residence for the entire ownership period. Renting it temporarily may still allow for partial exemptions, such as the 6-year rule. Keeping records is essential for claims.

If you move out of your main residence and rent it, you may treat it as your primary home for up to 6 years. This means you could still qualify for a full CGT exemption when you sell.

You may be exempt if the asset is your main residence, the gain is offset by capital losses, or the asset was acquired before 20 September 1985. The ATO outlines specific criteria for each exemption type.