What is a split home loan, and why should you consider it?

Introduction

As the RBA raised interest rates by 425 basis points since May 2022, the expense of borrowing money to purchase a house has escalated significantly. Consequently, first-time homebuyers are finding it increasingly challenging to enter the market, while existing homeowners are compelled to reassess their mortgage choices.

In such a volatile market, split loans have gained popularity as a way to hedge against rising interest rates and reduce the risk of being caught in a debt trap. In this blog, we will help you understand what split loans are and how they work so that you can make an informed decision about your mortgage options.

Key takeaways

- Split home loans provide a blend of stability and flexibility for mortgage repayments.

- Customise split ratios to match individual financial goals and risk tolerance.

- Utilise features like redraw and offset accounts to enhance repayment control.

- Prioritise a thorough assessment of financial health before committing to a split loan arrangement.

What is a split home loan?

A split loan, also referred to as a 'combo loan,' involves dividing your loan into distinct portions. This setup enables you to allocate one segment of your loan to a fixed interest rate, ensuring stability over a certain period, while the remaining portion is subject to a variable rate, which can fluctuate with market conditions.

This strategy offers the dual benefits of fixed-rate security and variable-rate flexibility, allowing borrowers to tailor their loan arrangements to suit their financial goals and risk tolerance. Let’s understand the concept better with an example below:

Example:

Suppose you have a $900,000 mortgage over 30 years and decide to split it evenly. You fix $450,000 at a 3.00% annual rate for 3 years, with monthly payments of $1,897. For the variable half, you start with a rate of 2.70%, resulting in monthly payments of $1,830.

Initially, your combined monthly payment is $3,727. If, after a year, the variable rate rises to 3.10%, the variable segment's monthly payment increases to $1,922, pushing your total monthly payment to $3,819.

While seeing payments go up isn't ideal, having half of your loan fixed mitigates the total increase. The fixed part remains unchanged, providing stability for budgeting. Conversely, if rates fell, only the variable loan portion would benefit from lower repayments.

What should be the ideal split home loan ratio?

The ideal split for a home loan hinges on your unique financial circumstances and goals. While opting for a 50:50 split between fixed and variable portions is common, you're free to tailor this ratio according to your preferences. For instance, if you're inclined towards the stability offered by a fixed rate but also desire the flexibility associated with an offset account, a configuration like an 80% fixed to 20% variable split could serve your needs well.

Before finalising how to split your home loan, tapping into the resources and knowledge offered by ZedPlus experts can provide you with invaluable insights. At ZedPlus, our team of home loan experts is dedicated to helping you navigate through the options to find a loan structure that best matches your financial strategy and lifestyle preferences.

With a focus on personalising your home loan experience, we ensure that your loan division enhances your financial stability and aligns with your long-term objectives.

Top 3 reasons to consider split loans

Here are the top three reasons to consider split loans:

You can save when interest rate drops

Split home loans allow you to benefit from the flexibility of a variable rate for a portion of your loan while enjoying the stability of a fixed rate for another portion. This means if interest rates fall, you can benefit from lower repayments on the variable portion, and if they rise, the fixed portion of your loan remains unaffected.

For instance, on a $400,000 split loan, if the variable rate decreases from 3.5% to 3% on a $200,000 portion, your annual interest savings could be around $1,000. This reduction in interest allows for lower monthly repayments on the variable part.

At the same time, the fixed part ensures your budget remains consistent even if market rates fluctuate, thus providing you with a stable and effective financial plan.

You can customise it as per your needs.

The flexibility to adjust your loan to fit your financial situation is a crucial advantage of split loans. For instance, if you have a $400,000 mortgage, specific lenders might allow you to divide this total into multiple portions—let's say, four segments. Here’s how you could organise these parts:

- First segment ($100,000 Fixed for Stability): You decide to fix the interest rate on the first $100,000. This means your payments for this part remain constant, providing predictability in your budget.

- Second segment ($100,000 Fixed for Stability): Similar to the first, another $100,000 is fixed. Together, these two segments ensure that $200,000 of your loan has stable, unchanging payments.

- Third segment ($100,000 Fixed for Stability): You also choose to fix this segment, ensuring that $300,000 of your loan benefits from predictable payments.

- Fourth segment ($100,000 Variable with Offset Account): The remaining $100,000 is on a variable rate, which can go up or down. However, you link this part to an offset account. Money in the offset account reduces the interest you pay on this variable segment. For example, if you have $50,000 in the offset account, you only pay interest on $50,000 of the variable loan instead of the full $100,000.

You can access different loan features:

Variable rate loans offer various features, like a re-draw facility, extra repayments, and offset accounts that can save you money in the long run. However, if you choose a fixed-rate home loan, these features may not be available or come at an additional cost.

A re-draw facility allows you to withdraw extra funds that you have paid towards your loan. This feature can be helpful if you need extra cash for unexpected expenses or emergencies. Similarly, making additional repayments on your variable portion can reduce the interest charged on that part of your loan, saving you money in the long run.

Furthermore, offset accounts can help reduce the interest payable on your loan, as mentioned earlier. Additionally, some lenders may offer discounts on fees or interest rates if you have a split loan with them, giving you additional savings opportunities.

Hence, split loans provide borrowers with the best of both worlds – flexibility and stability.

What are the drawbacks of splitting a home loan?

While split loans can be highly beneficial, they're not without their downsides, especially for those who might not fully grasp their intricacies. By consulting with a financial advisor, you can steer clear of these common pitfalls and select a loan structure that aligns with your financial goals.

Here are a few drawbacks that you should consider while choosing a split loan:

Interest rate changes: If interest rates go up, the variable part of your split loan will cost you more. Even though part of your loan has a fixed rate, the rest could see higher payments due to rising rates.

Fixed rate periods end: The security of a fixed rate doesn't last forever, usually up to 5 years. After this, you might find your payments increasing as the fixed rate expires. This is a good time to think about whether to fix your rate again or switch to a variable rate with the help of a financial advisor.

Break fees for changing plans: The break fee, also known as an Early Repayment Fee by some lenders, is charged when a loan is paid off or altered before the fixed term ends. This fee covers the lender's loss for ending the fixed funding arrangement early.

Example:

If you're on a 5-year fixed loan of $500,000 at a 4.5% annual rate with 12 months left, and you decide to switch to a new 5-year fixed rate at 2.5%, you might incur a break fee of $7,500, along with a possible small administrative charge from the bank.

Key factors to consider when choosing a split loan

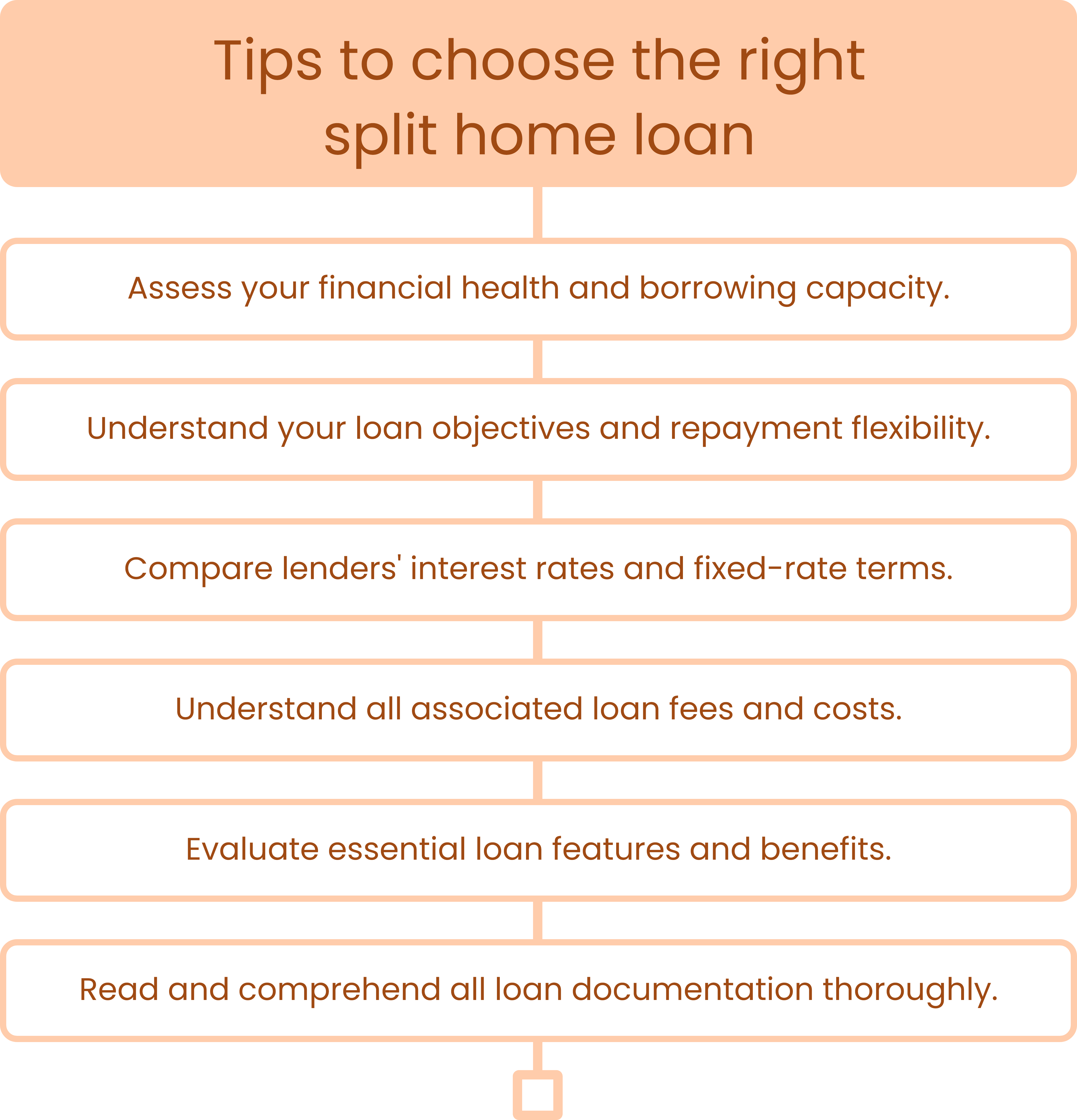

Once you clearly understand how split loans work, along with their advantages and disadvantages, you'll be better positioned to determine if this strategy fits your financial needs. Here are a few factors to consider when evaluating the suitability of a split home loan for your situation

Interest rate trends: Knowledge of potential interest rate shifts is vital. Understanding whether fixed or variable rates are expected to rise or fall can help you decide if a split loan offers a financial advantage.

Mortgage repayment goals: Identify your priorities, such as minimising interest costs or having predictable repayments. Splitting your loan allows for flexibility with a variable rate and security with a fixed rate.

Loan amount: The size of your mortgage impacts the decision to split. For larger loans, the benefits of a split loan, like potential interest savings, might outweigh the setup or ongoing management fees. For smaller loans, the complexity may not be worth it.

Financial stability: Your ability to handle possible increases in repayments for the variable portion of the loan is crucial. Ensure you have the financial means to manage repayment fluctuations without stress.

Lender options: The terms and flexibility offered by lenders for split loans vary. It's important to check if your lender provides competitive rates for both fixed and variable portions and if you can change the split ratio as your financial situation evolves.

Is refinancing possible with a split loan?

Refinancing involves replacing your current mortgage with a new one, potentially with better terms, a lower interest rate, or a different loan structure. When it comes to a split loan, which is divided into separate parts (typically one part fixed rate and the other variable rate), refinancing can certainly be achieved.

This process might require more documentation due to the dual nature of the loan. However, with the assistance of experts, managing the refinancing of a split loan becomes more straightforward.

At ZedPlus, our home loan experts guide you through refinancing split loans and provide support in selecting optimal loan structures.

Ending note:

Split home loans offer a versatile solution for borrowers navigating a fluctuating market. At ZedPlus, we excel in tailoring split loans to fit your financial needs precisely.

With access to offerings from over 40 lenders, we secure competitive deals that save you money. Our team evaluates your borrowing capacity and guides you toward a split loan that supports your immediate needs and future financial well-being. I

If you're looking for a flexible and secure home loan option, contact us today. Our team of experts will be happy to assist you in finding the best split home loan solution for your needs.

Remember, understanding the complexities of split loans and considering your financial goals are the keys to making an informed decision. Don't hesitate to seek professional advice and make the most of this loan option.