Top 10 tax planning strategies to reduce tax and build wealth for high-income employees

Tax is a significant concern for many, especially those with high incomes. While business owners often benefit from various tax management tools, high-salaried individuals might feel their options are limited. However, even if you're on a high salary, with the right information and careful planning, there are ways to manage your tax obligations effectively and enhance your wealth.

This blog aims to shed light on the top 10 tax planning strategies specifically crafted for high-income employees. By adopting these strategies, you can ensure you're in line with the guidelines set by the Australian Taxation Office and position yourself for a more secure and prosperous financial future. It's about making your money work smarter, not just harder, for you.

Key takeaways

- High-income earners should obtain private health insurance to sidestep the Medicare Levy Surcharge.

- Consider salary sacrificing for vehicles to gain tax benefits and enhance compensation.

- Income protection insurance offers a safety net, and its premiums are often tax-deductible.

- Deductions can be claimed for self-education expenses directly related to one's job.

- Engaging with expert advisors, like ZedPlus, can optimise tax-saving opportunities.

10 strategies to reduce taxes for high-income employees

Here are the top 10 strategies to consider for reducing your tax burden and building wealth:

Contribute to a superannuation fund:

Superannuation is a retirement savings system in Australia. Contributing more to your superannuation will secure a comfortable retirement and reduce your taxable income. As of the mentioned data, the concessional contributions cap stands at $25,000. This encompasses both your employer's contributions and any personal contributions.

Maximising this cap can lead to substantial reductions in taxable income. However, exceeding this cap can result in hefty penalties. Knowing how close you are to this cap is crucial, especially if you have multiple superannuation funds or change jobs frequently. Engaging with a financial advisor can provide clarity on optimising contributions without breaching the cap.

Negatively gearing investment property:

Property investment is a popular wealth-building strategy in Australia. Negative gearing occurs when the costs associated with an investment property (like loan interest, maintenance, and depreciation) surpass the rental income. This 'loss' can be offset against other income, effectively reducing your taxable income.

It's a strategy that requires careful planning. While the tax benefits can be significant, it's essential to consider property market trends, interest rate fluctuations, and long-term financial goals. A negatively geared property ideally becomes positively geared over time as rental income increases, and the loan decreases.

How much can you save on taxes with negative gearing?

Get private health insurance:

The Australian healthcare system is supported by the Medicare Levy, a tax applied to taxpayers. High-income earners without private health insurance are additionally charged the Medicare Levy Surcharge.

By obtaining private health insurance, you can avoid this surcharge. Beyond the tax benefits, private health insurance can offer quicker medical services, a choice of doctors, and private hospital rooms. It's essential to compare policies and ensure that coverage matches your health needs.

Salary sacrifice arrangements:

Salary sacrifice arrangements allow employees to exchange a portion of their salary for benefits, potentially reducing their taxable income. For high-income employees, this can be particularly advantageous. They can lower their tax bracket by receiving a reduced salary by opting for these arrangements.

Additionally, contributions to compliant super funds through salary sacrifice are taxed at a concessional rate of 15%, offering significant savings. Employees can also benefit from fringe benefits like cars or property, with some items exempt from fringe benefits tax.

Donate to charity

Charitable donations can be morally rewarding and financially beneficial. When you donate to recognised Australian Deductible Gift Recipients (DGRs), these donations can be claimed as tax deductions. However, not all charities have DGR status. Verifying the organisation's DGR status on the Australian Business Register website is crucial before donating.

Always retain receipts or bank statements as evidence of your contribution. Genuine donations mean you shouldn't expect any material return for your gift. While giving brings intrinsic joy, ensuring it's directed towards genuine DGRs can also offer financial benefits at tax time.

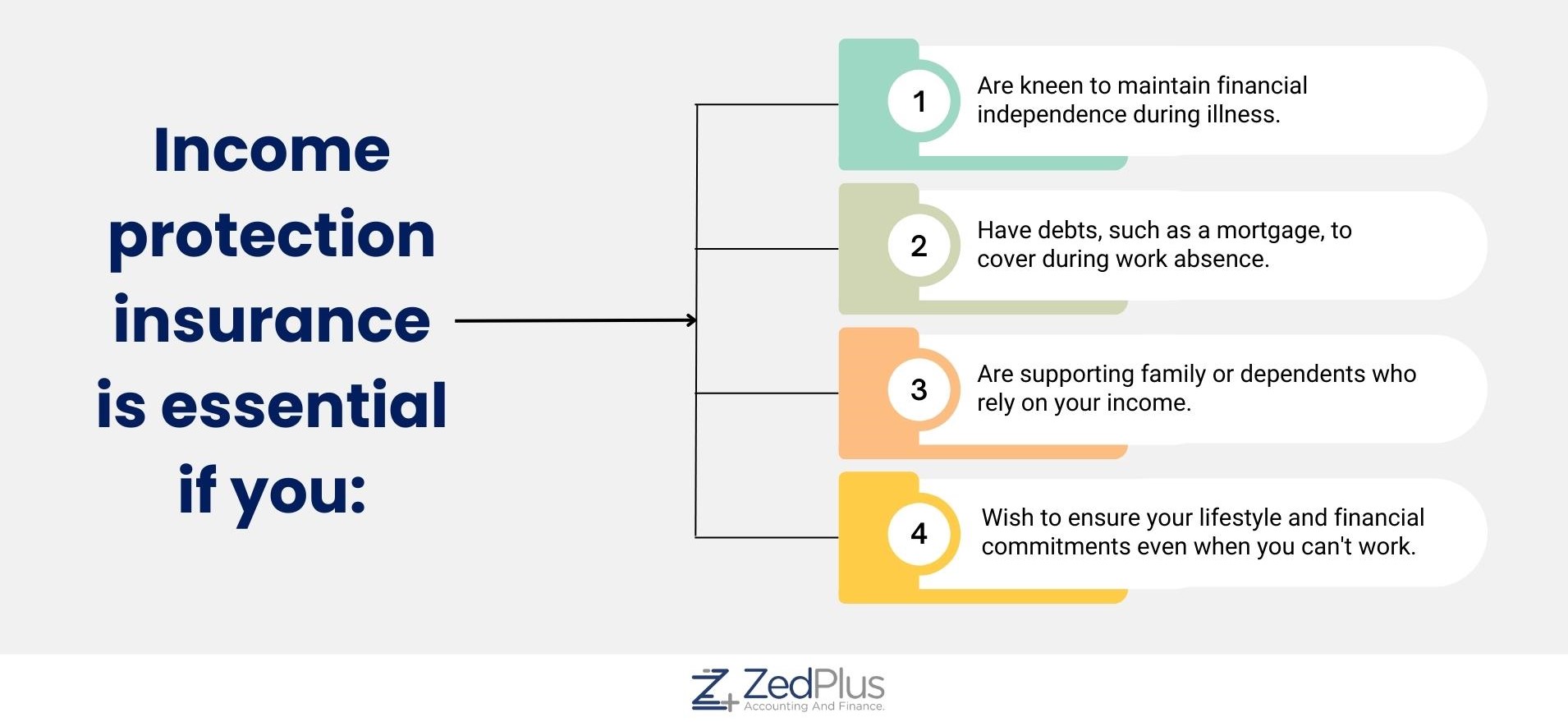

Income protection insurance

This financial safety net insurance offers up to 75% of your income if illness or injury prevents you from working. For high-income earners, the stakes are high. The premiums for this insurance are typically tax-deductible, providing another avenue for tax savings. It's essential to compare policies, understand waiting periods, and ensure the coverage amount matches your needs. However, if you receive a payout from this insurance, it must be declared in your tax return.

If the policy provides a lump sum for personal injury or total and permanent disability, it might be considered capital and could be subject to capital gains tax. Not all insurance premiums are deductible, especially if they are linked to superannuation or provide a capital sum for injury. Therefore, it's crucial to be well informed to ensure compliance.

Invest in self-education and training

Investing in continuous learning is a strategic move for personal and professional advancement. By engaging in education directly associated with your current job, such as specialised courses or insightful seminars, you elevate your job performance and pave the way for potential career growth.

The Australian Tax Office (ATO) recognises and incentivises this proactive approach to self-improvement. They permit individuals to claim tax deductions on these self-education expenses, provided they align directly with their ongoing employment activities. You benefit from a reduced taxable income as you enhance your skills and broaden your knowledge.

However, ensuring a clear connection between your educational pursuits and your current role is essential to avail of these tax advantages. Investing in your education offers dual rewards: fostering career progression and providing financial benefits.

Tax benefits on investment income

Investment income and its taxation are pivotal aspects of financial planning. The Australian Tax Office (ATO) offers guidelines for deductions related to such incomes. For instance, account-keeping fees for investment accounts are deductible.

Some expenses might be deductible if you attend seminars about your current investments, but not for potential investments. Share-related expenses, such as management fees, advice on investment changes, and certain computer expenses, are deductible.

If you've borrowed money to invest in shares that yield income, the interest you pay is often deductible. Additionally, specific deductions are available for those involved in forestry-managed investment schemes.

Optimise home office deductions

Many employees incur home office expenses with the rise of remote work. The Australian Tax Office provides guidelines on claiming these expenses, from internet bills to office equipment depreciation. To be eligible for these deductions, one must have additional running expenses due to working from home and should be actively fulfilling employment duties.

There are two primary methods for calculating these expenses: the revised fixed rate method, which allows a claim of 67 cents per hour for specific expenses, and the actual cost method, which requires detailed records of each expense.

Deductible expenses encompass data, internet, phone usage, electricity, computer consumables, stationery, and the decline in value of assets like computers. Proper record-keeping and understanding of these guidelines are crucial to maximise tax benefits.

Seek expert advice

Tax laws and regulations are intricate. For high-income earners, the potential savings from effective tax planning are significant. Engaging with a financial advisor or accountant ensures compliance and optimises every tax-saving opportunity. At ZedPlus, we help high-income earners find the best ways to reduce their tax bills. Our team knows all the tax-saving tricks and will guide you on what deductions you can claim.

Ending note

Tax planning is pivotal in financial success, especially for high-income earners. The strategies outlined in this blog offer a comprehensive approach to minimise tax burdens and amplify wealth accumulation.

From the nuances of superannuation contributions to the intricacies of negative gearing and the importance of expert advice, each strategy holds the potential to reshape one's financial landscape. Yet, the world of tax is ever-evolving and can be intricate.

This is where ZedPlus steps in. As expert tax accountants, we're committed to simplifying these complexities, ensuring our clients capitalise on every tax-saving opportunity. Contact us today if you want to make the most of your financial landscape and navigate the tax terrain confidently. Together, we'll chart a course towards maximised financial growth."