Owning property can be a great way to earn money. But, like all investments, there are taxes involved. If you don't plan well, you might pay more taxes than you need to. On the other hand, if you try to avoid taxes without knowing the rules, you could get into trouble. That's why it's so important for property investors to understand tax planning.

In this blog, we'll share some key strategies that can help you manage your taxes better. We'll talk about ways to increase your returns and make sure you're following all the rules.

This information is useful for both new investors and those who have been in the game for a while. By the end, you'll have a clearer idea of how to approach taxes in your property investments.

Key takeaways

- Understanding tax planning is crucial for property investors to manage taxes efficiently.

- The Australian Taxation Office (ATO) has set clear guidelines for claiming deductions on investment properties.

- Property investors should be aware of the claims and deductions they're entitled to, such as council claims, water rates, etc.

- Prepaying some property expenses can lower taxable income.

- Keeping detailed financial records is crucial for smooth tax returns.

7 strategies to maximise your investment property tax deductions

Here are 7 strategies to ensure optimal tax benefits for property investments.

Know your entitlements:

One of the foundational steps in optimising your property investment returns is to have a thorough grasp of the claims and deductions you're entitled to. This not only ensures you comply with tax regulations but also allows you to maximise your financial benefits. Let's delve deeper into some of the key claims:

Council claims

Council claims, often referred to as council rate deductions, are pivotal for property investors. Essentially, these are deductions that property owners can claim against the council rates they pay for their investment properties. These rates are fees imposed by local government bodies. The funds collected are channelled towards various community services, infrastructure development, and maintenance in the locality where the property stands.

Water rates

Water rates, commonly known as water utility charges, represent the fees that water authorities charge for providing water supply and sewerage services to properties. As a property investor, it's crucial to note that you may be eligible to claim tax deductions on these water rates. However, it's essential to be familiar with the specific rules and criteria that govern these deductions to ensure accurate claims.

Land taxes

Land taxes can be a complex area, with implications varying based on regional and jurisdictional regulations. In its essence, land tax is a levy imposed by governments on land ownership. The applicability and extent of tax deductions for land taxes on investment properties can differ widely. Hence, investors must be well-versed with the land tax regulations specific to their region.

Strata fees

Strata fees, commonly referred to as body corporate fees, represent recurring charges borne by owners of strata-titled properties or those within a community association. These fees play an essential role in maintaining, managing, and improving shared amenities and spaces, including communal areas, elevators, landscaping, and building insurance.By accurately identifying and claiming deductions on these charges, property owners can realise significant tax benefits.

Maintain accurate records:

Detailed and organised record-keeping is paramount for a seamless tax return experience, especially when dealing with property investments. It's essential to document every financial transaction diligently, be it income or expenses associated with your property. Such a practice not only eases the tax return process but also offers a comprehensive overview of your investment's financial health.

Leveraging digital tools or even considering the services of a professional bookkeeper can significantly enhance this documentation process. By maintaining a dedicated bank account for your investment property, you can further segregate and track relevant transactions. Remember, a well-maintained record not only aids in claiming all rightful deductions but also stands as a robust defence during potential audits.

Understand non-deductible expenses and their implications:

Property investment has its unique financial considerations, and one of the key aspects to grasp is the nature of non-deductible expenses. Some costs related to your investment property, though they might appear deductible at first glance, are not.

For instance, the initial purchase price, stamp duty on the purchase, and legal fees during acquisition or sale are non-deductible. Similarly, renovations made right after buying the property, before renting it out, cannot be claimed.

Other expenses that don't qualify for deductions include the following:

- Costs tied to personal use of the property,

- Bills covered by tenants, and

- Expenses linked to selling the property, such as advertising and agent fees.

The Australian Taxation Office (ATO) differentiates between repairs and capital expenses. While immediate deductions can be claimed for repairs, capital expenses are usually depreciated over a period. To illustrate, fixing a broken window is deductible, but upgrading to a modern window isn't.

Grasp the essentials of depreciation deductions for investment properties:

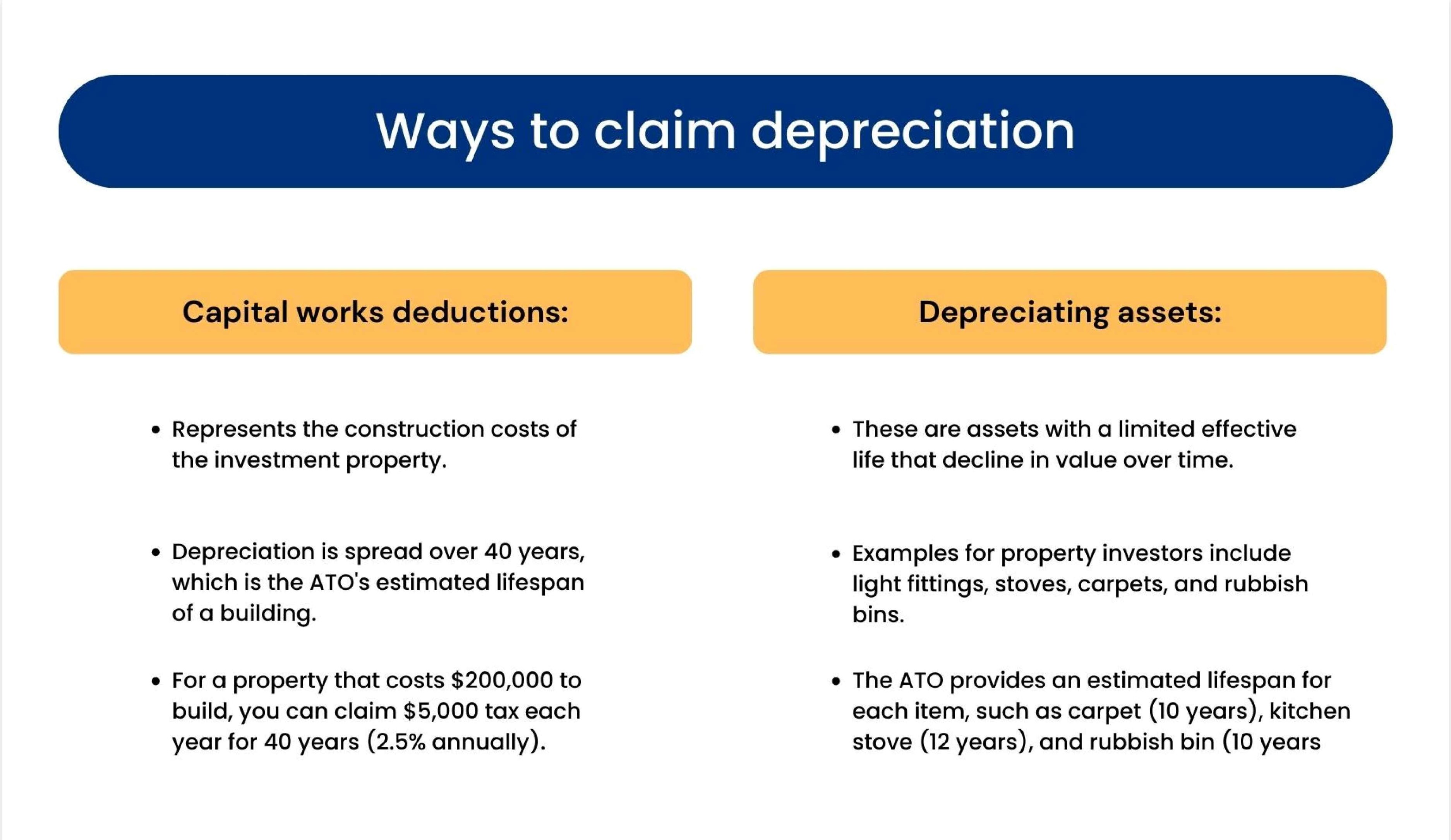

When diving into property investment, understanding depreciation is paramount. Depreciation refers to the tax deductions you can claim due to the natural wear and tear of the property over time.

For tax purposes, purchasing an investment property is seen as acquiring a building and various depreciating assets, often termed plant items. These deductions arise from the capital works on the property and the decrease in the value of the property's contents.

The Australian Tax Office (ATO) provides guidelines on how assets, such as computers or furniture, decrease in value as they age. For property investors, this might encompass items like light fittings, carpets, and appliances.

To determine the exact amount you can claim, it's advisable to obtain a depreciation schedule, ideally prepared by a qualified professional like a quantity surveyor. This schedule outlines the rate of decline in value and the possible deductions.

Engaging a quantity surveyor is beneficial as they can provide a detailed report on the rate of depreciation claimable on your property. Once you have this report, you can share it with your accountant, who will factor it in during tax filing.

Consider your capital gain tax:

Capital gains tax (CGT) is a crucial aspect to consider when selling or transferring assets. Notably, assets that were acquired before 20 September 1985 are exempt from CGT. This is particularly relevant for real estate, as any improvements made to such properties after this date might be subject to CGT.

Your primary residence, in most cases, is exempt from CGT. However, there are exceptions to this rule. For instance, if a portion of your home has been rented out or used for business purposes, or if the property spans more than 2 hectares of land, CGT could be applicable.

When it comes to personal use assets, items like boats, furniture, and household items might attract CGT if their acquisition cost is over $10,000. On the other hand, cars are categorically exempt. Collectables, such as artworks and antiques, have their own set of rules. For example, a collectable that was acquired for $500 or less is typically exempt from CGT.

Intangible assets, which encompass leases, goodwill, and contractual rights, can also be subject to CGT, especially during specific events like the granting of a lease. Depreciating assets, including business equipment or items in a rental property used exclusively for taxable purposes, are not subject to CGT. Instead, any gains or losses from these assets are treated as either income or deductions.

For those looking to navigate the complexities of CGT and gain a precise understanding of potential tax implications, our capital gain tax calculator is a recommended tool. It offers clarity and ensures that individuals are well-equipped to make informed decisions regarding their assets.

Use your expenses to offset your taxable deductions:

By prepaying some of your investment property expenses, you can effectively lower your taxable income and maximise your tax deductions. As an astute investor, it's essential to grasp the nuances of tax deductions, as they can significantly influence your financial strategy. For instance, if you prepay the next year's interest on your property loan, you can claim it on this year's tax return.

Regular maintenance and repairs not only keep your property in top shape but also offer valuable tax deductions. If your property is relatively new, you might benefit from its depreciation, which can be a notable tax break.

if you employ a property manager, their fees, including those for tenant advertising, are tax-deductible. It's also wise to insure your property, and the premiums you pay towards this insurance can be deducted from your taxable income.

If you ever travel for property inspections or maintenance, those expenses can be claimed. And when seeking legal or financial advice related to your property, those consultation fees are deductible.

Maximise your investment returns with ZedPlus expertise:

Dealing with taxes for investment properties can be challenging, especially with frequently changing tax rules. It's wise to engage an accountant or tax advisor well-versed in property investment.

ZedPlus stands as a beacon in this domain, ensuring you tread the right path. Our seasoned professionals pinpoint deductions, guarantee compliance, and optimise your returns.

With our finger on the pulse of tax shifts, we deliver timely counsel aligned with your investment goals. Collaborating with our experts empowers you to navigate tax intricacies with confidence, letting you focus more on your property ventures.

Ending note

While tax planning for property investment can be a complex task, investing smartly and following the regulations laid out by the government can reap great rewards in the long run. With so many strategies to choose from, savvy investors should always do their due diligence before making any decisions.

As changes come into effect with regards to taxation and restrictions, it is important to be prepared with efficient tax forecasts and knowledgeable professionals who understand the process. Risking losses through failure to comply with regulatory responsibilities and inaccurate tax advice can be prevented through expert guidance.

At ZedPlus, we pride ourselves on being more than just an accountant. Our dedicated team offers tailored tax strategies, ensuring that each investor is equipped with the best advice for their unique situation. We emphasise compliance, risk mitigation, and maximising returns.

With our expertise, investors can confidently navigate the ever-evolving landscape of property investment taxation. Get in touch with our experts and experience the difference between informed, strategic, and compliant tax planning.