Understanding the impact of inflation: Managing your finances in an inflationary environment

Inflation is a key economic concept that silently erodes the value of your money, impacting your personal finances in significant ways. At ZedPlus, a renowned firm of online mortgage brokers and tax agents in Australia, we understand the importance of grasping inflation's effects and taking control of your financial well-being. With our expertise and personalised strategies, we are here to help you navigate and conquer the challenges of an inflationary environment.

Understanding how inflation affects your everyday life is essential as prices rise and your purchasing power fluctuates. Through this blog, we will reveal the results of inflation and offer actionable insights to manage your personal finances effectively. Whether it is budgeting tips or investment diversification, we have the knowledge and tools to guide you on the path to financial stability.

Key takeaways

- Invest in sectors that are resilient to inflationary trends.

- Consider investing in treasury-indexed bonds or other inflation-resistant assets.

- Regularly review and adjust financial plans according to changing rates of inflation.

- Seek guidance from professional advisors when managing finances in an inflationary environment.

What is inflation?

Inflation refers to the general increase in prices of goods and services over time, resulting in the diminishing value of money. It is commonly measured using the consumer price index (CPI), which tracks the average price changes of various goods and services.

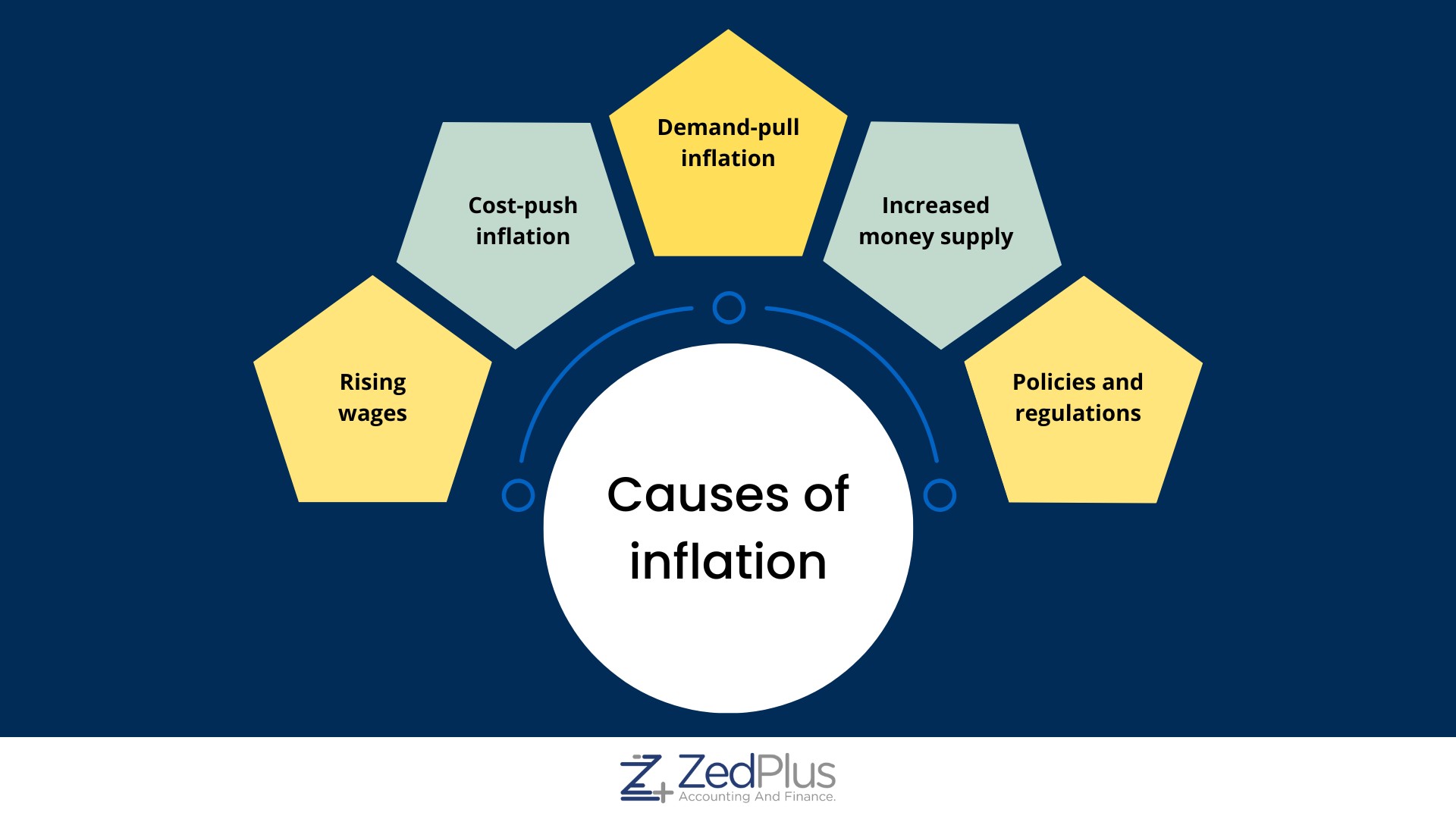

Which factors contribute to inflation?

Cost-push inflation:

This occurs when production costs, such as labour, raw materials, or rising energy prices cause businesses to pass on those increased costs to consumers through higher prices.

Demand-pull inflation:

When demand for goods and services surpasses their supply, it puts upward pressure on prices as businesses strive to meet the higher demand, leading to inflation.

Increased money supply:

If there is a significant increase in the money supply within an economy, it can result in more money chasing the same amount of goods, driving up prices and causing inflation.

Wage growth:

When wages increase across industries, it can lead to higher production costs for businesses, potentially contributing to inflation.

Devaluation:

When a country's currency loses value relative to other currencies, it can make imports more expensive, potentially leading to inflation as the cost of imported goods rises.

Policies and Regulations:

Government policies and regulations, such as changes in tax rates, trade policies, or monetary policy, can have an impact on inflation by influencing factors like consumer spending, investment, and money supply within an economy.

Example of the impact of inflation on savings and investments

Suppose you have $1,000 in your savings account, and you earn an annual interest rate of 5%. After a year, your savings will grow to $1,050.

Now, let's assume that the inflation rate during this period is 10%. This means that the prices of goods and services are expected to increase by 10%. Consequently, the price of a particular commodity that currently costs $1,000 may rise to $1,100 in the next year due to inflation.

Even though your savings have grown by 5%, the inflation rate of 10% has eroded the purchasing power of your money. The increased cost of the commodity indicates that you would need $1,100 to purchase it next year.

In this scenario, there is a negative impact on your real return on savings and investments. Essentially, the economic growth in your savings has not kept pace with the rising inflation, and you will have to spend more than what you have at your disposal.

What is the impact of inflation on finances?

Negative effects of inflation on savings and investments

Inflation exerts several detrimental effects on savings and investments, posing challenges for individuals and businesses alike. Firstly, high inflation erodes the purchasing power of money over time. As prices rise, the value of your savings diminishes. This can hinder your ability to achieve financial goals and maintain a comfortable standard of living.

Secondly, rising inflation can reduce the real return on investments. If the interest rates on your investments fail to outpace the inflation rate, the actual purchasing power of your investment returns diminishes. It becomes crucial to seek investment options that generate returns exceeding the inflation rate to preserve and grow your wealth effectively.

Erosion of value for fixed-income assets

Fixed-income assets, such as bonds or fixed-rate savings accounts, are particularly susceptible to the erosive influence of inflation. These assets typically offer a fixed interest rate or return, which may not keep pace with rising prices. As inflation increases, the interest income or returns from fixed-income assets declines. This means that the real value of these assets diminishes over time, potentially jeopardising your financial stability.

Challenges in retirement planning and future financial goals

Inflation poses significant challenges to retirement planning and long-term financial goals. As the cost of living rises, individuals need to ensure that their savings and investments can sustain them throughout retirement. Failing to account for inflation risk can result in a shortfall of funds and an inability to maintain the desired lifestyle in retirement.

Additionally, high inflation affects the affordability of future financial goals, such as buying a home, funding education, or starting a business. If these goals are not adjusted for inflation, the required financial resources may increase beyond initial estimates, making them more difficult to achieve.

To overcome the difficulties posed by inflation, it is vital to develop a comprehensive financial plan that incorporates inflationary factors. Working with a financial consultancy firm like ZedPlus can provide the expertise and personalised strategies necessary to navigate the impact of inflation on your finances.

By incorporating inflation-adjusted investments, diversifying your portfolio, and regularly reassessing your financial plan, you can mitigate the negative effects of inflation and work towards achieving your long-term economic growth.

In the next section, we will delve into effective strategies for managing your finances in an inflationary scenario, equipping you with the tools and knowledge to thrive amidst changing economic conditions.

What are the strategies for managing finances in an inflationary environment?

Budgeting and expense management

- Establishing a well-planned budget is essential in an inflationary environment. Start by assessing your current expenses and income, considering the potential inflation rises. Set realistic spending limits and allocate funds accordingly to prioritise essential needs while accounting for potential price increases.

- Combating inflation requires adjusting your personal consumption expenditures. Look for ways to reduce discretionary expenses, such as eating out less frequently or finding cost-effective alternatives for everyday items. Embrace a mindful approach to spending, making conscious choices to ensure your money is allocated wisely and aligned with your economic growth.

Diversification of investments

- Diversifying your investment portfolio is important. By spreading your investments across various asset classes, such as stocks, bonds, real estate, and commodities, you can reduce the impact of inflation on your overall portfolio. Different asset classes may respond differently to inflation, allowing you to benefit from favourable returns and minimise potential losses.

- Explore investment strategies that can act as a hedge against inflation rises. Consider investments in sectors that tend to perform well during inflationary periods, such as infrastructure, natural resources, or companies with pricing power. Additionally, allocating a portion of your portfolio to inflation-resistant assets like treasury inflation-protected securities or real estate can provide stability and potential growth during inflationary times.

Consideration of inflation-indexed securities

- Exchange-traded Treasury Indexed Bonds (eTIBs) are fixed-income securities whose principal and interest payments are adjusted for inflation. These bonds help safeguard your purchasing power by providing returns that keep pace with inflation.

- Investing in treasury inflation-protected securities offers the potential for preserving capital and obtaining good returns. These securities provide a reliable means to protect against the erosive effects of inflation. However, it's essential to consider factors such as interest rate fluctuations, market conditions, and the specific terms of the securities before investing.

Reviewing and adjusting financial plans

- In an inflationary scenario, it is necessary to review and adjust your financial plans periodically. As rate of inflation changes, your financial goals and strategies may need modification. Regularly assess your investment performance, evaluate the effect of core inflation on your savings, and make necessary adjustments to stay on track.

- Engaging the services of a trusted financial consultancy firm like ZedPlus can provide valuable guidance in managing your finances effectively. Professional advisors can help with economic analysis of your financial situation, devise strategies tailored to your goals, and navigate the complexities of an inflationary environment. Their expertise can ensure you make informed decisions and optimise your financial outcomes.

By implementing these strategies, you can proactively manage your finances, protect your purchasing power, grow your wealth, and achieve your long-term financial aspirations.

Final word

Inflation can significantly influence personal finances, but with the right strategies, you can effectively manage its effects and secure your financial well-being.

At ZedPlus, we specialise in helping individuals navigate the challenges of inflation. Our team of experts is here to assist you in developing customised financial strategies designed to protect and grow your wealth. Reach out to us today to embark on a journey towards financial success in the face of inflation.

With astute financial management and the right guidance, you can mitigate the effect of inflation and secure stable economic growth. Take control of your finances and make informed decisions to achieve your goals even during inflationary trends.