A step-by-step guide to making a property offer in 2025

Introduction

Making an offer is one of the most important parts of buying a home. It is the point where interest turns into action, and understanding the process can help you move forward with clarity.

Many buyers are unsure about how to approach this stage. Whether you are buying for the first time or returning to the market after a few years, it is common to have questions about how much to offer, what conditions to include, and what happens next.

This blog post walks you through each step, from preparing your finances and reviewing the contract to submitting the offer and getting ready for settlement. If you are planning to buy, here is what you need to know to make a well-timed offer.

Key takeaways

- Know your borrowing capacity before you start, so you can make offers within your true budget.

- Research recent sales and market trends in your target area to avoid overpaying and make informed decisions.

- Always arrange a building and pest inspection to uncover issues that may affect the price or future repairs.

- Review the contract of sale carefully with a conveyancer to understand the terms and protect your interests.

- Put your offer in writing with clear conditions and be ready to negotiate if the seller responds with changes.

11 steps every buyer should follow to make an offer on a property

Here are some key steps to follow when preparing and submitting an offer on a home:

Step 1: Talk to ZedPlus first

At ZedPlus, we believe that making an offer on a home should begin with a clear understanding of your financial position. We take the time to assess your borrowing capacity based on your income, savings, and financial commitments. This helps define your purchase range with accuracy and confidence.

Our lending specialists work closely with you to review your deposit and explore home loan options that suit your goals. If appropriate, we arrange a pre-approval so you are ready to act when the right property comes along.

When the right property becomes available, we ensure that the finance process begins promptly. This approach helps avoid delays during settlement and supports a smoother transaction from offer to ownership.

Step 2. Understand the market

Once you have clarity on your borrowing position, the next step is to explore the property market in your preferred areas. This helps you develop a realistic sense of what your budget can secure and prepares you for informed negotiations.

Key things to look for include:

- Properties that have sold recently in the same suburb with similar features.

- How long did each home stay on the market before selling.

- The difference between the original asking prices and the final sale price.

- The level of buyer interest or competition in the area.

- Any upcoming developments or changes in the local community.

By building this knowledge early, you will be better positioned to identify fair value, avoid overpaying, and act quickly when the right home becomes available.

Step 3: Research and shortlist comparable properties

After shortlisting a few homes based on research, it’s time to visit them. Property photos rarely tell the whole story, and what seems ideal online may feel very different in person.

Take the time to assess:

- Natural light and ventilation.

- Noise levels and the surrounding environment.

- Property layout, ceiling height, and overall feel.

- Any signs of water damage, mould, or poor workmanship.

We recommend bringing someone with you for a second perspective. A fresh pair of eyes may notice flaws you miss, especially when you’re emotionally invested.

This step also gives you a sense of whether a home is truly right for your lifestyle and whether you are ready to proceed with further checks.

Book an appointment with a ZedPlus loan expert

Let us help guide you through every step of your home loan journey.

Step 4: Arrange a building and pest inspection

If the home passes your initial inspection and feels like the right fit, your next priority is uncovering any hidden issues.

A licensed building and pest inspection will assess structural integrity, check for signs of termites, damp, drainage issues, roofing concerns, or safety hazards. These insights not only protect you from buying a money pit but may also support your price negotiations.

We recommend choosing an independent inspector who is not affiliated with the selling agent. This helps ensure the findings are unbiased and in your best interest.

Once you know the true condition of the home, you are ready to begin discussing legal terms and documentation.

Step 5: Ask for the contract and review the details

When you are ready to move forward, ask the selling agent for the contract of sale. This document sets out the legal terms of the transaction, including:

- Purchase price – Decide what you are comfortable offering based on your research and borrowing position.

- Deposit terms – Know how much you're ready to commit upfront. This often affects how seriously your offer is taken.

- Settlement period – Make sure the proposed timeline suits your finances and moving plans.

- Inclusions – Check what’s included in the sale, such as appliances, window coverings, or fixtures.

- Conditions – Review any clauses that may affect your ability to complete the purchase, such as those related to finance approval, inspections, or specific vendor requests.

It’s important to have the contract reviewed by your conveyancer before making an offer. This helps you understand the fine print and ensures you are fully aware of any terms that could favour the seller.

What if you miss the settlement date?

It could cost you money, time, and even the deal. Check out our blog to learn about the consequences in detail and how to avoid them.

Step 6: Make a reasonable offer

Once you have done your due diligence, you are ready to make an offer. But how much should you offer?

Your offer should reflect both your budget and the property's true market value. Use the following points to guide your decision:

- Look at the recent sale prices of similar homes in the same suburb.

- Consider how long the property has been on the market and any price adjustments.

- Assess buyer competition by observing open home traffic and auction activity.

- Review the condition of the home and any repairs that may be required.

- Understand where the local market sits in the cycle — rising, peaking, declining, or recovering.

In areas where demand is cooling or stock is sitting longer, it may be appropriate to offer slightly below the asking price. In faster-moving markets, a closer offer with appealing terms may be necessary.

Flexible terms like a shorter finance approval window or a settlement date that suits the seller can give your offer an edge.

Step 7: Put your offer in writing

Verbal offers are not enough. Always submit your offer in writing, which might be via:

- A Letter of Offer (prepared by your solicitor or agent)

- A signed and conditional contract of sale

Include key details such as:

- Your full legal name(s)

- Offer amount

- Deposit terms

- Settlement period

- Any special conditions (e.g., subject to finance or inspection)

Written offers demonstrate seriousness and help avoid confusion or miscommunication. In many states, real estate laws require the agent to present all written offers to the seller.

Step 8: Be ready for a counteroffer

After you make an offer, the seller may respond with a different price or new conditions. This is called a counteroffer and is a common part of the negotiation process.

Review the counteroffer carefully. Make sure it aligns with your budget, settlement timeframe, and any agreed-upon conditions. If there are changes that don’t suit your circumstances, you can suggest adjustments that reflect your position more accurately.

It’s important to respond promptly. Delays can reduce your chances of securing the property, especially if other buyers are still active. Staying clear, confident, and focused on your goals will help you negotiate calmly and effectively.

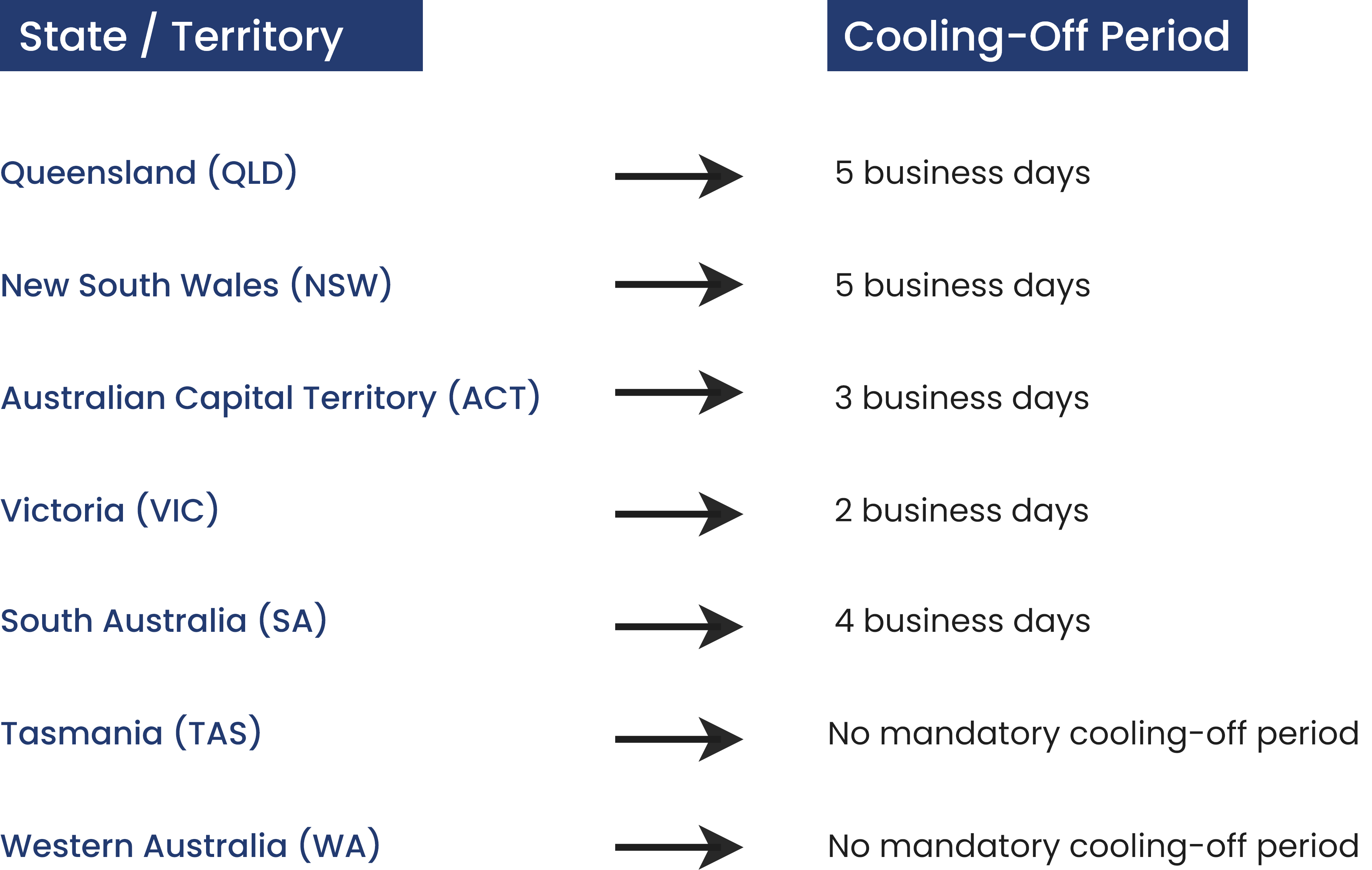

Step 9: Confirm the cooling-off period

Once both parties have signed the contract, you may still have time to withdraw from the agreement if you change your mind. This is known as the cooling-off period, and it varies by state.

Cooling-off periods across Australian states and territories

There is no cooling-off period if you buy at auction. Always speak to your conveyancer to confirm the rules in your state and make sure any important clauses are included before you sign.

Step 10: Follow up after offer acceptance

Once your offer is accepted and the contract is signed, there are a few important tasks to complete straight away.

First, arrange building insurance to protect your new property. This is usually required before settlement.

Next, send the signed contract to your mortgage broker so they can begin the formal loan approval process. This step is time-sensitive and essential to securing your finances on time.

At the same time, your solicitor or conveyancer will begin preparing for settlement. They will confirm all contract dates, coordinate with your lender, and ensure legal requirements are completed properly.

These steps help ensure a smooth transition from offer to ownership.

Step 11: Plan for settlement day

Settlement is the official day when the property becomes legally yours. Most settlements are set for 30 days after signing the contract unless another timeframe was agreed upon.

In the lead-up to settlement, your conveyancer will:

- Coordinate with your bank to ensure the funds are ready.

- Prepare and check all legal documents.

- Make sure all council rates and any other fees are up to date.

On the day of settlement, you can usually collect the keys after 2 pm.

Before that, you are entitled to a final inspection. This is your last chance to check:

- All promised appliances or inclusions are still in place and working.

- There is no new damage or rubbish left behind.

- The home is in the same condition as when you made the offer.

Let your conveyancer know immediately if there are any issues during this final inspection so they can take the necessary steps before settlement is finalised.

Final thoughts

Making an offer on a property is about more than just price. It takes preparation, timing, and the right support. By following these 11 steps, you can approach the process with confidence and make decisions that align with your goals.

If you need help with financing or have questions about the home-buying process, the team at ZedPlus is here to help. We can walk you through your options, assess your borrowing capacity, and ensure you're ready to take the next step when the time is right.

Reach out today and take the next step with the right support behind you.

Disclaimer: This article has been prepared for general information purposes and does not consider your individual objectives, financial position, or needs. The content is based on current market practices and general property processes, which may change over time.

Readers are encouraged to use this information as a starting point only and not as a substitute for professional advice. Decisions related to property purchase, finance, or legal matters should always be made in consultation with a licensed advisor, broker, or solicitor.