8 common mistakes to avoid when applying for a mortgage in 2025

Introduction

Applying for a mortgage is a big step, and for many Australians, it marks the beginning of homeownership and long-term financial commitment. However, it is also a process filled with fine print, lender requirements, and paperwork that can quickly become overwhelming.

Buyers often spend hours researching their options, getting their finances in order, and trying to understand what lenders actually want. Still, many applications end up delayed, declined, or pushed back for reasons that could have been avoided.

The Australian home loan market experienced strong growth in 2024, with 515,116 new home loans issued. This marked an 11 percent increase, totaling $331 billion in mortgages, reflecting just how active and competitive the lending environment has become.

With that level of demand, lenders are more thorough than ever, and even small mistakes in your application can slow things down or affect your borrowing power.

In this blog, we will walk through the most common mistakes Australians make when applying for a mortgage and share simple, practical ways to avoid them.

Key takeaways

- Secure loan pre approval before house hunting to understand your borrowing capacity.

- Compare loan structures such as fixed, variable, and interest-only to match your financial goals.

- Double-check your application for errors or missing information to prevent delays or rejections.

- Work with a mortgage broker for personalised guidance and access to better loan options.

Avoid these common home-buying pitfalls

Here are some of the most frequent mistakes of home buyers and tips to help you avoid them.

Mistake 1: Skipping pre approval:

Many buyers make the mistake of jumping into property hunting without securing loan preapproval, which sets them up for disappointment. Without preapproval, you have no clear understanding of your borrowing capacity, making it easy to fall in love with a property that’s beyond your budget.

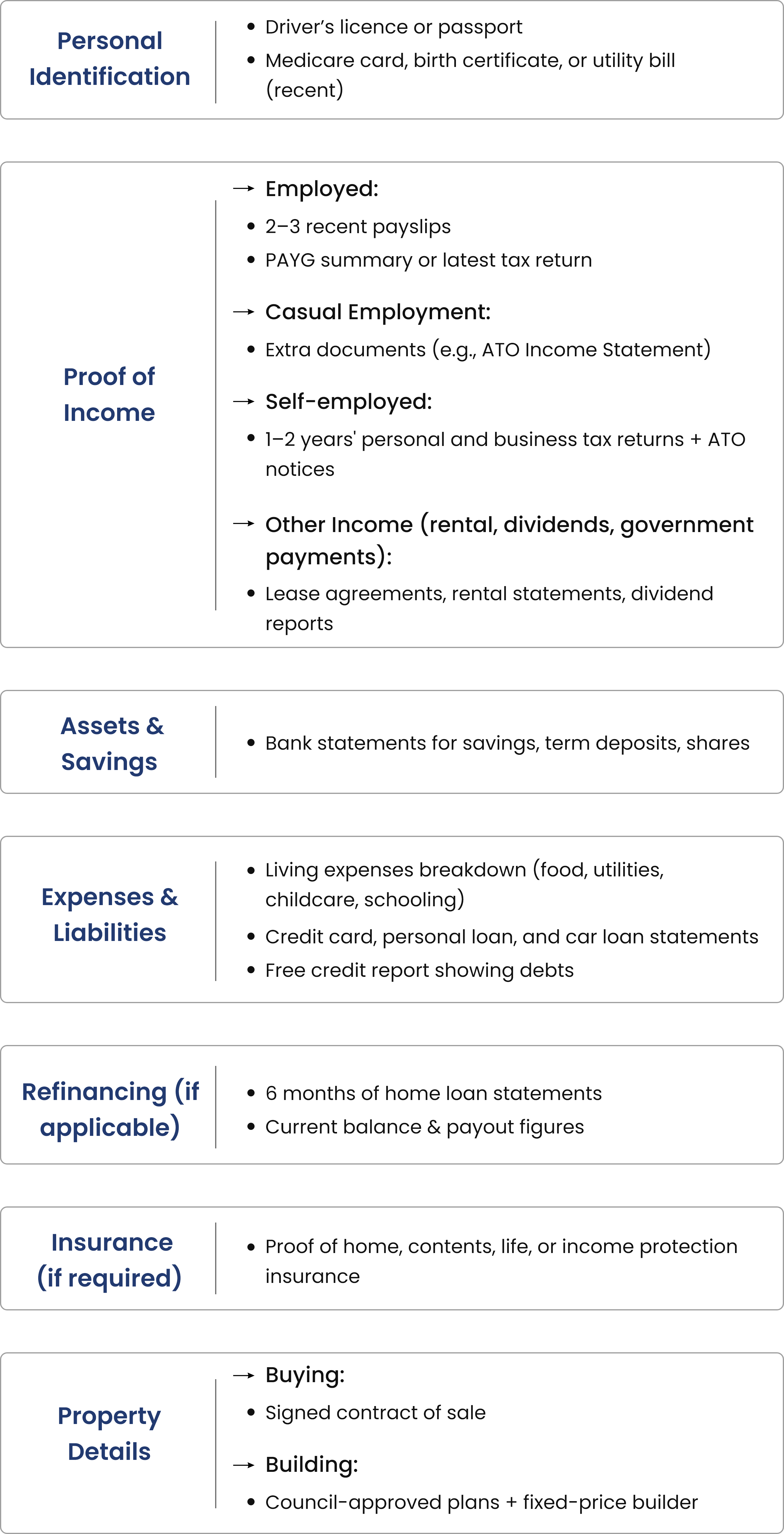

The preapproval process helps you avoid this by giving lenders the chance to assess your financial situation, starting with verifying your identity, income, and expenses. This step requires you to provide documents like payslips, proof of additional income, and details of your ongoing expenses.

The lender will also run a credit check and review your assets and liabilities to get a complete picture of your financial standing. Once you have pre-approval for a specific amount, you are in a stronger position to act quickly when the right property becomes available.

Speak with our experts today to get your pre-approval

Mistake 2: Applying to multiple lenders at the same time:

Many borrowers believe that applying with several lenders increases their chances of loan approval. In reality, this approach can work against you. Each time you apply for a loan, a hard inquiry is added to your credit file.

According to FICO, a single hard inquiry from a lender can reduce your credit score by up to five points. While that may seem minor, several applications in quick succession can have a noticeable impact on your overall credit rating.

Rather than applying everywhere, it is smarter to compare your options first. That is where ZedPlus comes in. With access to thousands of loan products from more than forty lenders, we help you compare and match with the right loan based on your financial goals.

This process does not affect your credit score and gives you a clearer path to approval.

Mistake 3: Changing jobs before applying for a mortgage:

When applying for a home loan, lenders want to see that you have a stable and reliable source of income. This is because your ability to repay the loan depends on consistent employment.

If you change jobs just before applying, it creates uncertainty around your income, even if the new role is permanent. Most lenders will ask for at least two or three recent payslips, so a new job can delay or complicate the process.

If you are in a probation period or have just started, the lender may question whether your employment is secure. This is especially true if you are borrowing a large amount or have a high loan-to-value ratio. Even short gaps between jobs can raise red flags, though most lenders are comfortable with a break of up to 28 days.

To give yourself the best chance of loan approval, it is a good idea to hold off on any job changes until after your mortgage has been approved and settled.

Mistake 4: Overlooking the true costs of homeownership:

Many home buyers concentrate on the purchase price and mortgage repayments, often overlooking the additional costs involved in owning a property. Stamp duty, which differs across states, can significantly impact your budget if not planned for in advance.

A deposit below 20 percent usually means paying Lenders Mortgage Insurance, an extra cost that benefits the lender but comes out of your pocket.

Upfront fees such as legal and conveyancing services, property inspections, and loan application charges also add up quickly. After moving in, ongoing costs like council rates, home insurance, utilities, and regular upkeep become part of your financial responsibility.

While some repairs may be minor, major issues such as plumbing faults or roof replacements can result in unexpected expenses. Preparing for these costs beyond the monthly mortgage ensures a more secure and stress-free homeownership experience.

Home loan document checklist:

Mistake 5: Submitting a home loan application with errors:

Some loan applications with errors can cause serious delays or even result in rejection. Simple mistakes like typos, missing information, or inconsistent details can raise red flags for lenders and lead to additional scrutiny.

This becomes especially important when you're close to settlement, as any delay in approval could result in missed deadlines and unexpected costs.

Being organised, preparing your documents in advance, and carefully reviewing every detail can make a big difference. Seeking help from a mortgage broker can also ensure your application is accurate, complete, and ready for smooth processing.

Mistake 6: Ignoring loan types:

In February 2025, the Reserve Bank of Australia reduced the cash rate by 0.25 percent, marking its first interest rate move in four years. As the lending environment shifts, the type of loan you choose can significantly affect how manageable your repayments are.

Fixed-rate loans offer stable and predictable repayments, which can help you budget with confidence. Variable-rate loans may begin with lower costs but can change over time, making it harder to plan for the future. Interest-only loans reduce repayments at the start but often lead to higher overall costs.

Without a clear understanding of how each loan type works, you may end up with a product that does not suit your needs. Taking time to compare your options and seeking expert advice can help you choose a loan that supports both your current situation and your long-term goals.

Choosing the wrong home loan type can cost thousands.

Check out our blog for a detailed breakdown of fixed vs variable home loans before signing your mortgage.

Mistake 7: Having high credit card limits:

Many borrowers are unaware that credit card limits can reduce their borrowing power, even if the card has no balance owing. Lenders assess the total limit as money you could potentially spend, treating it as a financial commitment. This means the higher your credit card limit, the less you may be allowed to borrow.

Every $10,000 you reduce from your credit card limit can boost your borrowing capacity by an average of $50,000 to $60,000. If you hold multiple cards or have high combined limits, the impact can be even greater.

To improve your borrowing position, it’s worth lowering your limits or cancelling any unused cards. Paying off any existing debt will also strengthen your application.

Mistake 8: Not seeking professional advice:

Buying a home involves more than just choosing a property, as the lending process can be complex and overwhelming without the right guidance. Many buyers try to handle everything themselves, which often leads to confusion, delays, or choosing the wrong loan.

Without professional support, it is easy to misunderstand your borrowing capacity or overlook important details in a loan product. A mortgage broker can help by assessing your financial situation and matching you with suitable loan options.

They also communicate with lenders on your behalf, making the process smoother and more accurate. This level of support is one reason more Australians are turning to brokers for help.

The Mortgage and Finance Association of Australia reported that in the three months to December 2024, seventy six percent of all new home loans were arranged through mortgage brokers.

This record figure shows the growing trust in brokers to simplify the process and improve outcomes. Seeking expert advice early can save time, reduce stress, and increase your chances of securing the right loan for your needs.

Conclusion

Applying for a mortgage does not need to feel overwhelming. With the right preparation and expert support, the process becomes easier to follow and more manageable. At ZedPlus, we guide you through each step, from understanding your borrowing power to choosing the right loan and preparing your application.

Our team takes the time to explain your options, answer your questions, and help you avoid common mistakes. The goal is to make your home loan journey simpler, more confident, and aligned with your goals. Contact us today for a stress-free home loan experience.