The process of calculating capital gains tax on property sales in Australia

Introduction

Have you recently sold or planned to sell a property or another asset for more than you originally paid? If so, you could be liable to pay capital gains tax (CGT) on your profit. But how much will you owe, and what factors influence the amount?

This blog aims to provide a detailed guide on how CGT is calculated in Australia, covering everything from determining your capital gain or loss, understanding discounts and exemptions, factors that can impact your tax bill, and tips to minimise your CGT bills.

Key takeaways

- A capital gain or loss is the difference between the asset's sale and purchase prices, including related expenses.

- Capital losses can be used to reduce gains in the same year or carried forward to offset future capital gains.

- Factors like asset acquisition cost, improvement expenses, and more impact CGT calculations.

- A user-friendly CGT calculator designed by ZedPlus experts helps you estimate taxable gains or losses quickly and efficiently.

What is a capital gain tax?

A capital gain or loss is the difference between the purchase price of an asset and the amount it was sold for, including any related costs incurred during the purchase and sale. If the sale price exceeds the purchase price, it results in a capital gain. Conversely, if the asset is sold for less than its purchase price, it results in a capital loss.

What do taxpayers need to pay tax on?

Taxpayers pay tax on net capital gains, which refers to the profit made from selling assets such as property or shares after subtracting any capital losses and eligible discounts. If they have owned an asset for more than 12 months, they may be entitled to a 50 percent capital gains tax (CGT) discount, meaning only half of the gain is subject to tax.

However, this discount is not available to companies. The tax on the net gain is not a separate tax but is included in the taxpayer’s assessable income and taxed at their marginal tax rate. Some assets, such as a person’s primary residence, may be exempt from CGT, although this exemption generally does not apply to companies.

Steps to calculate your capital gain tax manually

Here are the steps you can follow to calculate your capital gain tax manually:

Step 1: Determine capital proceeds:

This refers to the monetary value you received when you disposed of an asset. Disposal can be through selling, gifting, or other events that qualify as CGT events. A CGT event is a significant occurrence, like an asset's sale or destruction, resulting in a capital gain or loss. The item that's the subject of this event is a CGT asset, which can be anything from real estate to shares, contractual rights, or even cryptocurrencies.

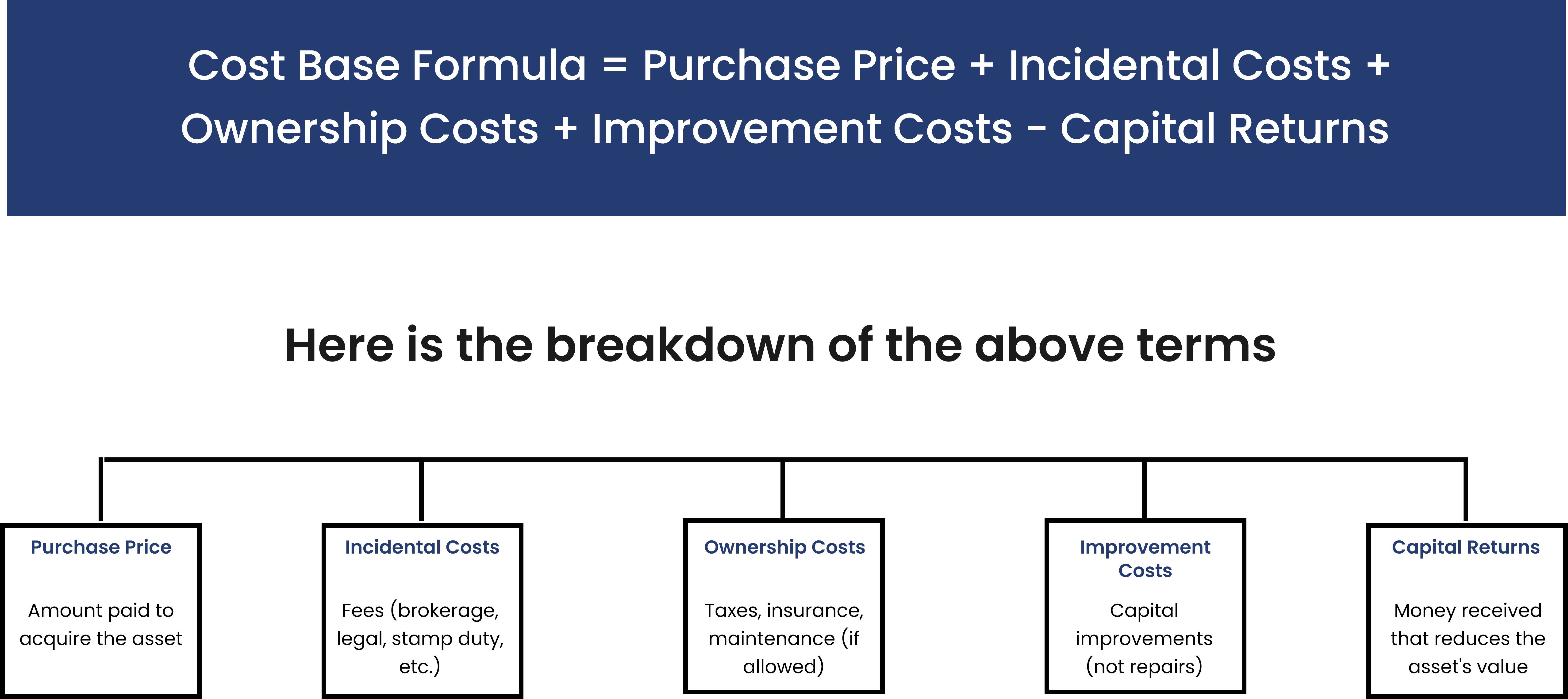

Step 2: Calculate costs

This step involves tallying up all the expenses associated with the CGT asset. This includes its purchase price, associated fees, maintenance costs, and other relevant expenditures. This total is termed the 'cost base. If the asset was sold at a loss, a 'reduced cost base,' which might include additional costs, is used.

Step 3: Compute gain or loss

You'll subtract the cost base (from Step 2) from the capital proceeds (from Step 1). If the resulting number is positive, you've made a capital gain. If it's negative, you've incurred a capital loss.

Step 4: Tally all CGT events

You might dispose of multiple assets over a financial year. Repeat steps 1-3 for each of these disposals or CGT events.

Step 5: Offset losses against gains

If you've made both capital gains and losses over the year, you can use the losses to reduce your gains. This step ensures you only pay tax on your net gain. It's strategic first to offset gains that don't qualify for CGT discounts.

Step 6: Determine net amount

After offsetting, if you're left with a positive amount, that's your net capital gain for the year. If it's negative, you have a net capital loss, which can be used to reduce capital gains in future years.

Step 7: Apply CGT discount

Some capital gains qualify for a discount, reducing the amount of tax you owe. The specifics of this discount depend on factors like how long you've held the asset and the type of asset it is.

Step 8: Report in tax return

Finally, you must declare your net capital gain or loss in your annual income tax return. A net capital gain will be taxed at your marginal rate, while a net capital loss can be saved to offset gains in subsequent years.

Let’s understand the above steps better with an example below

John bought a piece of artwork in 2015 for $5,000 and spent an additional $500 on its maintenance. In 2023, he sold the artwork for $10,000. In the same year, he also sold a vintage car he had bought in 2018 for $15,000 at a loss, receiving only $12,000.

Calculation:

John's capital proceeds from the artwork sale were $10,000. After accounting for the purchase price and maintenance, his total costs for the artwork were $5,500. This means he made a capital gain of $4,500 from the artwork.

John received $12,000 for the vintage car but initially spent $15,000. This resulted in a capital loss of $3,000.

Combining both transactions, John's total capital gain is $4,500 - $3,000 = $1,500.

Assuming John qualifies for a 50% CGT discount on the artwork sale (as he held it for more than 12 months), his taxable gain would be reduced to $750.

John would declare a net capital gain of $750 on his tax return and pay tax based on his income bracket.

Make your calculations effortless with the ZedPlus capital gains tax calculator

ZedPlus's CGT Calculator is incredibly user-friendly and simple. In a few easy steps, users can estimate their capital gains tax. Here are the simplified steps to calculate capital gain or loss using our capital gains tax calculator:

Step 1: Enter property details: Specify if you owned the asset for over 12 months.

Step 2: Input financial information: Fill in the purchase price, sold price, cost of purchase, and cost of selling.

Step 3: Add other taxable income: Include any other taxable income you have.

Step 4: View results: The calculator will provide the estimated capital gain or loss, capital gain tax payable, and other tax payable.

Note : Keep in mind that this is an estimation tool. The calculator doesn’t account for certain factors like Medicare levy, rebates, or offsets, so consulting a tax professional is recommended for a comprehensive assessment.

Key factors influencing CGT calculations

Acquisition cost:

The initial cost of acquiring the asset is fundamental in CGT calculations. This includes the purchase price and other associated costs such as legal fees, stamp duty, and brokerage fees.

Improvement costs:

Any cost spent on improving an asset after its purchase can affect the CGT. For example, upgrades like renovations or extensions to a property can increase its cost base, which will influence the amount of capital gain or loss when the asset is sold.

Duration of ownership:

The time an asset is held can significantly influence the CGT, especially in countries that offer a CGT discount for assets held longer than a specific period. For example, assets held for over 12 months in Australia often qualify for a 50% CGT discount.

Exemptions and concessions:

Various exemptions and concessions can influence the final CGT amount. For instance, the sale of one's primary residence might be exempt from CGT, or small businesses might have specific concessions that reduce their capital gains.

Sale price and associated costs:

The asset's selling price, minus any costs associated with the sale (like advertising or agent's commission), determines the capital proceeds. The difference between this and the adjusted acquisition cost gives the capital gain or loss, subject to CGT.

Still struggling with complex CGT calculations? Let us help!

Maximise your returns with Zedplus! Our experts handle every detail, from accurate CGT calculations to filing your tax return, so you only pay what’s needed.

Practical tips for minimising capital gain tax

Here are the key strategies taxpayers should follow to minimise capital gains tax (CGT) on the sale of their assets.

Invest for the long term:

Holding onto investments for an extended period can lead to more favourable tax rates. For instance, if you hold an asset for more than a year, it's typically considered a long-term gain, taxed at a lower rate than short-term gains. The tax system often benefits long-term investors, with short-term investments generally being taxed at higher rates.

Take advantage of tax-deferred retirement plans:

Investing through retirement plans can offer significant tax benefits. The ATO highlights the importance of understanding when to access superannuation and the tax implications of retirement payments.

Tax offsets, such as the seniors and pensioners tax offset and the superannuation income stream tax offset, become available post-retirement. The capital gains tax retirement concession can also exempt gains on business assets, aiding in retirement planning, especially for small business owners.

Use capital losses to offset gains:

If you experience an investment loss, you can use it to decrease the tax on gains from other investments. For instance, if you have two stocks, one with a gain and the other with a loss, selling both can offset the capital gains tax owed. If capital losses exceed gains, up to $3,000 can be used to offset ordinary income, with any remaining loss carried over to future tax years.

Watch your holding periods:

You must check the exact purchase date if you're about to sell an asset you've held for around a year. Waiting a bit longer to qualify for long-term capital gains treatment might be beneficial, especially if the asset's price remains relatively stable.

Pick your cost basis:

Determining the cost basis is significant when selling shares acquired at different times and prices. While many investors use the First In, First Out (FIFO) method, other methods like Last In, First Out (LIFO), Specific Share Identification, and Average Cost (for mutual funds) are available.

Wrap up

Hope you found this blog helpful in understanding the process of calculating capital gains tax on property sales in Australia. However, if you're still uncertain about the complexities of CGT calculations or want to ensure that you are taking advantage of all available exemptions, discounts, and deductions, now is the time to get professional assistance.

Our team of tax experts at ZedPlus is here to guide you through the details of capital gains tax while helping you maximize your savings. So, rather than leaving it to chance, take action today by booking an appointment with us to handle your tax calculations and achieve the best possible outcome.