Background

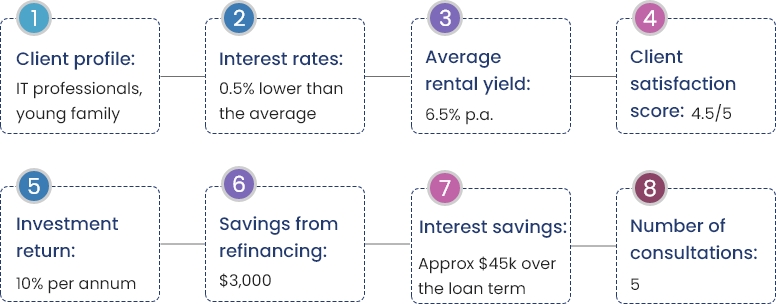

Monalisha and Saisrikanth, both hard working IT professionals, embarked on their property investment journey three years ago when they made the life-changing decision to purchase their first home in Australia.

However, being new to the world of property investment, they faced a multitude of questions and concerns related to property buying.

Recognising the need for expert guidance, they sought help from expert mortgage consultants from ZedPlus to assist them in navigating the intricacies of the property investment process.

Beyond finding a suitable mortgage solution, Monalisha and Saisrikanth had bigger aspirations. They envisioned building a substantial property portfolio by leveraging the equity from their existing properties and tax optimisation strategies from negative gearing.

Their journey was not without challenges. The initial property purchase required a significant financial commitment, and there were moments of uncertainty and doubt. Today, Monalisha and Saisrikanth are proud owners of multiple investment properties, having successfully navigated the complexities of the property market.

Challenges they initially faced:

The couple faced the following challenges:

- Lack of knowledge: As new bee property investors, the couple were unfamiliar with the home-buying process and the technical jargon involved.

- Navigating the market: Identifying the best loan options was challenging with many lenders and varying interest rates.

- Busy schedules: Working in IT and having young children, they had limited time to manage the complexities of securing and refinancing home loans.

- Competition: The property market was competitive, and it was difficult to find good deals on properties. The couple needed to be patient and persistent in their search for the right properties.

How did ZedPlus help?:

At ZedPlus, our team prepared a comprehensive loan application to guide Monalisha Dhall and her husband through home-buying.

- Initially, they were unfamiliar with technical terms like offset facilities, redraw accounts, LMI, and stamp duty.

- The team explained each of these terms and their implications thoroughly, making the process transparent and straightforward.

- Additionally, they assisted them in understanding various financial calculations like deposit amounts and borrowing power.

- This enabled them to move forward in their home-buying journey with a clear understanding of their financial commitments.

Successful growth in property portfolio

The comprehensive support from ZedPlus led to a highly successful outcome for Monalisha and Saisrikanth. They were able to not only purchase their first home in Australia with confidence and clarity but also managed to grow their property portfolio to include two additional properties.

Their journey serves as an inspiration to aspiring property investors, demonstrating that with hard work, dedication, and the right guidance, it is possible to achieve financial freedom through property investment.

Excited about buying your first home?

Let our home loan expert help you with budgeting, saving for a deposit, understanding costs, and planning your path, all for free and with no obligation.