Home equity: What it is, how it works, and how can you use it?

Introduction

Owning a home is one of the most significant financial investments you’ll ever make, and over time, it can turn into a powerful financial asset. With every mortgage payment and rise in property value, you build equity in your home.

This equity isn’t just a number on a statement; it’s an opportunity that, when understood and used correctly, can significantly impact your financial future. The key is knowing how to effectively unlock and leverage this asset to maximise its potential.

In this blog, we have listed everything you need to know about home equity – how it works, why it matters, how it works, and how you can use it to your advantage.

Key takeaways

- Home equity refers to the difference between your home’s current market value and the outstanding balance on your mortgage.

- Home equity can be used as a financial asset to build wealth and provide flexibility in times of need.

- Calculating home equity helps you understand the financial value you can tap into without selling your property.

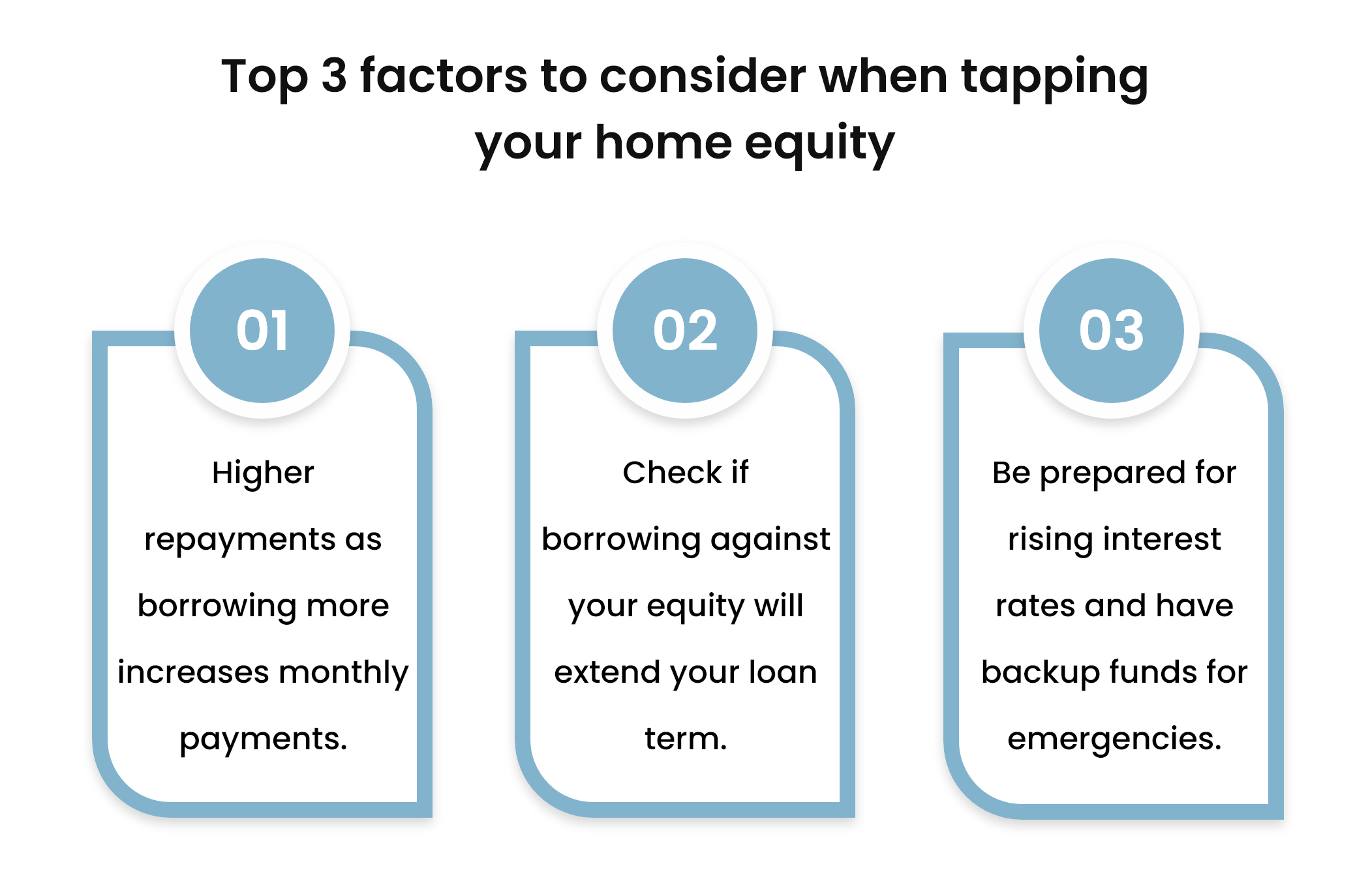

- There are four ways to use home equity; just be mindful of increased payments, extended terms, and the need for emergency funds.

What is home equity?

Home equity is the amount of your home's value that exceeds the outstanding mortgage balance. For instance, if your home is valued at $400,000 and you owe $280,000, you have $120,000 in equity, which is around 30%. Positive equity occurs when your home is worth more than your mortgage. However, you have negative equity if you owe more than the home's value, such as $420,000 on a $400,000 property.

How to calculate home equity?

Calculating home equity is simple—it’s the difference between your home’s current market value and the amount you owe on your mortgage. Here’s how to calculate it:

Start by finding out what similar homes in your area have recently sold for. Let’s say your property is valued at AUD 1.29 million. You can request a property valuation from a professional or use online tools provided by Australian real estate websites.

Next, obtain your loan balance from your lender. For example, if your outstanding mortgage is AUD 550,000, you can apply these figures to the home equity formula:

Home Equity formula = Value of home-loan balance

Equity = AUD 1,290,000 − AUD 550,000

Equity = AUD 740,000

In this case, your home equity would be AUD 740,000.

Skip the tedious math!

Let our home equity calculator handle the numbers and show you exactly how much equity you can unlock in just a few clicks.

Why does home equity matter?

Home equity matters because it serves as a way to build wealth and provides financial flexibility in emergencies. Having equity in your home means you have a valuable asset that can be used for important financial goals, such as funding major renovations or securing a down payment on another property.

As your mortgage decreases and your property value increases over time, your equity grows, giving you more financial leverage. However, it’s essential to use this equity wisely, as borrowing against it adds a new debt obligation. Mismanaging this could result in financial strain or even losing your home. Therefore, home equity represents wealth and provides opportunities and security when managed carefully.

What are the key ways to build home equity?

Home equity builds in several ways. The first way is through your down payment at the time of purchase. For example, if you buy a home for $350,000 and make a $50,000 down payment, your initial equity is $50,000, with the remaining $300,000 representing the loan amount. This down payment is the foundation of your equity and grows as you reduce your loan balance over time.

The next way equity builds is by paying down the mortgage principal. Each monthly payment reduces the amount you owe on the loan, gradually increasing the equity you owe in the property. If you can afford to make extra payments toward the principal, you can accelerate the process and build equity more quickly. However, ensure to check your mortgage agreement for any early repayment fees that may apply if you exceed the allowable payment limit.

Equity also increases through property value appreciation. As the value of your home rises over time due to market conditions, your equity grows. For example, if your home’s value increases from $350,000 to $400,000 while your mortgage balance decreases to $250,000, your equity grows to $150,000. This increase in value, combined with paying down the mortgage, significantly boosts your equity.

Another effective strategy for building equity is to shorten the mortgage term. By choosing a shorter repayment period, you make higher monthly payments but reduce the loan balance faster. This helps you build equity quicker since more of your payment goes directly toward the principal.

Additionally, making strategic home improvements can increase your property's value and, as a result, your equity. However, not all renovations provide the same return on investment, so it’s important to choose upgrades that will add significant value, such as remodelling kitchens or bathrooms. Researching which improvements offer the best return will help you make informed decisions.

Best 4 ways to tap your home equity

There are several ways to tap into the equity you’ve built in your home. Below, we outline the top four methods that homeowners can use to access their home equity:

HELOC (Home Equity Line of Credit)

A HELOC is similar to a credit card, where the lender extends a line of credit based on the equity in your home. You can borrow money as needed during the "draw period" (typically 10 years) and pay back only the interest during that time.

After the draw period, the loan enters the repayment phase, where you repay the principal and interest. The key advantage of a HELOC is flexibility; you can borrow and repay multiple times within the draw period. However, HELOCs often come with variable interest rates, which can lead to fluctuating monthly payments.

Reverse mortgage

A reverse mortgage allows homeowners aged 60 and over to borrow money against the equity in their home without needing to make regular repayments. The loan amount is determined by the borrower’s age and the home's value, with older individuals able to access a larger portion of their equity. Interest on the loan compounds over time, which increases the total amount owed. Repayment is only required when the home is sold, the owner moves out permanently or passes away.

Although reverse mortgages provide a way to access funds, they reduce the homeowner’s equity over time due to accumulating interest. It's important to seek independent financial advice to fully understand the impact on future financial needs, inheritance, and government benefits and to ensure that the product fits your financial goals. Negative equity protection prevents the borrower from owing more than the home’s value.

Home equity loan

Home equity loan, also known as a ‘second mortgage,’ provides homeowners with a way to borrow money based on the equity they have built up in their property. The loan amount and interest rates are influenced by several factors, including the property’s value, how much of the original loan has been repaid, the homeowner’s credit score, financial situation, the loan's purpose, and the condition of the property market.

One of the key benefits of a home equity loan is that it allows access to a large sum of money without needing to sell the home or resort to high-interest options like credit cards or personal loans. Lenders also find these loans less risky since the property acts as collateral, making it easier for homeowners to qualify compared to other types of loans.

Apply for a home equity loan with ZedPlus today.

Our fast and secure application process makes it easy to access your home equity.

Cash-out refinance

A cash-out refinance allows you to replace your existing mortgage with a new, larger mortgage. The new loan amount is higher than what you currently owe on your home, and the difference between the two amounts is given to you as cash. This lets you access the equity you’ve built up in your home without taking out a separate loan.

For example:

If you owe $150,000 on your current mortgage and your home is worth $300,000, you could refinance for $200,000. You would pay off the $150,000 balance on your old mortgage and receive the remaining $50,000 as cash.

This option gives you access to a lump sum, but it comes with some important factors:

- You will have a new mortgage, potentially with different interest rates and terms.

- The closing costs for the new mortgage can be between 2-5% of the loan amount.

- You must have enough equity left in your home after the refinance, typically at least 20%.

A cash-out refinance can be a good option if you need a large amount of money and can secure a favorable interest rate. However, it's important to consider how it affects your mortgage payments and the long-term cost.

What are the different ways to use your home equity?

- Home renovations and improvements: Use your home equity to make value-enhancing improvements, such as adding energy-efficient features or upgrading kitchens and bathrooms. These upgrades can increase your home's value and help build more equity over time.

- Debt consolidation: Home equity can be used to consolidate high-interest debts, like credit card balances or personal loans, into a single, lower-interest home equity loan or line of credit (HELOC). This can reduce your monthly payments and save on interest.

- Emergency fund: If you don't have an adequate emergency fund, you can tap into your home equity to cover unexpected expenses such as medical bills or urgent repairs. A HELOC can provide flexibility by allowing you to borrow as needed.

- Investment in real estate: For experienced real estate investors, home equity can be used to purchase additional investment properties. Leveraging your home equity to generate rental income can be a wise strategy for long-term wealth growth.

- Fund retirement or personal ambitions: Homeowners nearing retirement can use their equity to supplement retirement income or fund important life goals such as starting a business or pursuing higher education.

- Downsizing to a smaller home:If your current home is too large or costly to maintain, you can sell it and use the equity to buy a smaller, more affordable home, potentially without taking on a new mortgage.

- Pay for major life events:Home equity can be used to fund significant life events such as weddings, education costs, or vacations. However, this should be done cautiously to avoid unnecessary financial strain.

- Avoid foreclosure:In times of financial difficulty, home equity can be used as a buffer to avoid foreclosure. Selling your home and using the equity to pay off remaining mortgage debt can prevent financial losses.

- Remortgage to release cash:You can refinance your existing mortgage to take out some of the equity in cash. This is a good option for homeowners who need liquidity but don't want to take out an entirely new loan.

Ending Note

Home equity is a significant asset that can provide homeowners with valuable financial options. As your equity grows, it becomes an important resource that, when used strategically, can offer substantial benefits. However, it’s essential to carefully evaluate how and when to access this equity to ensure it supports your overall financial goals.

By understanding the process and making well-informed decisions, you can maximise the potential of your home equity and enhance your financial well-being for the long term. At ZedPlus, we provide a range of Home Equity Mortgage solutions tailored to your unique needs.

If you're looking to explore our home equity mortgage options or have questions about how to make the best use of your home equity, connect with us today. Our team of experienced mortgage professionals is dedicated to providing personalised advice and support to help you achieve your financial goals.