Unlocking your credit potential: Innovative strategies to improve credit score

Overview

In today’s society, where we rely highly on credit payments and loans, you must have come across the term credit scores many times.

Do you know what your credit score is? A credit score is a numerical representation of a person's creditworthiness. It is a statistical calculation based on a person's credit history, including past borrowing and repayment behaviour.

Lenders, such as banks, credit card companies, and other financial institutions, use credit scores to determine a person's ability to repay debt and assess their credit risk.

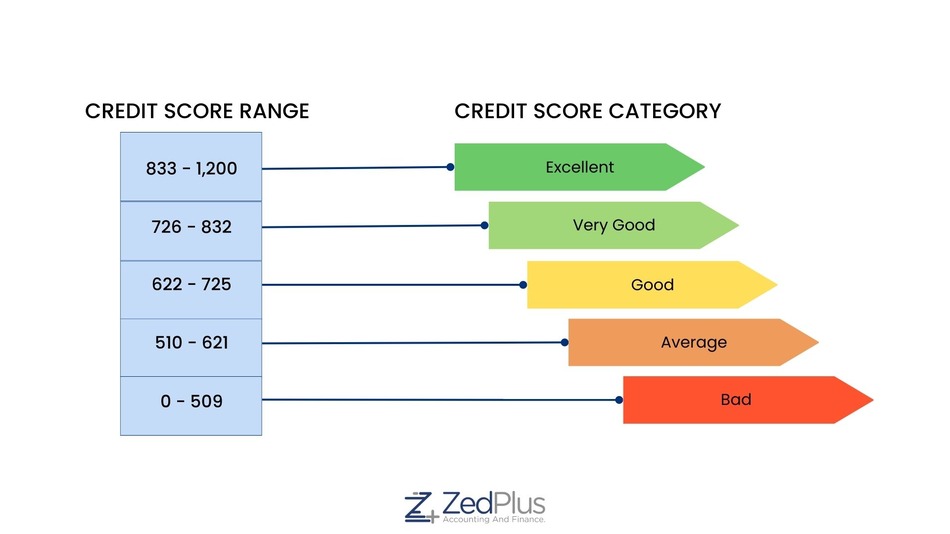

In Australia, credit scores are typically calculated by credit reporting agencies such as Equifax, Experian, and illion. Credit scores range from 0 to 1,200, and a higher score generally indicates better creditworthiness.

While the specific criteria for calculating credit scores may vary between agencies. Generally, a score of 700 or above is considered a good credit score in Australia. Whereas scores between 500 and 700 may be considered average, while scores below 500 as bad credit.

Why is your credit score so important?

Well, it is one of the most vital factors that lenders and credit provider consider when deciding whether to approve you for a loan or credit card. An excellent credit score can help you qualify for better loan terms and lower interest rates, potentially saving you thousands of dollars over the life of your loan.

So, understanding and improving your credit score is essential whether you hope to buy a new car, purchase a home, or improve your financial standing.

But where do you start? In this post, we at ZedPlus, a trusted firm of tax agents and online mortgage brokers in Australia, will share some simple and practical tips on how to improve credit score and take control of your financial future. So let's delve in.

What are the benefits of improving your credit score?

Increasing your credit score can have many benefits, especially when obtaining loans and other types of credit. Here are some of the most compelling benefits that you should know about:

Better interest rates

A higher credit score can lead to better interest rates on loans and credit cards. This means you will have access to more attractive terms and lower interest rates on loans from financial institutions, making it easier to get the money you need without overpaying.

Easier loan approval

Lenders like banks and credit providers are more likely to approve loans and credit applications from borrowers with higher credit scores because they are considered lower risk. This means you are more likely to be approved for a loan and may have more options to choose from.

More negotiating power

When you have a good credit score, you may have more negotiating power regarding loan terms and interest rates. This can help you get better terms on insurance premiums and access special offers from financial institutions with enticing rewards programs or lower interest rates.

Access to higher credit limits

With a higher credit score, you may be eligible for higher credit limits on credit cards and lines of credit. This can be helpful for emergencies or large purchases and improve your credit utilisation ratio (an important factor in credit scores).

Improved financial opportunities

A good credit score can open up many financial options, such as getting approved for a mortgage to buy a home or qualifying for a low-interest car loan. It can also help you secure rental properties, get better insurance rates, and even qualify for certain jobs.

Improving your credit score takes time and effort, but the benefits can be worth it.

How is a credit score calculated?

Understanding your credit score can seem daunting, but it is essential if you want to better it. Your credit score comprises several components, each of which has a different weight in determining your overall score.

In Australia, credit scores are typically calculated by credit reporting bodies (CRBs) using a combination of factors. Here's a breakdown of the most common factors used in credit scoring:

- Payment history – 35%

- Credit utilisation – 30%

- Credit history length – 15%

- Credit mix – 10 %

- New credits – 10%

It is worth noting that credit scores can vary depending on the credit reporting agency and scoring model used. The three major credit reporting bureaus in Australia are Equifax, Experian, and Illion. Each of these CRBs uses its own scoring model to calculate credit scores.

How long does negative information stay on your credit report, and how does it impact your credit score?

In Australia, negative information can remain on your credit report for different periods, depending on the severity of the data. Here's a breakdown of how long different types of negative information can stay on your credit report:

Late payments

Late payments can stay on your credit report for up to two years.

Defaults

Defaults can stay on your credit report for up to five years from the date they were listed.

Court judgments

Court judgments can stay on your credit report for up to five years from the date they were entered.

Bankruptcies

Bankruptcies can stay on your credit report for up to five to seven years, depending on the type of bankruptcy.

Part IX debt agreements

Part IX debt agreements can stay on your credit report for up to five years from the date they were entered.

Please remember that negative information on your credit report can significantly impact your credit score, making it more challenging to get approved for credit in the future. However, as negative information ages, its impact on your credit score can diminish.

If you have negative information on your credit report, taking steps to improve your credit score is essential.

How to improve credit score?

Improving your credit score in Australia can take time and effort, but it is necessary if you want to increase your chances of being approved for credit in the future. Here are some steps you can take to boost your credit score:

Check your credit file regularly

Regularly checking your credit reports is essential for maintaining a high credit score. Your credit report summarises your credit history, and any errors or fraudulent activity can significantly damage your score. To obtain your credit report in Australia, you can request a free copy annually from each of the three major credit bureaus: Equifax, Experian, and illion.

You should check your credit file at least once a year and more frequently if you are working to improve your score. Reviewing your credit report helps ensure that all information is accurate and allows you to dispute any errors or identity theft before it impacts your credit score.

Make on-time payments

To maintain a good credit score, making payments on time is crucial. Late or missed payments can significantly harm your score and make it harder to obtain credit in the future. To avoid this, you can stay organised by setting up automatic payments or reminders for your bills.

Make a list of all your bills and prioritise them based on their importance and due dates. Set up automatic payments whenever possible and use phone or calendar reminders to ensure you catch all due dates. By making timely payments and staying organised, you can keep your credit score healthy and set yourself up for financial success.

Keep credit utilisation low

Credit utilisation is the percentage of available credit you use, significantly impacting your credit score. To keep your utilisation rate low, pay off debts quickly and avoid maxing out your credit cards. Try to make more than the minimum monthly payment and focus on paying down high-interest debt first.

If you use a lot of your available credit limits, make multiple monthly payments to keep your balance low. Keep your credit utilisation below 30% of your total credit limit. If you have multiple credit cards with high balances, consider consolidating your debt to a single credit card account with a lower interest rate

Keep old credit accounts open

Keeping old credit accounts open can help maintain a more extended credit history. Credit reporting bodies use the length of your credit history as one of the factors in calculating your credit score, so the longer your credit history, the more data lenders have to assess your creditworthiness.

It's important to note that keeping old credit accounts open can come with risks, such as potential fees or charges associated with the account. Additionally, if the account has a high credit limit, it can affect your credit utilisation ratio if you have multiple outstanding debts. In such cases, closing the account may be a better option, but only after carefully considering the potential impact on your credit score.

Limit credit inquiries

Having too many credit inquiries can hurt your credit score. To limit inquiries, only apply for credit when you need it and research lenders to find the best terms. Apply for credit within a short period to have multiple inquiries count as one. If you are shopping for a mortgage or car loan, consider getting pre-approved credit offers to limit the number of inquiries on your report.

Limiting credit inquiries can protect your credit score and make it easier to obtain credit in the future. Be strategic about when and how often you apply for credit, and take steps to minimise the impact of hard inquiries on your report.

Be mindful of your credit mix

A diverse mix of credit accounts, such as credit cards, loans, and mortgages, can positively impact your credit score. It suggests that you can manage different types of credit responsibly. To build a healthy credit mix over time, consider opening different kinds of credit accounts and using them responsibly.

For example, if you only have credit cards, consider applying for a small personal loan or car loan. Use these accounts responsibly by making payments on time and keeping balances low. Over time, you will establish a diverse credit mix and demonstrate to lenders that you can manage debt responsibly. Being mindful of your credit mix can help improve credit score over time.

What to do in case of complex credit issues?

If you are struggling to improve your credit score or have a complex financial situation, consider seeking professional advice from a financial planner, credit counsellor, or mortgage broker.

We at ZedPlus, have years of experience and expertise in helping people improve their credit scores in order to get their loans approved. We provide all the necessary help to ensure they get their home loan without any hassles.

We contact various lenders to understand whether they are willing to lend on your behalf. We believe in providing personalised services to our clients to make their dream of owning a home come true.

If necessary, we get our clients in touch with a reputed credit counsellor to ensure that their credit history is repaired. They can help them identify areas of improvement in their credit report and develop strategies to improve them.

Final Word

Improving your credit score may take time and effort, but it is worth it in the long run. By following the tips outlined in this blog, you can improve your credit score and qualify for better loan terms and interest rates.

At ZedPlus, we understand the importance of a higher credit score when obtaining a home loan in Australia. That’s why we offer to check the credit reports of our clients at no extra cost and discuss their credit profiles with them.

From understanding your credit report to identifying the best home loan options for you, we are here to help you navigate the home loan process and achieve financial success. You can contact us if you have any queries or need any information.