Is using a home equity calculator the first step to unlocking your home's value?

Homeownership is not just about having a roof over our heads; it's also about understanding the financial potential of our property. The home equity calculator has emerged as a prominent tool for homeowners eager to gauge their property's value. This blog aims to highlight the importance of this calculator and its role in the broader context of property valuation.

While it offers a quick snapshot of potential equity, is it the definitive first step in assessing a home's worth? With the property market being so dynamic, there are various factors that can influence a home's value. We'll explore these aspects, ensuring homeowners have a comprehensive understanding to make informed decisions about their most prized asset.

Key takeaways

- Home equity represents the true ownership portion of your property.

- Factors like market value, mortgage balance, and local trends influence home equity.

- The formula to determine home equity is Property Value − Remaining Loan Amount.

- Strategies to boost home equity include paying off the mortgage early, maintaining and repairing the home regularly, and more.

- The home equity calculators provide a reasonably accurate estimate of home equity.

Home equity: What is it?

Owning a home is undeniably a significant achievement in one's life. However, unless you've had the luxury of paying the entire amount upfront, you don't fully own your home. This brings us to the concept of home equity. Home equity represents the portion of your home you can claim.

In simpler terms, imagine your home's current market value is $300,000, but you still have a pending mortgage of $200,000. In this scenario, your home equity stands at $100,000. Grasping how to determine this equity is crucial as it offers a snapshot of your financial position in real estate.

Factors that influence home equity

To make the most of your property investment and to plan for the future, it's essential to understand the dynamics that can affect your home equity. These factors can shift over time, and staying updated can set you up for better financial decisions, whether you're considering borrowing against your home or putting it on the market.

Home market value

The real estate market is ever-evolving. If you notice that house prices in your locality are upward, it's a reason to celebrate. Why? Because it indicates that your home's equity is probably on the rise as well. Let's illustrate this with an example: say you purchased your home at $250,000. If its current market valuation is $300,000, you've accrued an additional $50,000 in equity.

Outstanding mortgage balance

With every mortgage instalment you clear, especially the part that reduces your principal amount, you're inching closer to increasing your home equity. To break it down, if your original loan amount was $200,000 and you've managed to repay $50,000, you've added $50,000 to your equity.

Home improvements

Thoughtful home improvements aren't just about aesthetics or functionality; they can be strategic financial moves. By investing in significant upgrades, you can potentially boost your home's market valuation. For instance, a modern, well-designed bathroom renovation might amplify your home's worth by $10,000, directly contributing to your equity.

Economic indicators

While factors like inflation, deflation, and prevailing interest rates might not tweak your home's equity directly, they play a pivotal role in influencing home prices and the overall market demand. For example, a period of reduced interest rates often spurs buying enthusiasm, which can inadvertently push up your property's value.

Local real estate trends

Local events and developments can surprisingly impact your home equity. If a surge of people relocates to your facility or a prominent company establishes its base nearby, it increases house-hunting activities. you might witness a substantial uptick in your home's equity.

How do you calculate your equity?

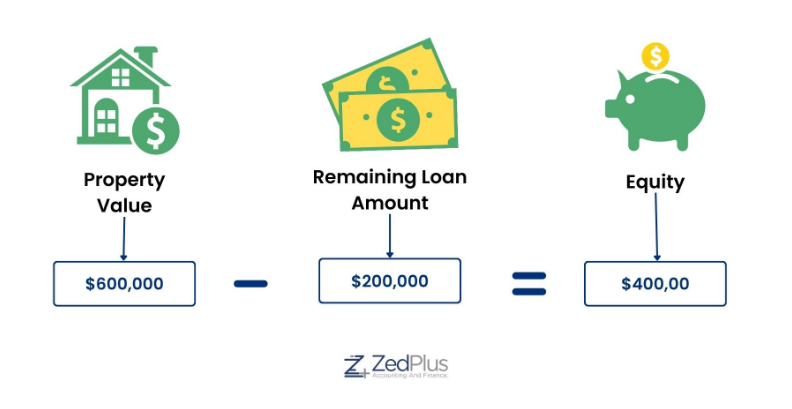

Calculating the equity in your home is a straightforward process. Start by determining the difference between your property's current market value and the outstanding amount on your mortgage. For example if your home is appraised at $600,000 and you have a remaining mortgage of $200,000, the calculation becomes:

This indicates an equity of $400,000. While this provides a general idea, the true value of a home often becomes clear upon its sale. To get a closer estimate beforehand, property listing sites can be consulted, analysing recent sales of homes similar to yours in your locality.

Our home equity calculator, designed by experts, offers invaluable assistance. You get instant equity estimates when you input your estimated property value and the remaining loan amount into our calculator. This calculator is a straightforward way for homeowners to understand their property's equity without the complexities of professional valuations.

Advantages of using a home equity calculator

Every property journey is unique. Brokers initiate discussions to grasp your specific circumstances, forming the basis of their recommendations.

Accuracy:

One of the primary benefits of a home equity calculator is its ability to provide homeowners with a reasonably accurate estimate of their home's equity. While it might not give the exact value, it offers a ballpark figure that can be instrumental in understanding one's financial position in relation to one's property.

Convenience:

In today's digital age, the ease of use and online accessibility of home equity calculators make them a preferred choice for many. Homeowners can get quick insights from their homes without needing physical appointments or lengthy processes.

Planning:

Beyond just numbers, these calculators play a pivotal role in financial planning. Whether you're contemplating refinancing, considering a home equity loan, or thinking of selling, having a clear picture of your home's equity can guide your decisions, ensuring they align with your financial goals.

Aspiring to capitalise on your home's equity and achieve tax efficiency?

Let our experts guide you with our comprehensive financial suite.

Limitations of Home Equity Calculators

Dependence on accurate input data:

The accuracy of the results is directly proportional to the accuracy of the input data. The equity estimate will be skewed if the provided property value or loan amount is off.

Market fluctuations:

These calculators generally provide static results based on the input data. They might not account for sudden market fluctuations, economic downturns, or surges that can significantly impact property values.

Local trends:

Every neighbourhood or region can have specific trends affecting property values. Standard calculators might not factor in these localised trends, potentially leading to discrepancies in estimates.

Professional Consultation:

Despite the convenience and insights offered by these calculators, consulting with a real estate professional is always recommended. Their expertise and understanding of the market can provide a more comprehensive and accurate assessment of your property's value and equity.

How to increase your home equity?

Now that we understand home equity and how to calculate it, let's explore ways to increase it effectively. Here are a few proven strategies:

Pay off your mortgage early:

Every extra payment towards your principal reduces the outstanding loan amount, effectively increasing your equity. This might be a long-term strategy, but it can significantly impact the long run.

Keep up with maintenance and repairs:

Regular maintenance and timely repairs ensure that your property is in top condition, directly contributing to its value. A well-maintained home will attract buyers and fetch higher prices, ultimately increasing your equity.

Stay updated on local market trends:

Keep yourself informed about the happenings in your neighbourhood and surrounding areas. This can help you understand how external factors might impact your property's value, allowing you to increase its equity proactively.

The dual edges of equity calculators: Jane's success and Mark's dilemma

Jane, a homeowner, wanted to renovate her kitchen. Before approaching banks for a loan, she used an equity calculator to estimate her home's equity. The results showed she had substantial equity, giving her the confidence to negotiate better loan terms. Post-renovation, her home's value increased significantly, validating her decision.

In contrast, Mark solely depended on an online calculator to gauge his home's equity for a major investment. The calculator provided an optimistic estimate. Relying on this, Mark made investment commitments. However, when he approached lenders, a professional valuation revealed his equity was lower than the online estimate. This discrepancy left Mark in a financial bind, emphasising the importance of professional consultations alongside online tools.

Tips for homeowners

Understanding and maximising your home's equity is vital to homeownership. One of the foundational steps in this process is ensuring accurate data input when using tools such as the ZedPlus Home Equity Calculator.

Even slight discrepancies in property values or loan amounts can lead to significant variations in equity estimates. While these calculators offer valuable insights, they should ideally serve as an initial reference point. Consulting with a real estate professional is always recommended for a more comprehensive perspective.

Additionally, staying informed about your local market and trends impacting property values is essential. This can help you make informed decisions about your home and its equity.

Remember, increasing your home's equity is a long-term process that requires consistent effort and planning. With the right strategies, tools, and professional guidance, homeowners can effectively navigate this aspect of homeownership and reap the benefits in the long run. So, make the most of your property's equity and secure a strong financial future.

Ending note

Unlocking the potential of home equity can provide a variety of benefits and can be the path towards great financial gain. While calculating your home equity can be complex and challenging, ZedPlus provides an easy-to-use home equity calculator for homeowners that keeps track of all necessary factors.

Homeowners should take advantage of this helpful tool to stay informed on their finances and to prepare for whatever may come in the future with their home's value. Remember: no matter how much your home is worth, it remains an essential part of who you are as a family or as an individual.

Make sure you're nice to your house - use it wisely, cherish its value, and always seek the best ways to enhance and protect your investment. If you have any questions or need further guidance, please contact us or our experts. We're here to help!