How to prepare for a business loan application: A step-by-step guide

Introduction

Preparing a business loan application in Australia involves more than completing forms or submitting bank statements. Lenders assess factors such as cash flow stability, credit history, existing commitments, and the purpose of the loan before deciding whether to approve funding and on what terms.

Many business loan applications are declined not because a business lacks potential, but because the application does not clearly address lender expectations or risk requirements. Understanding what lenders look for and preparing in advance can significantly improve approval outcomes.

This blog post outlines the steps to follow when preparing a business loan application, helping you approach lenders with confidence and improve your chances of securing the right funding.

Key takeaways

- Australian lenders assess business loan applications based on cash flow stability, credit history, existing debts, and the purpose of the loan

- Many business loan applications are declined due to poor preparation rather than a lack of business potential

- Business and personal credit histories play a significant role in how lenders assess loan risk and pricing

- Different loan products suit different needs, from long-term growth funding to short-term cash flow support

- Professional guidance from our lending specialists helps match your business with lenders aligned to your financial position and goals

Steps to secure the business loan you need

Below is a step-by-step approach to securing a business loan, helping you avoid common mistakes and apply with greater confidence.

Step 1: Understanding the purpose of a business loan

Before applying for a business loan, be clear about why you need the money and how you plan to use it. Taking a loan without a clear purpose can lead to wasted funds and added pressure on cash flow. When the reason is clear, it becomes easier to choose the right loan and use it wisely.

Some common reasons businesses apply for a loan include:

- Growing or expanding the business

- Buying equipment or tools

- Purchasing stock or inventory

- Spending on marketing or branding

- Developing new products or services

- Managing short-term cash flow gaps

- Covering unexpected expenses

- Paying tax obligations over time

- Consolidating existing business debts

- Purchasing commercial property

- Funding short-term opportunities through bridging finance

Step 2: Review your business plan

When was the last time you reviewed your business plan? Does it still reflect how your business operates today and where it is heading?

Your business plan should accurately represent your current position. As your business evolves, services, customers, and priorities can change, and your plan should reflect these developments rather than outdated assumptions.

It should clearly explain what your business does today, who your target market is, and how you intend to grow. Outlining both short and longer-term objectives helps communicate the direction of the business and the reasoning behind key decisions.

Step 3: Can your business handle the loan?

Not every business loan is the right move, even when funding is available. A loan should support your business, not create ongoing pressure. Before proceeding, consider whether repayments can be managed comfortably within your cash flow, even if income fluctuates.

For example, if loan repayments are $3,000 per month, your business should consistently generate enough surplus after wages, rent, suppliers, and other expenses to cover this amount with room to spare. If repayments leave little flexibility, the loan may place unnecessary strain on the business.

Step 4: Manage your credit score

Your business credit score plays an important role in any loan application, so it is important to understand its current position before applying. Lenders use your credit history to assess how reliably your business has handled financial commitments.

While it is possible to get a loan with a lower credit score, it often comes with higher interest rates and stricter terms. Keeping your credit profile in good order can make borrowing easier and more affordable.

To maintain or improve your business credit score, focus on the following:

- Pay all business bills and supplier invoices on time

- Keep business registrations and contact details up to date

- Manage credit limits carefully and avoid using most of the available credit

- Reduce outstanding debts and clear overdrafts where possible

- Build a credit history if the business is new, as no credit record can be viewed as risky

For many businesses, especially sole traders and partnerships, personal credit is also considered during a loan application. In companies with multiple directors, lenders may review the personal credit history of each director. Keeping both business and personal credit in good order strengthens your position when applying for finance.

Step 5: Get all required documents organised and accurate

Poor documentation is one of the main reasons loan applications get delayed or declined. Presenting complete and accurate paperwork shows lenders that you are well-organised and trustworthy.

Here is a checklist of common documents you may need:

- Valid identification (e.g. driver's licence, passport)

- Your business plan

- Financial statements for the past two to three years (if applicable)

- Year-to-date financials

- Forecasted Recent bank statements

- Details of existing debts and liabilities

- Evidence of business registration and ABN

- Tax compliance documentation

- Personal asset and liability statement (for sole traders or guarantors)

Depending on the loan product and the lender, you may be asked for additional documents. Having everything ready in advance will make the process smoother and faster.

It is also advisable to check your business credit file to identify any potential issues or incorrect information. You can request a credit report and resolve any red flags before applying.

Step 6: Choose the right type of loan for your needs

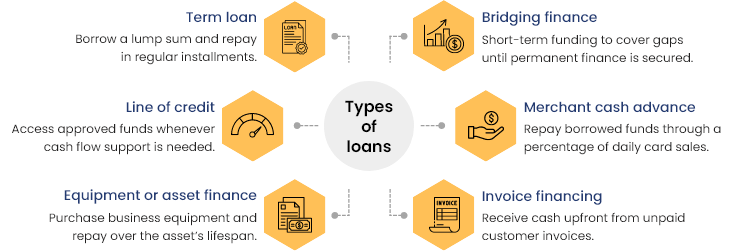

There are many types of business loans available in Australia, and choosing the right one is just as important as qualifying for it. Not every business loan suits every business.

Some common types of loans include:

Below is a detailed explanation of each business loan type outlined above.

Term loans

A term loan is one of the most common forms of business finance. It involves borrowing a fixed amount of money and repaying it over a set period through regular instalments, usually monthly.

- The loan can have a fixed or variable interest rate.

- Available as secured (backed by assets like property or equipment) or unsecured (no collateral required, but often higher interest rates).

- Suitable for funding large purchases, expansions, or long-term investments.

This type of loan works well for businesses with predictable income and a clear purpose for the funds.

Line of credit

A business line of credit is a flexible, revolving facility that allows you to withdraw funds up to an approved limit at any time, much like a credit card.

- Interest is only charged on the amount drawn, not the full limit.

- Useful for managing short-term cash flow, payroll, or unexpected expenses.

- Can be secured or unsecured, depending on the lender and credit profile.

Lines of credit are especially helpful for businesses with fluctuating income or seasonal operations.

Explore our helpful reads

Equipment or asset finance

This loan is designed specifically for purchasing equipment, vehicles, or other assets used in the business. The asset being purchased typically serves as the security for the loan.

- Repayments are spread over the useful life of the asset.

- Helps preserve working capital while still gaining access to essential tools.

- Available through leasing, hire purchase, or chattel mortgage arrangements.

Asset finance suits businesses in industries such as manufacturing, construction, logistics, and farming.

Invoice financing

Also known as debtor finance, this short-term lending option allows businesses to access cash tied up in unpaid invoices.

- The lender provides a percentage (usually 80–90%) of the invoice value upfront.

- Once the customer pays the invoice, the lender releases the remaining balance minus fees.

- Ideal for businesses with long payment cycles or high-volume invoicing.

This type of finance improves cash flow without needing to wait for clients to settle accounts.

Merchant cash advance

A merchant cash advance offers a lump sum loan that is repaid through a fixed percentage of your business’s daily credit or debit card sales.

- No fixed repayment schedule; repayment varies based on sales volume.

- Easier to qualify for than traditional loans.

- Typically higher in cost, with fees built into the advance.

Best suited for retailers, cafes, or hospitality businesses with regular card transactions but limited assets for traditional security.

Bridging finance

Bridging loans are short-term, fast-access funding solutions used to cover immediate financial needs until more permanent financing is arranged.

- Often used to cover gaps between buying and selling property, fund urgent purchases, or manage project transitions.

- Usually secured by property or assets.

- Higher interest rates due to short duration and speed of access.

Bridging finance is useful when timing is important, but it should be approached with a clear repayment or exit strategy

Need help choosing the right loan type?

Book a call now

Step 7: Explore Government-backed loan options

Government-backed loan programs in Australia are designed to make funding more accessible for businesses that may not meet standard bank lending criteria. By reducing the risk for lenders, these schemes often offer lower interest rates, longer repayment terms, or more flexible security requirements.

Start-Up Finance Package

One example is the Start-Up Finance Package, which supports eligible Aboriginal and Torres Strait Islander businesses. This program provides funding of up to $150,000, with up to 30 percent offered as a grant to purchase business assets.

The remaining loan comes with flexible repayments, no application or service fees, and a loan term of up to seven years, making it a practical option for new businesses in their early stages.

Regional Investment Corporation (RIC) loan program

Another option is the Regional Investment Corporation (RIC) loan program, which supports farm businesses and farm-related small businesses across Australia.

RIC provides low-interest loans to help businesses manage cash flow, recover from drought or natural disasters, and plan for long-term sustainability. These loans are particularly valuable for regional businesses needing financial breathing space to stabilise operations and invest in future growth.

Step 8: Understand the lending climate and market conditions

The broader economic environment significantly influences the availability and terms of business loans in Australia. As market conditions shift, being aware of these factors is essential to strategically time your application and prepare your business for potential challenges.

Key market trends to watch:

- Interest rates: Rising interest rates can make borrowing more expensive, affecting your loan repayments. Staying informed about the Reserve Bank of Australia's monetary policy and its potential changes is crucial.

- Inflation: Ongoing inflationary pressures increase costs for small businesses, impacting profit margins and cash flow. Lenders may consider these factors when reviewing your application.

- Late payments: As businesses face increased pressure to manage late payments, lenders are tightening their criteria to mitigate risk. Timely payments to suppliers and creditors can strengthen your application.

Sector-specific considerations:

Certain industries, such as construction, retail, and real estate, are experiencing heightened volatility. If your business operates in one of these sectors, lenders may request additional documentation, such as detailed cash flow forecasts or risk management strategies, to ensure you can weather economic uncertainties.

In times of economic uncertainty, lenders are prioritising:

- Sustainability: They want to see that your business is built for the long term and can thrive despite market fluctuations.

- Cash flow strength: Businesses with robust and predictable cash flow are more attractive to lenders, as it reassures them that repayments can be consistently met.

- Risk mitigation: Lenders appreciate borrowers who actively manage risks, such as supply chain issues, seasonal fluctuations, and rising operating costs.

Being well-informed about economic conditions and demonstrating your understanding of these external factors will strengthen your application. Show that you are proactive in managing risks and adapting to market shifts, which will increase lender confidence in your ability to repay the loan.

Step 9 – Prepare the loan application

The final step is to submit your loan application. If you have completed the earlier steps properly and gathered all required information, this stage should be straightforward and move relatively quickly.

It is important to understand that submitting a formal loan application will have an impact on your business credit profile. When an application is approved, this is generally not an issue. However, if an application is declined, it can affect how future applications are viewed in the short term.

Applying for several loans within a short period can also work against you. Multiple applications may signal financial stress to lenders and increase the perception of risk, which can reduce your chances of approval.

For this reason, it is usually better to avoid speculative applications. Taking the time to prepare thoroughly and apply for the most suitable loan first gives you a stronger chance of success.

If you experience repeated rejections, it may be necessary to pause your plans and allow time for your financial position or credit profile to improve.

How ZedPlus can help you secure the right business loan

As you have now gone through all the steps involved in preparing a business loan application, it is clear that applying for finance requires careful planning. Every decision you make before applying can influence approval outcomes and your business credit profile.

If you want expert guidance before taking the next step, the lending specialists at ZedPlus can support you through the process.

Our support includes:

- Reviewing your funding needs and confirming the correct loan purpose

- Assessing cash flow and repayment capacity before any application is submitted

- Helping you choose a loan structure that suits your business position

- Identifying lenders aligned with your industry and financial profile

- Preparing and reviewing documentation to reduce delays or avoid declines

- Assisting with eligible government loan schemes or support programs where available

Our goal is to help you apply with clarity and confidence, while avoiding unnecessary credit impacts or speculative applications. Book a quick call with our loan specialist to take the next step towards securing the right funding for your business.

Business loans FAQs

How much can I realistically borrow for my business?

Your borrowing amount depends on business income, existing debts, cash flow stability, time trading, and the loan purpose. Stronger financials and clear repayment capacity typically support higher limits.

Is collateral always necessary for a business loan?

Not always. Unsecured loans may not require collateral, but lenders may still request a personal guarantee. Secured loans generally offer better rates because the lender’s risk is lower.

Can I pay off my business loan early, and are there penalties?

Many loans allow early repayment, but some lenders charge early payout or break costs. Always check the loan terms before signing so you understand any fees that may apply.

Can I increase my loan amount during the repayment term?

Sometimes. A top-up may be possible if repayments are up to date and your business performance supports it. In many cases, an increase requires reassessment or refinancing.

How does seasonal cash flow affect my ability to get a business loan?

Seasonal income is common, but lenders want proof you can meet repayments during slower months. Strong forecasting, clean bank statements, and the right loan structure can improve outcomes.

Final thoughts

Applying for a business loan takes a bit of planning, but getting it right can make all the difference. By following the steps covered in this blog, you put your business in a much stronger position when it comes time to apply.

A well-prepared application helps lenders clearly understand your business, improves approval outcomes, and reduces unnecessary back and forth.

If you would like a second set of eyes before applying, a quick chat with a ZedPlus lending specialist can help you assess your options, identify any gaps, and approach lenders with clarity.