6 tips to avoid paying LMI charges on home loan

Entering the property market, especially as a first-time homebuyer, comes with its set of challenges. One significant challenge is the added cost of lender's mortgage insurance (LMI). In fact, while LMI is designed to protect lenders in case borrowers default on their loans, it's often the borrowers who feel its financial pinch the most.

For many in Australia, this additional expense can feel like an uphill battle, making the dream of homeownership seem even more distant. However, with the right strategies and insights, it's possible to navigate this challenge effectively. In this blog, we'll provide valuable tips and guidance on how to approach LMI and potentially reduce this cost from your home-buying journey.

Key takeaways

- LMI is designed to protect lenders against potential losses if a borrower defaults on their loan.

- LMI protects lenders and is usually needed when borrowing exceeds 80% of a property's value.

- The cost of LMI can vary based on the proportion of the property's value borrowed and the total loan sum.

- Different lenders have varying criteria for LMI. Shopping around can help find more favorable terms.

What is LMI?

Lenders Mortgage Insurance (LMI) is a specialised insurance that lenders acquire to safeguard themselves against potential losses if a borrower fails to meet loan payments and the property's sale doesn't cover the outstanding loan balance. While LMI is for the borrower's benefit, it primarily protects the lender.

If borrowers borrow more than 80% of a property's value, they typically need to pay for LMI. However, this cost is often passed on to the borrower. It's crucial to differentiate LMI from mortgage protection insurance, which borrowers might obtain to protect themselves from being unable to meet loan payments due to unforeseen circumstances.

LMI plays a pivotal role in the housing market. For potential homeowners who meet all lender requirements but lack a substantial deposit, LMI can facilitate the acquisition of mortgage finance. By mitigating the lender's risk, LMI encourages them to approve loans even when the borrower doesn't have a significant initial deposit.

How much does LMI cost and how is it paid?

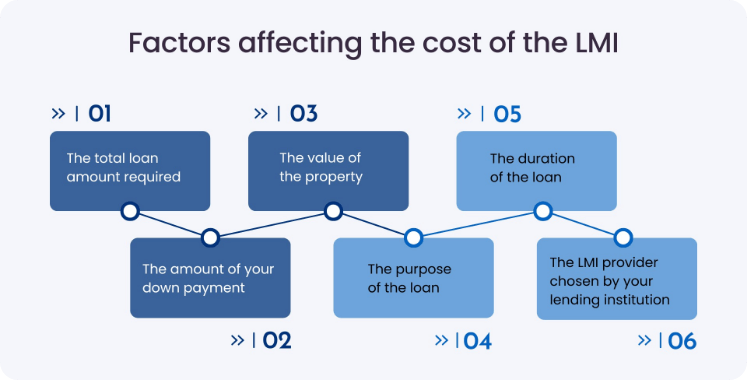

The LMI cost can fluctuate based on the proportion of the property's value borrowed and the total loan sum. The premium differs based on the origin of your down payment, whether from genuine savings or alternative sources like gifts.

Given these variables, a precise LMI cost can only be determined once a property and lender are chosen. It could range from a nominal amount to several thousand dollars.

The LMI premium is a singular, non-returnable fee paid during the loan settlement. Most lending institutions allow the inclusion of the LMI fee within the loan's total amount. If the LMI is incorporated into the mortgage, interest will be charged on the entire sum, slightly elevating the monthly repayments.

While the borrower bears the LMI cost, the lender arranges it. Every lender has guidelines about when LMI is mandated and its associated cost. If a borrower decides to refinance, the LMI premium doesn't carry over. If the new loan necessitates LMI, a fresh premium will be levied.

How to avoid paying LMI charges on home loan

If you're looking to save on LMI costs, there are ways to avoid it. Below are a few tips that might help you steer clear of this extra charge.

Keep your loan-to-value ratio less than 80%:

To avoid extra charges like lender mortgage insurance (LMI), it's a good idea to save up and keep your loan amount below 80% of the property's total value. This means aiming for at least a 20% deposit. Lenders see this as a safety net. If property prices drop, they can still get their money back if someone can't pay their loan.

However, in areas with a higher risk of people not paying back or where property prices fall, lenders ask for a bigger deposit, maybe 30% or even 40%. If you're looking to save up a bigger deposit, think about buying in a less expensive area. Another idea? Consider shared living arrangements for a year. It can be a great way to save money faster.

Use financial gift:

Receiving a financial gift can be a big help when trying to save for a property deposit. Using this gift can help you avoid extra charges like LMI. It's essential to ensure that this money is clearly labeled as a "gift," which means you won't be paying it back.

However, there's something to keep in mind: while the gift can boost your deposit, lenders often like to see that you've done some saving on your own. They want to know you're financially responsible.

So, even with the gift, it's a good idea to show that you've also set aside some personal savings. This combination of personal savings and a financial gift can put you in a strong position when approaching lenders.

Get a guarantor loan:

If you aim to avoid LMI, a guarantor home loan might be your solution. Here's how it works: a close family member, like a parent, uses their home's equity to support your loan. Their backing, primarily if it covers the needed 20% deposit, means you can skip LMI.

But there's a responsibility attached: if you can't make payments, the guarantor has to. The guarantor's role ends once you've paid off the guaranteed portion. This route can make buying a home more manageable, but it's crucial to understand fully. Before committing, it's a good idea to get advice from a financial expert. With property prices climbing, this could be a timely move.

Compare different lenders:

When seeking a home loan, it's crucial to shop around and compare different lenders to maximize your chances of avoiding LMI. Each lender has its own set of criteria and offers.

While many expect a 20% deposit to bypass LMI, some are more lenient, requiring a 15% deposit. This difference underscores the importance of diligent research. By casting a wider net, you can discover more favorable terms.

Navigating the myriad of options can be overwhelming, but you're not alone. At Zedplus, our experts are equipped to guide you. They'll sift through the choices, connecting you with lenders that best match your needs and ensuring your path to homeownership is both cost-effective and seamless.

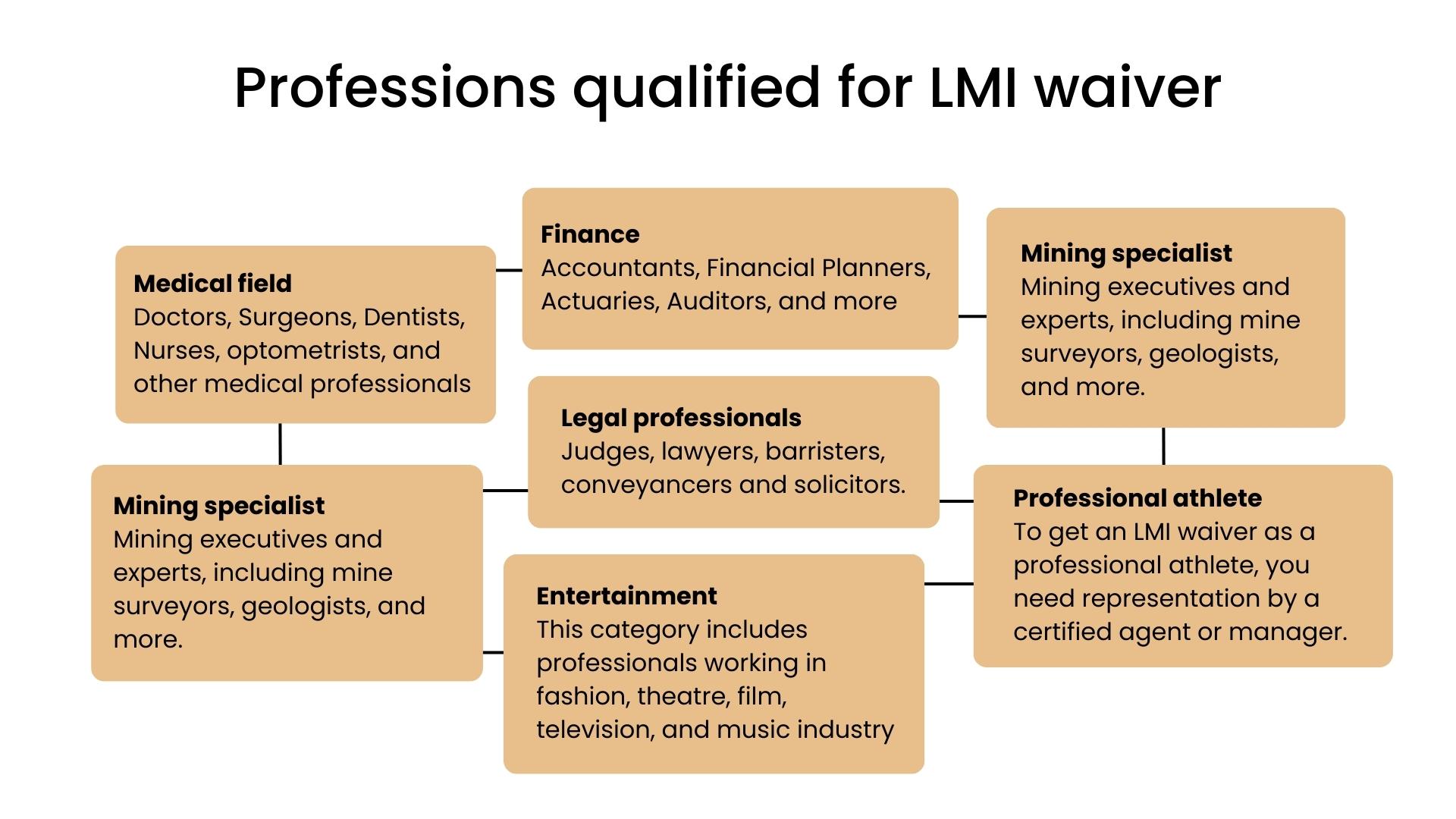

Your profession can help you waive your LMI:

Depending on your profession, LMI could be waived on your home loan. This significant financial advantage is often extended to professionals such as doctors, dentists, accountants, and engineers.

The rationale behind this benefit is the high earning potential and consistent employment tenure typical of these fields. Lenders perceive individuals in these professions as low-risk borrowers, making them more inclined to offer favorable loan terms.

However, while the opportunity to have LMI waived is undoubtedly appealing, it's essential to be aware that not all lenders have the same criteria. The list of eligible professions and the specifics of the waiver can vary among financial institutions. As a potential borrower, it's crucial to research and consult with various lenders to ensure you're getting the best deal tailored to your profession.

Take advantages of government schemes:

The Australian property market often requires a 20% deposit to avoid Lender's Mortgage Insurance (LMI). To help first-time buyers, the federal government offers the First Home Loan Deposit Scheme, allowing them to buy a home with just a 5% deposit and no LMI. This is achieved as the government steps in to guarantee up to 15% of the home's value.

In addition to this, the First Home Owners Grant (FHOG) is available to provide further financial support, assisting buyers in reaching their deposit objectives. However, it's important to note that there's a limited number of spots available in these schemes each year, making it essential to check eligibility and apply promptly.

Get shared equity agreements:

A shared equity mortgage involves a financial institution serving as both a lender and an investor in a property. Here, the homebuyer sells a portion of their property, including future value gains, to the lender in return for a reduced mortgage loan.

By having an equity partner, like a family member, contribute to the home's price, the purchase amount decreases. The mortgage then covers the property's cost minus the deposit and the equity partner's contribution.

This arrangement often allows the buyer to meet the typical 20% deposit requirement, thereby avoiding the need to pay Lender's Mortgage Insurance (LMI). While the contribution from the equity partner must eventually be repaid, the terms can be favorable, especially if the property appreciates over time.

For instance, a 20% contribution on a million-dollar home may seem minimal if the property's value doubles in a decade, making shared equity agreements an attractive option.

Wrap-up

In all, avoiding LMI charges on your home loan is a strategic move towards financial prudence. It's a step that not only saves money but also places you in a stronger financial position. With the insights shared in this blog post, the dream of property ownership becomes more attainable, without the burden of unnecessary costs.

At ZedPlus, we stand out by offering a vast panel of lenders, ensuring you always get the most competitive deal in the market. We act as your intermediary, helping you understand exactly how much you can borrow, all at no additional cost.

Our commitment doesn't end once you secure a loan; we stay connected throughout its lifespan, ensuring you remain in a favorable position. Ready to make your property ownership dreams come true? Contact us, and our experts will guide you every step of the way.